Question

1. A company is firm financed with common stock (equity) and bonds (debt). It has bonds outstanding with a price of $960 (par value

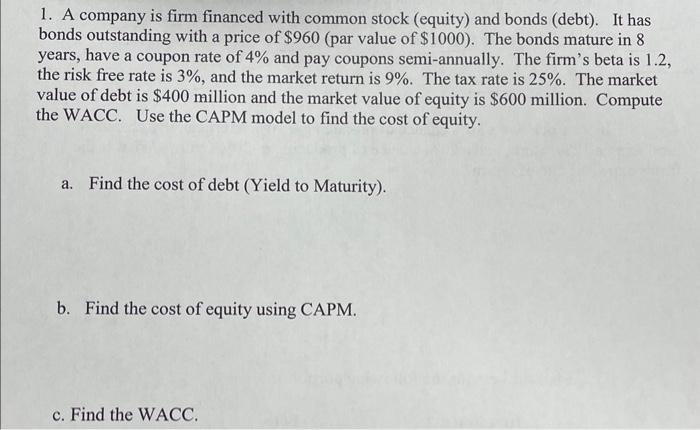

1. A company is firm financed with common stock (equity) and bonds (debt). It has bonds outstanding with a price of $960 (par value of $1000). The bonds mature in 8 years, have a coupon rate of 4% and pay coupons semi-annually. The firm's beta is 1.2, the risk free rate is 3%, and the market return is 9%. The tax rate is 25%. The market value of debt is $400 million and the market value of equity is $600 million. Compute the WACC. Use the CAPM model to find the cost of equity. a. Find the cost of debt (Yield to Maturity). b. Find the cost of equity using CAPM. c. Find the WACC.

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To find the cost of debt we need to calculate the yield to maturity YTM of the bond We ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

4th Edition

1439078084, 978-1439078082

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App