Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) a) Find the market share in Ontario for 2021 in sales dollars (or revenue) for Barrie ATV's INC. if they sold 600 ATVs

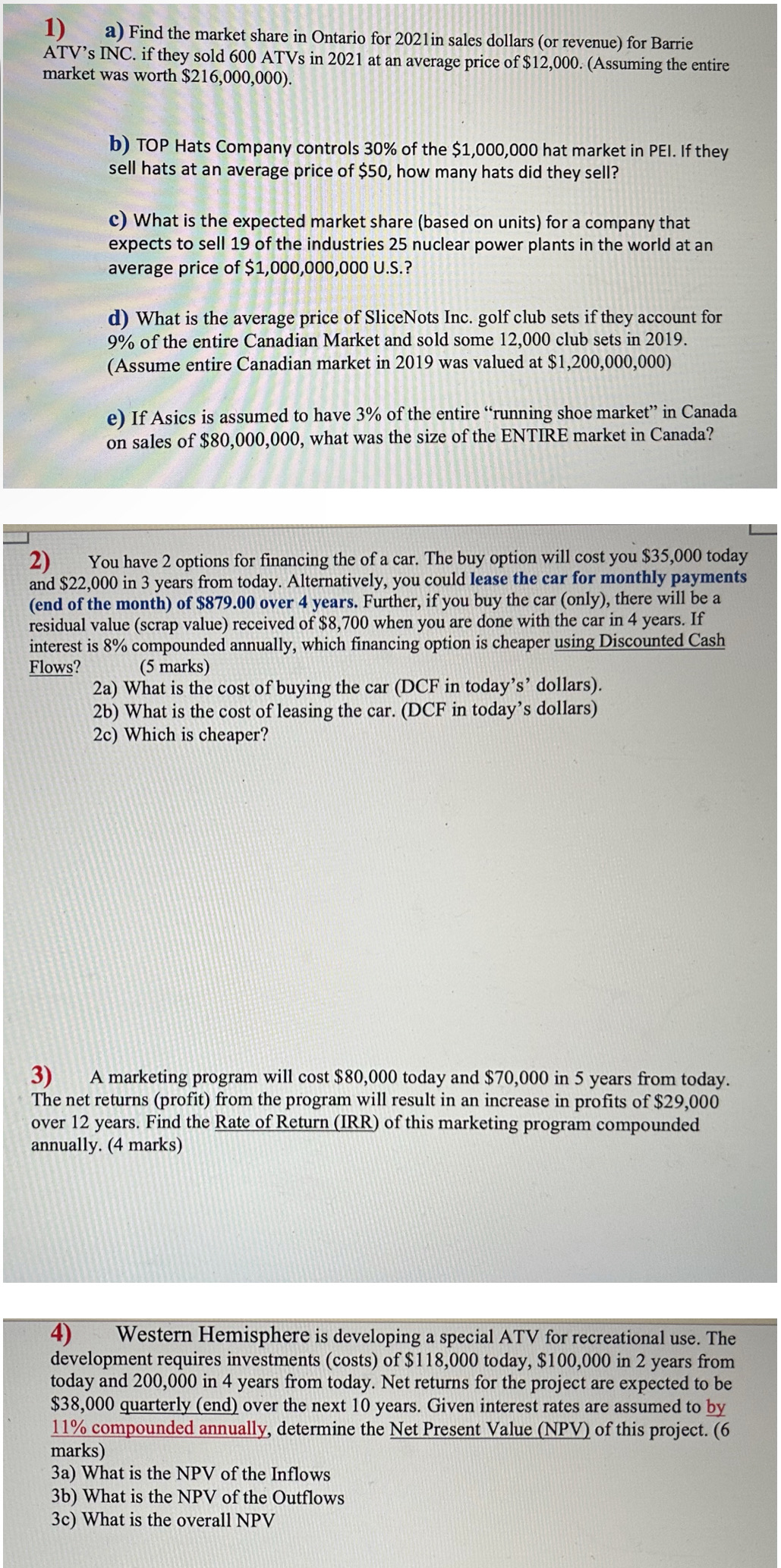

1) a) Find the market share in Ontario for 2021 in sales dollars (or revenue) for Barrie ATV's INC. if they sold 600 ATVs in 2021 at an average price of $12,000. (Assuming the entire market was worth $216,000,000). b) TOP Hats Company controls 30% of the $1,000,000 hat market in PEI. If they sell hats at an average price of $50, how many hats did they sell? c) What is the expected market share (based on units) for a company that expects to sell 19 of the industries 25 nuclear power plants in the world at an average price of $1,000,000,000 U.S.? d) What is the average price of SliceNots Inc. golf club sets if they account for 9% of the entire Canadian Market and sold some 12,000 club sets in 2019. (Assume entire Canadian market in 2019 was valued at $1,200,000,000) e) If Asics is assumed to have 3% of the entire "running shoe market" in Canada on sales of $80,000,000, what was the size of the ENTIRE market in Canada? 2) You have 2 options for financing the of a car. The buy option will cost you $35,000 today and $22,000 in 3 years from today. Alternatively, you could lease the car for monthly payments (end of the month) of $879.00 over 4 years. Further, if you buy the car (only), there will be a residual value (scrap value) received of $8,700 when you are done with the car in 4 years. If interest is 8% compounded annually, which financing option is cheaper using Discounted Cash (5 marks) Flows? 2a) What is the cost of buying the car (DCF in today's' dollars). 2b) What is the cost of leasing the car. (DCF in today's dollars) 2c) Which is cheaper? 3) A marketing program will cost $80,000 today and $70,000 in 5 years from today. The net returns (profit) from the program will result in an increase in profits of $29,000 over 12 years. Find the Rate of Return (IRR) of this marketing program compounded annually. (4 marks) 4) Western Hemisphere is developing a special ATV for recreational use. The development requires investments (costs) of $118,000 today, $100,000 in 2 years from today and 200,000 in 4 years from today. Net returns for the project are expected to be $38,000 quarterly (end) over the next 10 years. Given interest rates are assumed to by 11% compounded annually, determine the Net Present Value (NPV) of this project. (6 marks) 3a) What is the NPV of the Inflows 3b) What is the NPV of the Outflows 3c) What is the overall NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started