Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A Chinese company offered to a British counterpart in London at USD500per case FOB Shanghai. The British importer asked the exporter to offer

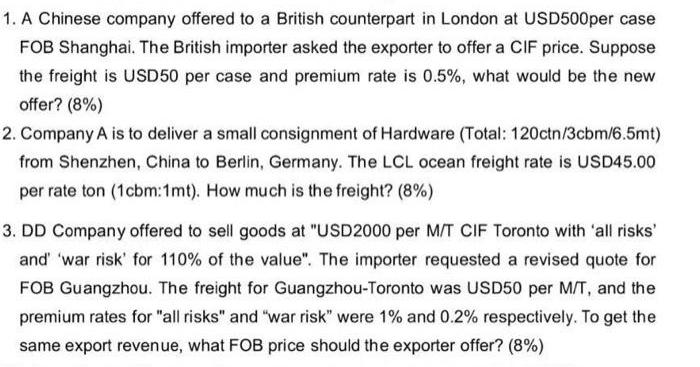

1. A Chinese company offered to a British counterpart in London at USD500per case FOB Shanghai. The British importer asked the exporter to offer a CIF price. Suppose the freight is USD50 per case and premium rate is 0.5%, what would be the new offer? (8%) 2. Company A is to deliver a small consignment of Hardware (Total: 120ctn/3cbm/6.5mt) from Shenzhen, China to Berlin, Germany. The LCL ocean freight rate is USD45.00 per rate ton (1cbm:1mt). How much is the freight? (8%) 3. DD Company offered to sell goods at "USD2000 per M/T CIF Toronto with 'all risks' and' 'war risk' for 110% of the value". The importer requested a revised quote for FOB Guangzhou. The freight for Guangzhou-Toronto was USD50 per M/T, and the premium rates for "all risks" and "war risk" were 1% and 0.2% respectively. To get the same export revenue, what FOB price should the exporter offer? (8%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the new CIF price offer CIF price FOB price Freight Insurance FOB price USD 500 per c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started