Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A business contemplates building a new manufacturing facility and will need to seek loanable funds of $130 million. It expects that the new

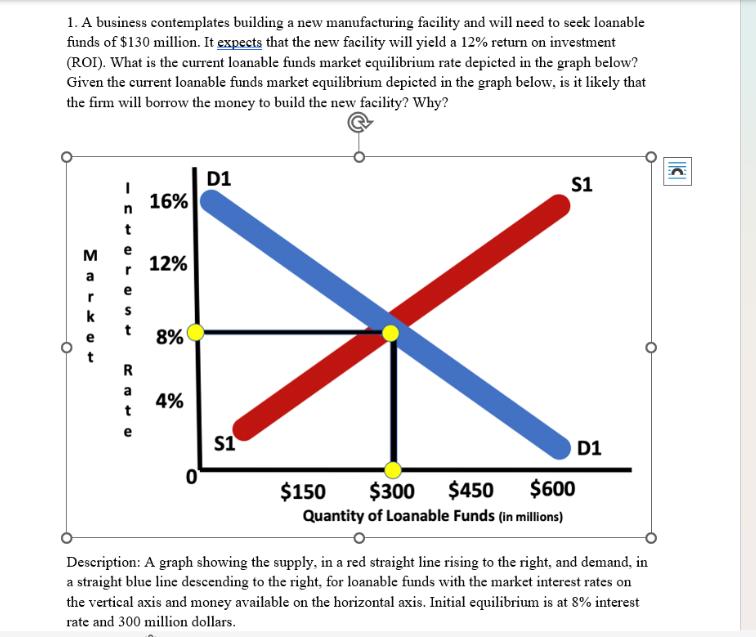

1. A business contemplates building a new manufacturing facility and will need to seek loanable funds of $130 million. It expects that the new facility will yield a 12% return on investment (ROI). What is the current loanable funds market equilibrium rate depicted in the graph below? Given the current loanable funds market equilibrium depicted in the graph below, is it likely that the firm will borrow the money to build the new facility? Why? MALKO M a r k I n t REC R 16% 12% 8% 4% 0 D1 S1 S1 $150 $300 $450 $600 Quantity of Loanable Funds (in millions) D1 Description: A graph showing the supply, in a red straight line rising to the right, and demand, in a straight blue line descending to the right, for loanable funds with the market interest rates on the vertical axis and money available on the horizontal axis. Initial equilibrium is at 8% interest rate and 300 million dollars. El

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Answer 1 Yes the company is likely to borrow money for new investments This is because the equilibrium interest rate in the market is 8 and the desired return on investment is 4 which is greate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started