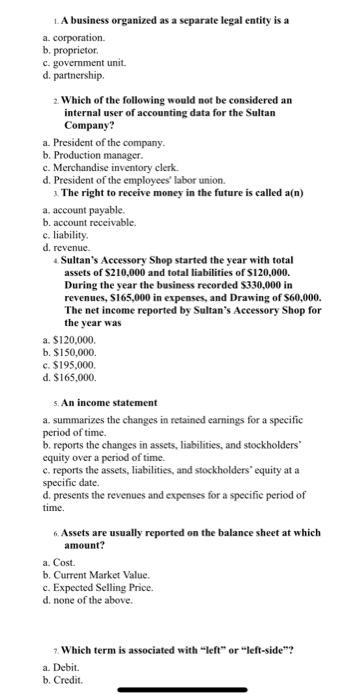

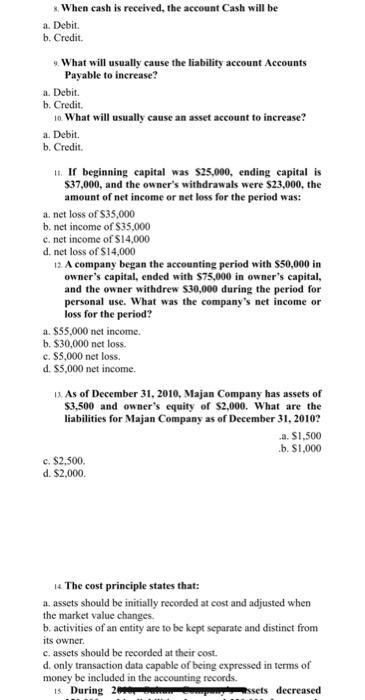

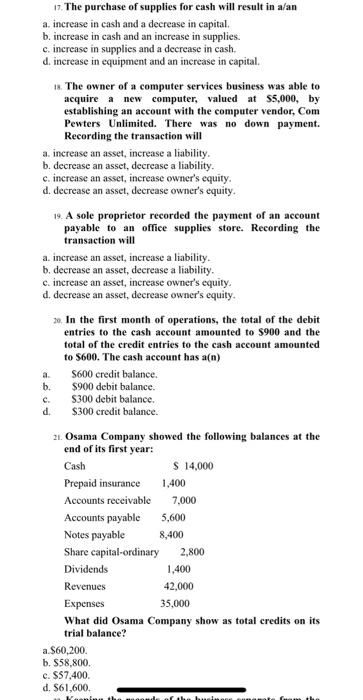

1. A business organized as a separate legal entity is a a. corporation b proprietor c. government unit. d. partnership 2. Which of the following would not be considered an internal user of accounting data for the Sultan Company? a. President of the company. b. Production manager. c. Merchandise inventory clerk d. President of the employees labor union. The right to receive money in the future is called a(n) a account payable b. account receivable c. liability d. revenue Sultan's Accessory Shop started the year with total assets of S210,000 and total liabilities of $120,000. During the year the business recorded $330,000 in revenues, S165,000 in expenses, and Drawing of S60,000. The net income reported by Sultan's Accessory Shop for the year was a. S120,000 b. $150,000 c. $195,000 d. $165,000 5. An income statement a. summarizes the changes in retained earnings for a specific period of time. b. reports the changes in assets, liabilities, and stockholders equity over a period of time. c. reports the assets, liabilities, and stockholders equity at a specific date. d. presents the revenues and expenses for a specific period of time. Assets are usually reported on the balance sheet at which amount? a. Cost. b. Current Market Value c. Expected Selling Price d. none of the above. Which term is associated with "left" or "left-side"? a. Debit b. Credit When cash is received, the account Cash will be a. Debit b. Credit What will usually cause the liability account Accounts Payable to increase? a. Debit. b. Credit 10. What will usually cause an asset account to increase? a. Debit. b. Credit 1. If beginning capital was $25,000, ending capital is $37,000, and the owner's withdrawals were $23,000, the amount of net income or net loss for the period was: a. net loss of S35,000 b. net income of $35.000 c. net income of $14.000 d. net loss of S14,000 12. A company began the accounting period with $50,000 in owner's capital, ended with $75,000 in owner's capital, and the owner withdrew $30,000 during the period for personal use. What was the company's net income or loss for the period? a. $55,000 net income. b. $30,000 net loss. c. $5,000 net loss. d. $5,000 net income 13. As of December 31, 2010, Majan Company has assets of $3,500 and owner's equity of $2,000. What are the liabilities for Majan Company as of December 31, 2010? .a. S1.500 .b. $1,000 c. $2.500 d. $2.000 14 The cost principle states that: a. assets should be initially recorded at cost and adjusted when the market value changes b. activities of an entity are to be kept separate and distinct from its owner. c.assets should be recorded at their cost. d. only transaction data capable of being expressed in terms of money be included in the accounting records. 1 During 2 sets decreased 17. The purchase of supplies for cash will result in a/an a. increase in cash and a decrease in capital b. increase in cash and an increase in supplies. c. increase in supplies and a decrease in cash. d. increase in equipment and an increase in capital. 1. The owner of a computer services business was able to acquire a new computer, valued at $5,000, by establishing an account with the computer vendor, Com Pewters Unlimited. There was no down payment. Recording the transaction will a. increase an asset, increase a liability. b. decrease an asset, decrease a liability. c. increase an asset, increase owner's equity. d. decrease an asset, decrease owner's equity. 19. A sole proprietor recorded the payment of an account payable to an office supplies store. Recording the transaction will a increase an asset, increase a liability b. decrease an asset, decrease a liability. c. increase an asset, increase owner's equity. d. decrease an asset, decrease owner's equity. 20. In the first month of operations, the total of the debit entries to the cash account amounted to $900 and the total of the credit entries to the cash account amounted to $600. The cash account has a(n) S600 credit balance. b. $900 debit balance. S300 debit balance. $300 credit balance. 21. Osama Company showed the following balances at the end of its first year: Cash $ 14,000 Prepaid insurance 1,400 Accounts receivable 7,000 Accounts payable 5,600 Notes payable 8,400 Share capital-ordinary 2,800 Dividends 1,400 Revenues 42,000 Expenses 35,000 What did Osama Company show as total credits on its trial balance? a $60,200 b. S58,800. c. SS7,400 d. $61,600. c. d. 22. Keeping the records of the business separate from the personal records of the owner of the business is said to be adherence to which accounting principle or concept? a. Continuing-concern concept. b. Business entity principle. c. Realization principle. d. Objectivity principle. 23. Assets total $50,000 and Liabilities total $10,000. The equity of the business must total a. $4,000. b. $40,000 c. $400. d. $40. 24. If during the accounting period the assets increased by $5,000, and the owner's equity increased by $1,000, then the liabilities must have a.increased by S6,000. b. increased by S4,000 c. decreased by $4,000. d. decreased by $6,000. 25. Which of the following statements about a journal is false? a. It is not a book of original entry. b. It provides a chronological record of transactions. c. It helps to locate errors because the debit and credit amounts for each entry can be readily compared. d. It discloses in one place the complete effect of a transaction