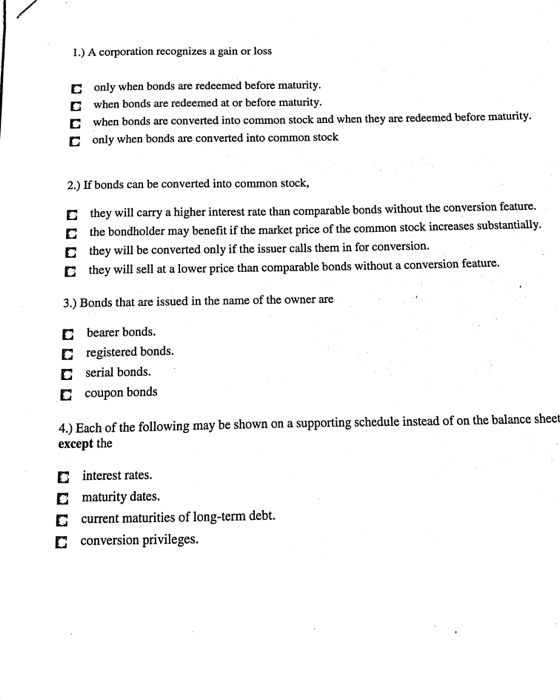

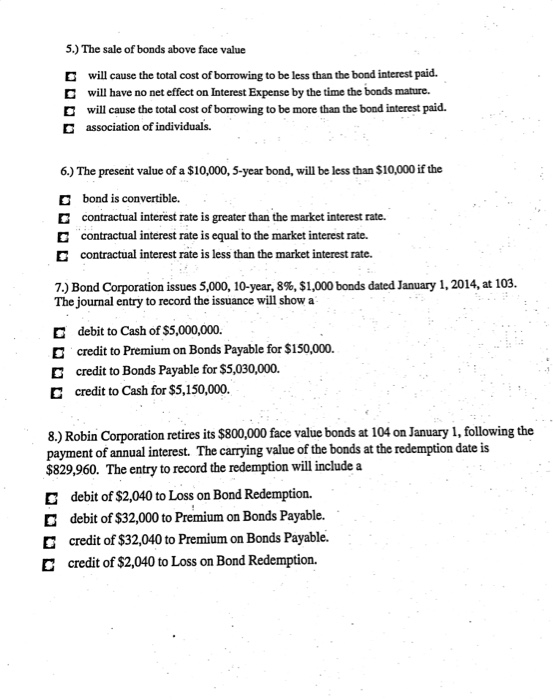

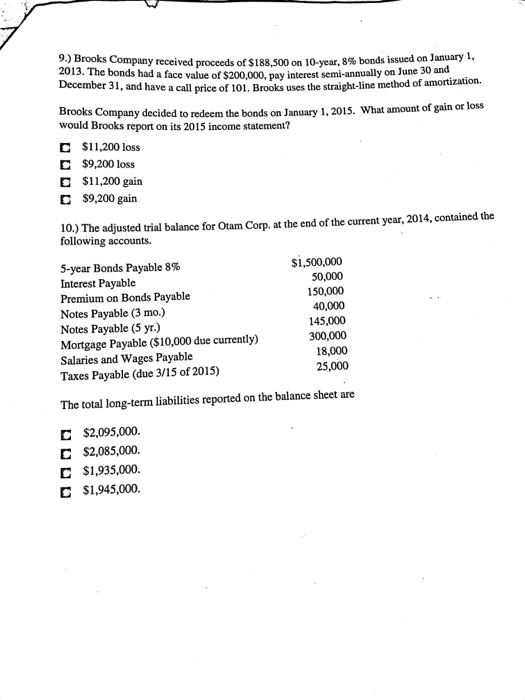

1.) A corporation recognizes a gain or loss C C C only when bonds are redeemed before maturity. when bonds are redeemed at or before maturity. when bonds are converted into common stock and when they are redeemed before maturity. only when bonds are converted into common stock 2.) If bonds can be converted into common stock, C they will carry a higher interest rate than comparable bonds without the conversion feature. the bondholder may benefit if the market price of the common stock increases substantially. they will be converted only if the issuer calls them in for conversion. they will sell at a lower price than comparable bonds without a conversion feature. 3.) Bonds that are issued in the name of the owner are D C E E bearer bonds. registered bonds. serial bonds. coupon bonds 4.) Each of the following may be shown on a supporting schedule instead of on the balance sheet except the E interest rates. maturity dates. current maturities of long-term debt. conversion privileges. C C 5.) The sale of bonds above face value D D will cause the total cost of borrowing to be less than the bond interest paid. will have no net effect on Interest Expense by the time the bonds mature. will cause the total cost of borrowing to be more than the bond interest paid. association of individuals. 6.) The present value of a $10,000, 5-year bond, will be less than $10,000 if the E bond is convertible. contractual interest rate is greater than the market interest rate. contractual interest rate is equal to the market interest rate. contractual interest rate is less than the market interest rate. 7.) Bond Corporation issues 5,000, 10-year, 8%, $1,000 bonds dated January 1, 2014, at 103. The journal entry to record the issuance will show a E debit to Cash of $5,000,000. credit to Premium on Bonds Payable for $150,000. credit to Bonds Payable for $5,030,000. credit to Cash for $5,150,000. E 8.) Robin Corporation retires its $800,000 face value bonds at 104 on January 1, following the payment of annual interest. The carrying value of the bonds at the redemption date is $829,960. The entry to record the redemption will include a debit of $2,040 to Loss on Bond Redemption.. debit of $32,000 to Premium on Bonds Payable. credit of $32,040 to Premium on Bonds Payable. credit of $2,040 to Loss on Bond Redemption. .) Brooks Company received proceeds of $188.500 on 10-year, 8% bonds issued on January 1, 2013. The bonds had a face value of $200.000. nav interest semi-annually on June 30 and December 31, and have a call price of 101. Brooks uses the straight-line method of amortization. Brooks Company decided to redeem the bonds on January 1, 2015. What amount of gain or loss would Brooks report on its 2015 income statement? C $11,200 loss C $9,200 loss $11,200 gain E $9,200 gain 10.) The adjusted trial balance for Otam Corp. at the end of the current year, 2014, contained the following accounts. 5-year Bonds Payable 8% $1,500,000 Interest Payable 50,000 Premium on Bonds Payable 150,000 Notes Payable (3 mo.) 40,000 Notes Payable (5 yr.) 145,000 300,000 Mortgage Payable ($10,000 due currently) 18,000 Salaries and Wages Payable 25,000 Taxes Payable (due 3/15 of 2015) The total long-term liabilities reported on the balance sheet are C C C D $2,095,000 $2,085,000. $1,935,000. $1,945,000