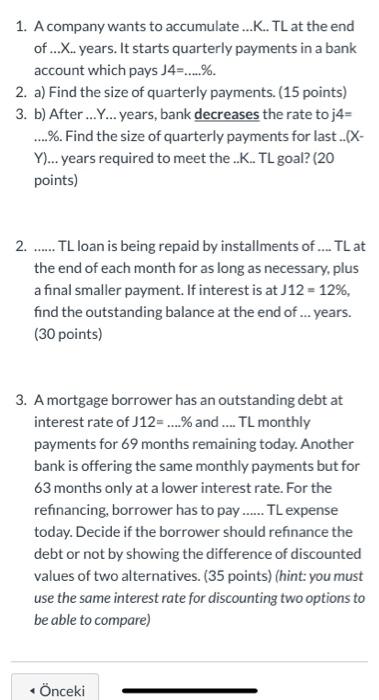

1. A company wants to accumulate ..... TL at the end of ... X. years. It starts quarterly payments in a bank account which pays J4=...%. 2. a) Find the size of quarterly payments. (15 points) 3. b) After...Y... years, bank decreases the rate to j4= .....%. Find the size of quarterly payments for last..(X- Y)... years required to meet the .... TL goal? (20 points) 2. ..... TL loan is being repaid by installments of . TL at the end of each month for as long as necessary, plus a final smaller payment. If interest is at J12 = 12%, find the outstanding balance at the end of... years. (30 points) 3. A mortgage borrower has an outstanding debt at interest rate of J12-...% and ... TL monthly payments for 69 months remaining today. Another bank is offering the same monthly payments but for 63 months only at a lower interest rate. For the refinancing, borrower has to pay ..... TL expense today. Decide if the borrower should refinance the debt or not by showing the difference of discounted values of two alternatives. (35 points) (hint: you must use the same interest rate for discounting two options to be able to compare) nceki 1. A company wants to accumulate ..... TL at the end of ... X. years. It starts quarterly payments in a bank account which pays J4=...%. 2. a) Find the size of quarterly payments. (15 points) 3. b) After...Y... years, bank decreases the rate to j4= .....%. Find the size of quarterly payments for last..(X- Y)... years required to meet the .... TL goal? (20 points) 2. ..... TL loan is being repaid by installments of . TL at the end of each month for as long as necessary, plus a final smaller payment. If interest is at J12 = 12%, find the outstanding balance at the end of... years. (30 points) 3. A mortgage borrower has an outstanding debt at interest rate of J12-...% and ... TL monthly payments for 69 months remaining today. Another bank is offering the same monthly payments but for 63 months only at a lower interest rate. For the refinancing, borrower has to pay ..... TL expense today. Decide if the borrower should refinance the debt or not by showing the difference of discounted values of two alternatives. (35 points) (hint: you must use the same interest rate for discounting two options to be able to compare) nceki