Answered step by step

Verified Expert Solution

Question

1 Approved Answer

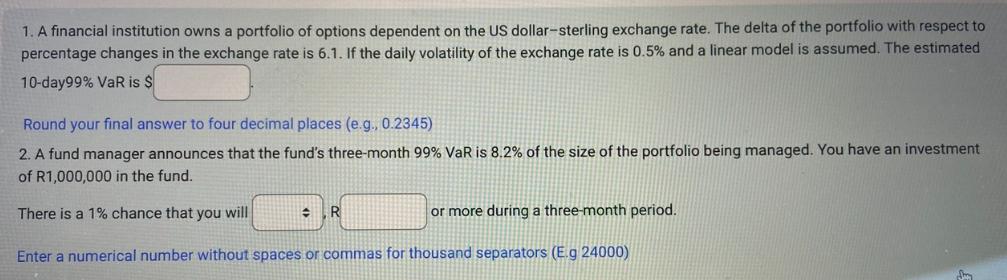

1. A financial institution owns a portfolio of options dependent on the US dollar-sterling exchange rate. The delta of the portfolio with respect to

1. A financial institution owns a portfolio of options dependent on the US dollar-sterling exchange rate. The delta of the portfolio with respect to percentage changes in the exchange rate is 6.1. If the daily volatility of the exchange rate is 0.5% and a linear model is assumed. The estimated 10-day99% VaR is $ Round your final answer to four decimal places (e.g., 0.2345) 2. A fund manager announces that the fund's three-month 99% VaR is 8.2% of the size of the portfolio being managed. You have an investment of R1,000,000 in the fund. There is a 1% chance that you will R or more during a three-month period. Enter a numerical number without spaces or commas for thousand separators (E.g 24000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the 10day 99 Value at Risk VaR for the financial institutions portfolio of options de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started