Question

1. A business's financial statements show a significant increase in intangible assets as a percentage of total assets. What is likely impact of this on

1. A business's financial statements show a significant increase in intangible assets as a percentage of total assets. What is likely impact of this on the business's borrowing needs?

A. Borrowing needs likely to increase during the period

B. Borrowing needs will remain the same because intangible assets are financed with equity

C. Borrowing needs will remain the same because intangible assets do not require cash.

D. Borrowing needs are likely to decrease during the period

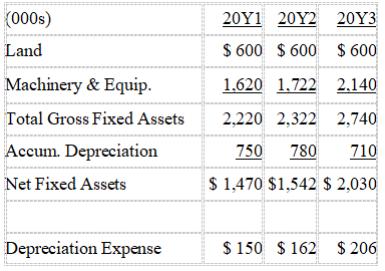

2. A company's fixed assets and depreciation appear on its financial statements as follows:

Based on this data, which of the following conclusions appear to be the most accurate?

A. It appears the company replaced few (or no) fixed assets in 20Y2 and only about one-third of what was due for replacement in 20Y3

B. The company will very likely have to replace a significant amount of fixed assets in the near future

C. The company appears to have replaced a reasonable amount of fixed assets in 20Y2 and more in 20Y3

D. As of year-end 20Y3, it appears that the company's fixed assets will be fully depreciated in about 3 years

(000s) 20Y1 202 203 Land $ 600 $ 600 $ 600 Machinery & Equip. 1.620 1.722 2.140 Total Gross Fixed Assets 2,220 2,322 2,740 Accum. Depreciation 750 780 710 Net Fixed Assets $ 1,470 $1,542 $ 2,030 Depreciation Expense $ 150 $ 162 $ 206

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER QUESTION 1 B Borrowing needs will remain the same because intangible assets are financed with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6363e53fe03fc_238691.pdf

180 KBs PDF File

6363e53fe03fc_238691.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started