Answered step by step

Verified Expert Solution

Question

1 Approved Answer

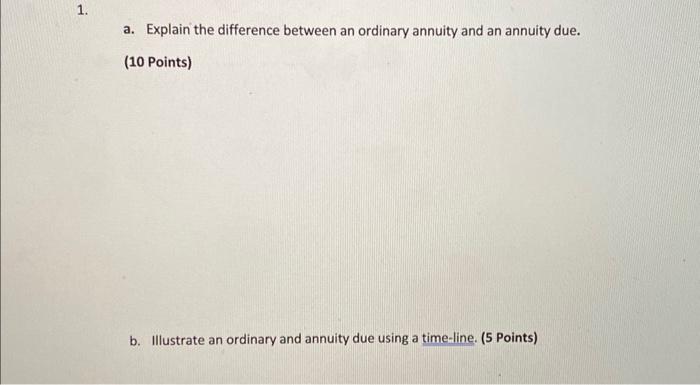

1. a. Explain the difference between an ordinary annuity and an annuity due. (10 Points) b. Illustrate an ordinary and annuity due using a

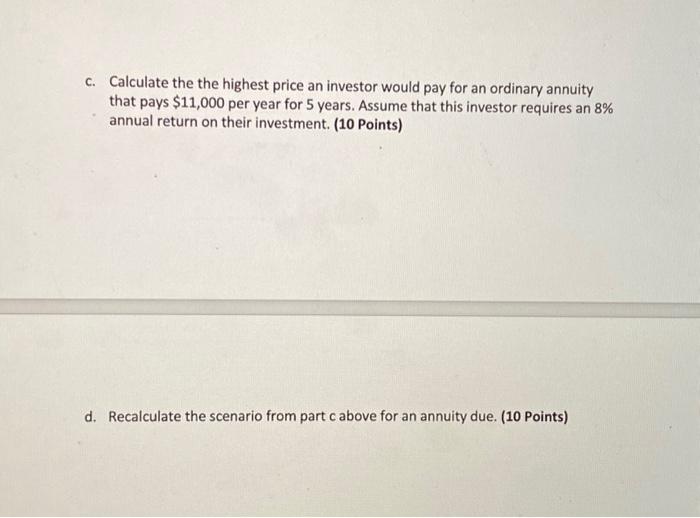

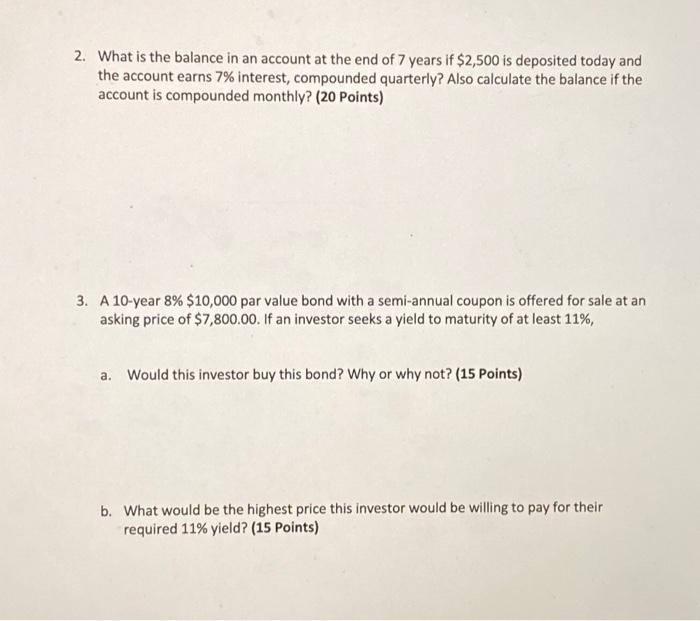

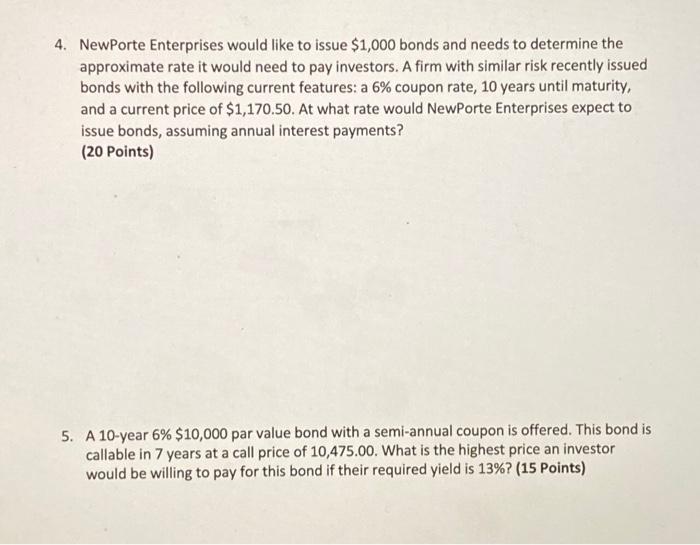

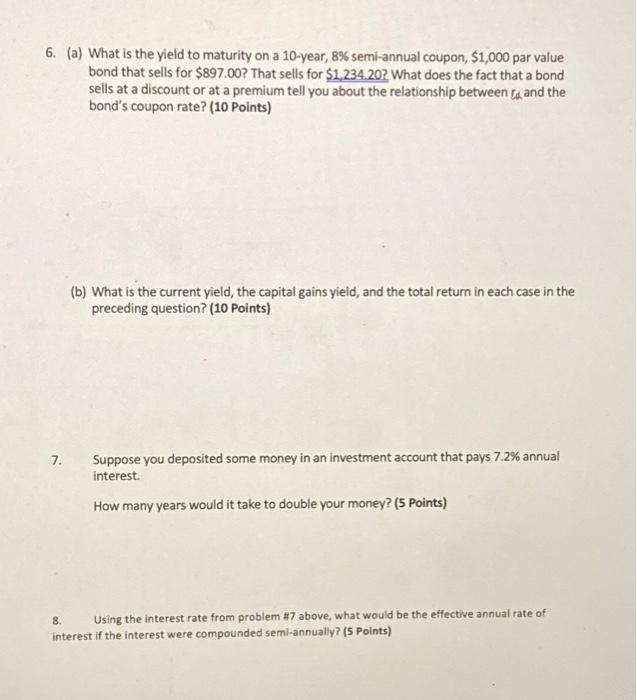

1. a. Explain the difference between an ordinary annuity and an annuity due. (10 Points) b. Illustrate an ordinary and annuity due using a time-line. (5 Points) c. Calculate the the highest price an investor would pay for an ordinary annuity that pays $11,000 per year for 5 years. Assume that this investor requires an 8% annual return on their investment. (10 Points) d. Recalculate the scenario from part c above for an annuity due. (10 Points) 2. What is the balance in an account at the end of 7 years if $2,500 is deposited today and the account earns 7% interest, compounded quarterly? Also calculate the balance if the account is compounded monthly? (20 Points) 3. A 10-year 8 % $10,000 par value bond with a semi-annual coupon is offered for sale at an asking price of $7,800.00. If an investor seeks a yield to maturity of at least 11%, a. Would this investor buy this bond? Why or why not? (15 Points) b. What would be the highest price this investor would be willing to pay for their required 11% yield? (15 Points) 4. NewPorte Enterprises would like to issue $1,000 bonds and needs to determine the approximate rate it would need to pay investors. A firm with similar risk recently issued bonds with the following current features: a 6% coupon rate, 10 years until maturity, and a current price of $1,170.50. At what rate would NewPorte Enterprises expect to issue bonds, assuming annual interest payments? (20 Points) 5. A 10-year 6% $10,000 par value bond with a semi-annual coupon is offered. This bond is callable in 7 years at a call price of 10,475.00. What is the highest price an investor would be willing to pay for this bond if their required yield is 13%? (15 Points) 6. (a) What is the yield to maturity on a 10-year, 8 % semi-annual coupon, $1,000 par value bond that sells for $897.00? That sells for $1,234.20? What does the fact that a bond sells at a discount or at a premium tell you about the relationship between and the bond's coupon rate? (10 Points) 7. (b) What is the current yield, the capital gains yield, and the total return in each case in the preceding question? (10 Points) Suppose you deposited some money in an investment account that pays 7.2% annual interest. How many years would it take to double your money? (5 Points) 8. Using the interest rate from problem #7 above, what would be the effective annual rate of interest if the interest were compounded semi-annually? (5 Points)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Here are the answers to the questions 1 a An ordinary annuity is a series of fixed payments made at regular intervals over a specified period o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started