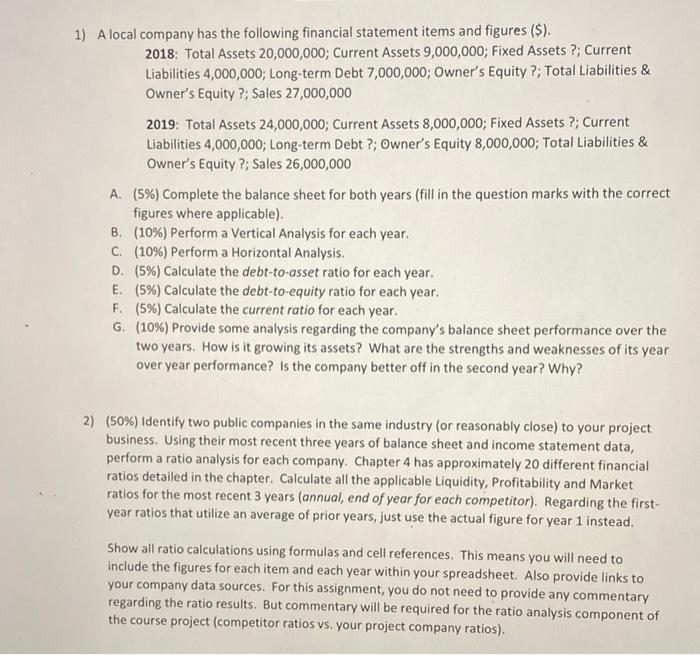

1) A local company has the following financial statement items and figures ($). 2018: Total Assets 20,000,000; Current Assets 9,000,000; Fixed Assets ?, Current Liabilities 4,000,000; Long-term Debt 7,000,000; Owner's Equity ?; Total Liabilities & Owner's Equity ?; Sales 27,000,000 2019: Total Assets 24,000,000; Current Assets 8,000,000; Fixed Assets ?; Current Liabilities 4,000,000; Long-term Debt ?; Owner's Equity 8,000,000; Total Liabilities & Owner's Equity ?; Sales 26,000,000 A. (5%) Complete the balance sheet for both years (fill in the question marks with the correct figures where applicable). B. (10%) Perform a Vertical Analysis for each year. C. (10%) Perform a Horizontal Analysis. D. (5%) Calculate the debt-to-asset ratio for each year. E. (5%) Calculate the debt-to-equity ratio for each year. F. (5%) Calculate the current ratio for each year. G. (10%) Provide some analysis regarding the company's balance sheet performance over the two years. How is it growing its assets? What are the strengths and weaknesses of its year over year performance? Is the company better off in the second year? Why? 2) (50%) Identify two public companies in the same industry (or reasonably close) to your project business. Using their most recent three years of balance sheet and income statement data, perform a ratio analysis for each company. Chapter 4 has approximately 20 different financial ratios detailed in the chapter. Calculate all the applicable Liquidity, Profitability and Market ratios for the most recent 3 years (annual, end of year for each competitor). Regarding the first- year ratios that utilize an average of prior years, just use the actual figure for year 1 instead. Show all ratio calculations using formulas and cell references. This means you will need to include the figures for each item and each year within your spreadsheet. Also provide links to your company data sources. For this assignment, you do not need to provide any commentary regarding the ratio results. But commentary will be required for the ratio analysis component of the course project (competitor ratios vs. your project company ratios)