Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A company takes out a loan of $50,000 at 6% interest. The term of the loan is seven years, with equal payments of $5000

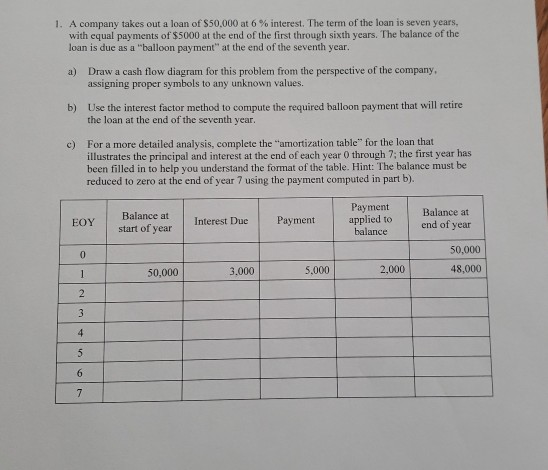

1. A company takes out a loan of $50,000 at 6% interest. The term of the loan is seven years, with equal payments of $5000 at the end of the first through sixth years. The balance of the loan is due as a "balloon payment" at the end of the seventh year. a) Draw a cash flow diagram for this problem from the perspective of the company. assigning proper symbols to any unknown values. b) Use the interest factor method to compute the required balloon payment that will retire the loan at the end of the seventh year. c) For a more detailed analysis, complete the "amortization table for the loan that illustrates the principal and interest at the end of each year through 7, the first year has been filled in to help you understand the format of the table. Hint: The balance must be reduced to zero at the end of year 7 using the payment computed in part b). EOY Balance at start of year Interest Duc Payment Payment applied to balance Balance at end of year 0 50,000 48,000 1 50,000 3.000 5.000 2,000 2 3 4 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started