Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) A company has the following results for the year to 31 March 2018: Adjusted trading profit, after deduction of capital allowances 360,000 Bank deposit

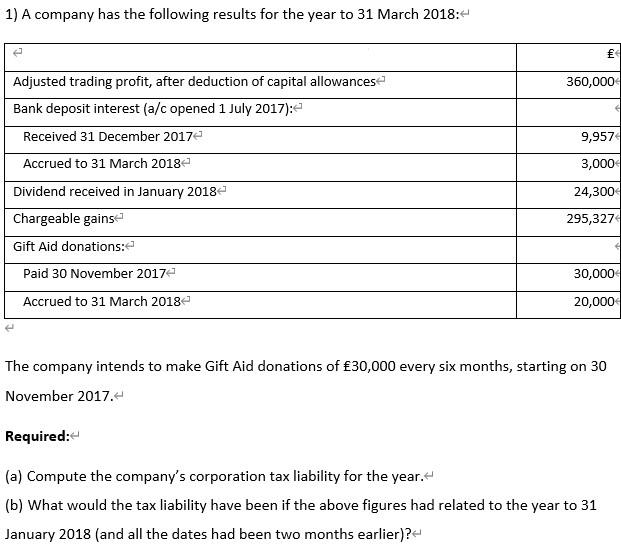

1) A company has the following results for the year to 31 March 2018:

|

| |

| Adjusted trading profit, after deduction of capital allowances | 360,000 |

| Bank deposit interest (a/c opened 1 July 2017): |

|

| Received 31 December 2017 | 9,957 |

| Accrued to 31 March 2018 | 3,000 |

| Dividend received in January 2018 | 24,300 |

| Chargeable gains | 295,327 |

| Gift Aid donations: |

|

| Paid 30 November 2017 | 30,000 |

| Accrued to 31 March 2018 | 20,000 |

The company intends to make Gift Aid donations of 30,000 every six months, starting on 30 November 2017.

Required:

- Compute the companys corporation tax liability for the year.

- What would the tax liability have been if the above figures had related to the year to 31 January 2018 (and all the dates had been two months earlier)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started