Answered step by step

Verified Expert Solution

Question

1 Approved Answer

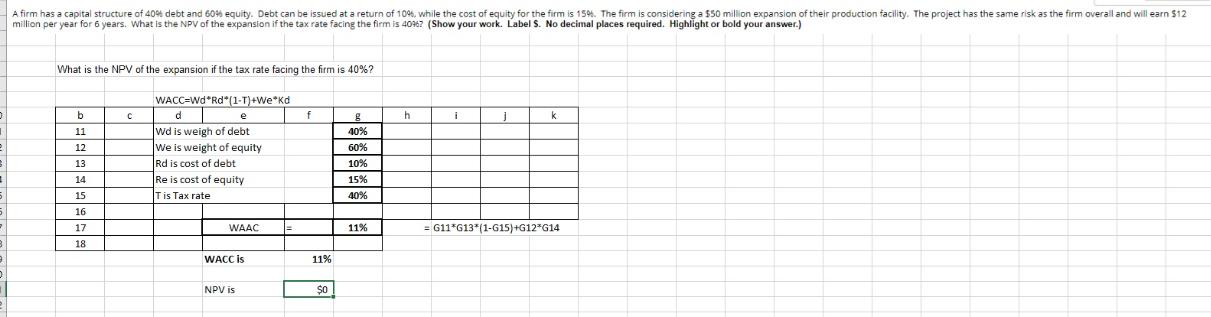

A firm has a capital structure of 40% debt and 60% equity. Debt can be issued at a return of 10%, while the cost

A firm has a capital structure of 40% debt and 60% equity. Debt can be issued at a return of 10%, while the cost of equity for the firm is 15%. The firm is considering a $50 million expansion of their production facility. The project has the same risk as the firm overall and will earn $12 million per year for 6 years. What is the NPV of the expansion if the tax rate facing the firm is 40967 (Show your work. Label S. No decimal places required. Highlight or bold your answer.) What is the NPV of the expansion if the tax rate facing the firm is 40%? WACC=Wd*Rd (1-T)+We*Kd b d 11 Wd is weigh of debt 12 We is weight of equity 13 Rd is cost of debt 14 Re is cost of equity 15 Tis Tax rate 16 17 WAAC 18 f g h i k 40% 60% 10% 15% 40% WACC is 11% NPV is $0 11% = G11*G13*{1-G15)+G12*G14 A firm has a capital structure of 40% debt and 60% equity. Debt can be issued at a return of 10%, while the cost of equity for the firm is 15%. The firm is considering a $50 million expansion of their production facility. The project has the same risk as the firm overall and will earn $12 million per year for 6 years. What is the NPV of the expansion if the tax rate facing the firm is 40967 (Show your work. Label S. No decimal places required. Highlight or bold your answer.) What is the NPV of the expansion if the tax rate facing the firm is 40%? WACC=Wd*Rd (1-T)+We*Kd b d 11 Wd is weigh of debt 12 We is weight of equity 13 Rd is cost of debt 14 Re is cost of equity 15 Tis Tax rate 16 17 WAAC 18 f g h i k 40% 60% 10% 15% 40% WACC is 11% NPV is $0 11% = G11*G13*{1-G15)+G12*G14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

contains a formula for calculating the Weighted Average Cost of Capital WACC for a company considering a new project The WACC is used to discount the cash flows of the project to determine its net pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started