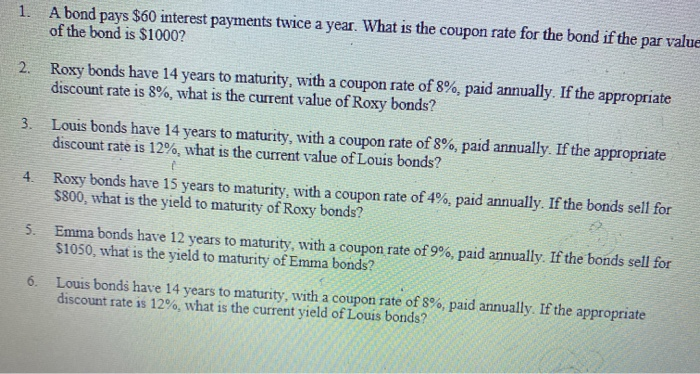

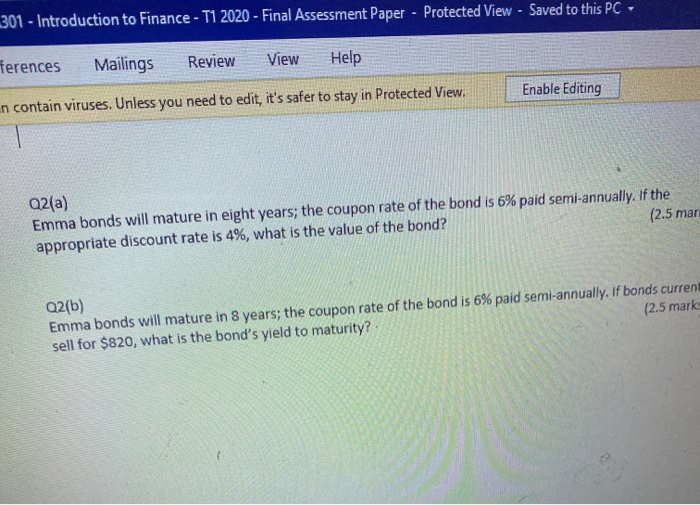

1. A bond pays $60 interest payments twice a year. What is the coupon rate for the bond if the par value of the bond is $1000? 2. Roxy bonds have 14 years to maturity, with a coupon rate of 8%, paid annually. If the appropriate discount rate is 8%, what is the current value of Roxy bonds? 3. Louis bonds have 14 years to maturity, with a coupon rate of 8%, paid annually. If the appropriate discount rate is 12%, what is the current value of Louis bonds? 4. Roxy bonds have 15 years to maturity, with a coupon rate of 4% paid annually. If the bonds sell for $800, what is the yield to maturity of Roxy bonds? Emma bonds have 12 years to maturity, with a coupon rate of 9%, paid annually. If the bonds sell for $1050, what is the yield to maturity of Emma bonds? 5. 6. Louis bonds have 14 years to maturity, with a coupon rate of 8%, paid annually. If the appropriate discount rate is 12%, what is the current yield of Louis bonds? 301 - Introduction to Finance - T1 2020 - Final Assessment Paper - Protected View - Saved to this PC- Ferences Mailings Review View Help Enable Editing n contain viruses. Unless you need to edit, it's safer to stay in Protected View. Q2(a) Emma bonds will mature in eight years; the coupon rate of the bond is 6% paid semi-annually. If the appropriate discount rate is 4%, what is the value of the bond? (2.5 mar Q2(b) Emma bonds will mature in 8 years; the coupon rate of the bond is 6% paid semi-annually. If bonds current sell for $820, what is the bond's yield to maturity? (2.5 marks 1. A bond pays $60 interest payments twice a year. What is the coupon rate for the bond if the par value of the bond is $1000? 2. Roxy bonds have 14 years to maturity, with a coupon rate of 8%, paid annually. If the appropriate discount rate is 8%, what is the current value of Roxy bonds? 3. Louis bonds have 14 years to maturity, with a coupon rate of 8%, paid annually. If the appropriate discount rate is 12%, what is the current value of Louis bonds? 4. Roxy bonds have 15 years to maturity, with a coupon rate of 4% paid annually. If the bonds sell for $800, what is the yield to maturity of Roxy bonds? Emma bonds have 12 years to maturity, with a coupon rate of 9%, paid annually. If the bonds sell for $1050, what is the yield to maturity of Emma bonds? 5. 6. Louis bonds have 14 years to maturity, with a coupon rate of 8%, paid annually. If the appropriate discount rate is 12%, what is the current yield of Louis bonds? 301 - Introduction to Finance - T1 2020 - Final Assessment Paper - Protected View - Saved to this PC- Ferences Mailings Review View Help Enable Editing n contain viruses. Unless you need to edit, it's safer to stay in Protected View. Q2(a) Emma bonds will mature in eight years; the coupon rate of the bond is 6% paid semi-annually. If the appropriate discount rate is 4%, what is the value of the bond? (2.5 mar Q2(b) Emma bonds will mature in 8 years; the coupon rate of the bond is 6% paid semi-annually. If bonds current sell for $820, what is the bond's yield to maturity? (2.5 marks