Question

1) A company is purchasing a new machine which will cost $125,000 with additional shipping costs of $5,000 and set up and installation costs of

1) A company is purchasing a new machine which will cost $125,000 with additional shipping costs of $5,000 and set up and installation costs of $10,000.

An additional $8,000 in Net Working Capital will be required.

Project life is six (6) years.

The project will increase revenues by $90,000 each year and operating costs will increase by $30,000 annually.

The machine has a class life of seven (7) years and will be depreciated using the straight line method.

The company will sell the machinery for $50,000 at the end of five years.

The companys cost of capital is 12% and the marginal tax rate is 40%.

Calculate the Annual Cash Flows for year ONE.

Calculate the last year's cash flow (operational and non-operational).

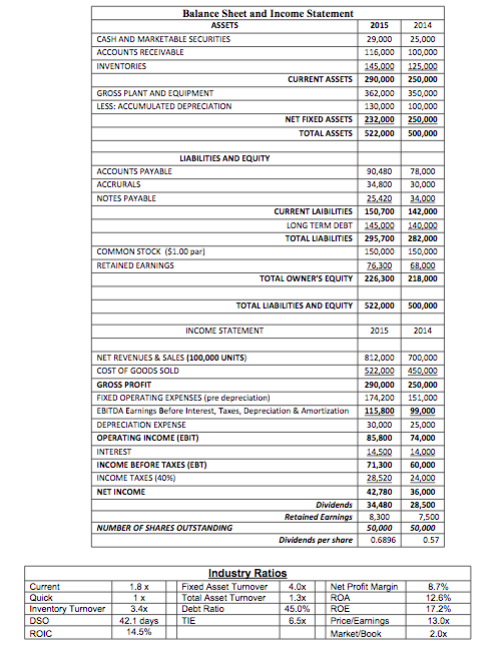

2) You have been tasked to prepare a Pro-forma income statement and balance sheet for next year projecting a 20% increase in sales.

The firm's tax rate is 40%

Assume the company will operate at 100% capacity.

Calculate the firms new level of net income at 100% capacity.

Calculate the firm,s new level of Total assets at 100% capacity.

2014 Balance Sheet and Income Statement ASSETS CASH AND MARKETABLE SECURITIES ACCOUNTS RECENABLE INVENTORIES CURRENT ASSETS CROSS PLANT AND EQU PMENT LESS: ACCUMULATED DEPRECIATION NET FIXED ASSETS TOTAL ASSETS 2015 29.000 136,000 245.000 290,000 362.000 130,000 232,000 522,000 25,000 100,000 125.000 250,000 350.000 100,000 250,000 500,000 LIABILITIES AND EQUITY ACCOUNTS PAYABLE ACCRURALS NOTES PAYABLE CURRENT LAIBILITIES LONG TERM DEBT TOTAL LIABILITIES 90.480 78,000 34,800 30,000 25.42034000 150,700 142.000 245.000 240.000 295,700 282,000 150,000 150,000 76.300GBODO 226,300 218,000 COMMON STOCK (51.00 par RETAINED EARNINGS TOTAL OWNER'S EQUITY TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2015 2014 NET REVENUES & SALES (100,000 UNITS) COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation EBITDA Earnings Before Interest, Taxes, Depreciation & Amortization DEPRECIATION EXPENSE OPERATING INCOME (CIT) INTEREST INCOME BEFORE TAXES (EBT) INCOME TAXES (40%) NET INCOME Dividends Retoined Earnings NUMBER OF SHARES OUTSTANDING Dividends pershere 812,000 522,000 290,000 174,200 115,800 30,000 85,800 14.500 71,300 28.520 42,780 34,480 8300 50,000 0.5896 700.000 450,000 250,000 151.000 99,000 25,000 74,000 14.000 60,000 24,000 36,000 28,500 7 500 50,000 0.57 N Current Quic Inventory Turnover DSO ROIC 1.8x 1x 3.4 42.1 days Industry Ratios Foxed Asset Turnover 4.0x Total Asset Turnover 13 Dect Rabo 45.00 I TE 6.5x et Profit Margin ROA ROE Price Earnings Varket Book 3.7% 125% 172% 13.Ox 2 Ox 2014 Balance Sheet and Income Statement ASSETS CASH AND MARKETABLE SECURITIES ACCOUNTS RECENABLE INVENTORIES CURRENT ASSETS CROSS PLANT AND EQU PMENT LESS: ACCUMULATED DEPRECIATION NET FIXED ASSETS TOTAL ASSETS 2015 29.000 136,000 245.000 290,000 362.000 130,000 232,000 522,000 25,000 100,000 125.000 250,000 350.000 100,000 250,000 500,000 LIABILITIES AND EQUITY ACCOUNTS PAYABLE ACCRURALS NOTES PAYABLE CURRENT LAIBILITIES LONG TERM DEBT TOTAL LIABILITIES 90.480 78,000 34,800 30,000 25.42034000 150,700 142.000 245.000 240.000 295,700 282,000 150,000 150,000 76.300GBODO 226,300 218,000 COMMON STOCK (51.00 par RETAINED EARNINGS TOTAL OWNER'S EQUITY TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2015 2014 NET REVENUES & SALES (100,000 UNITS) COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation EBITDA Earnings Before Interest, Taxes, Depreciation & Amortization DEPRECIATION EXPENSE OPERATING INCOME (CIT) INTEREST INCOME BEFORE TAXES (EBT) INCOME TAXES (40%) NET INCOME Dividends Retoined Earnings NUMBER OF SHARES OUTSTANDING Dividends pershere 812,000 522,000 290,000 174,200 115,800 30,000 85,800 14.500 71,300 28.520 42,780 34,480 8300 50,000 0.5896 700.000 450,000 250,000 151.000 99,000 25,000 74,000 14.000 60,000 24,000 36,000 28,500 7 500 50,000 0.57 N Current Quic Inventory Turnover DSO ROIC 1.8x 1x 3.4 42.1 days Industry Ratios Foxed Asset Turnover 4.0x Total Asset Turnover 13 Dect Rabo 45.00 I TE 6.5x et Profit Margin ROA ROE Price Earnings Varket Book 3.7% 125% 172% 13.Ox 2 OxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started