Question

A certain firm has the capacity to produce 700,000 units of product per year. At present, it is operating at 75% of capacity. The

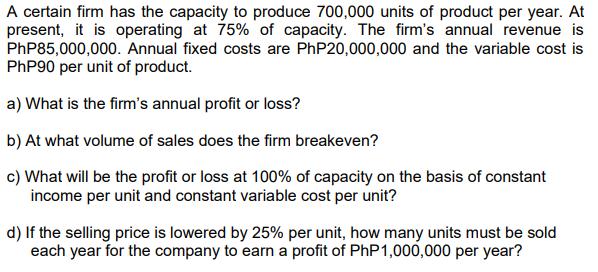

A certain firm has the capacity to produce 700,000 units of product per year. At present, it is operating at 75% of capacity. The firm's annual revenue is PHP85,000,000. Annual fixed costs are PHP20,000,000 and the variable cost is PHP90 per unit of product. a) What is the firm's annual profit or loss? b) At what volume of sales does the firm breakeven? c) What will be the profit or loss at 100% of capacity on the basis of constant income per unit and constant variable cost per unit? d) If the selling price is lowered by 25% per unit, how many units must be sold each year for the company to earn a profit of PHP1,000,000 per year?

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Contribution Revenue variable cost 85000000 7000007590 377...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting A Focus on Ethical Decision Making

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins

5th edition

324663854, 978-0324663853

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App