Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A forward contract is an agreement to buy or sell an asset at a certain future time for a certain price (called the

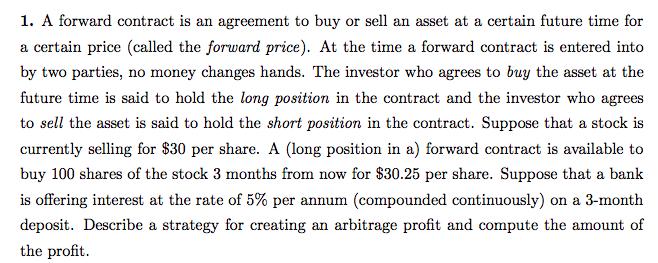

1. A forward contract is an agreement to buy or sell an asset at a certain future time for a certain price (called the forward price). At the time a forward contract is entered into by two parties, no money changes hands. The investor who agrees to buy the asset at the future time is said to hold the long position in the contract and the investor who agrees to sell the asset is said to hold the short position in the contract. Suppose that a stock is currently selling for $30 per share. A (long position in a) forward contract is available to buy 100 shares of the stock 3 months from now for $30.25 per share. Suppose that a bank is offering interest at the rate of 5% per annum (compounded continuously) on a 3-month deposit. Describe a strategy for creating an arbitrage profit and compute the amount of the profit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Arbitrage Strategy with Forward Contract and Interest Rate Heres a strategy to create an arbitrage profit using the forward contract and the interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started