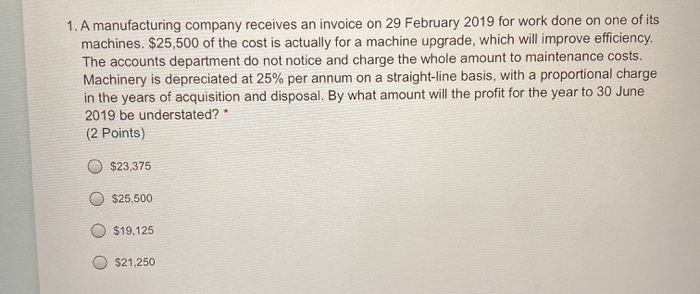

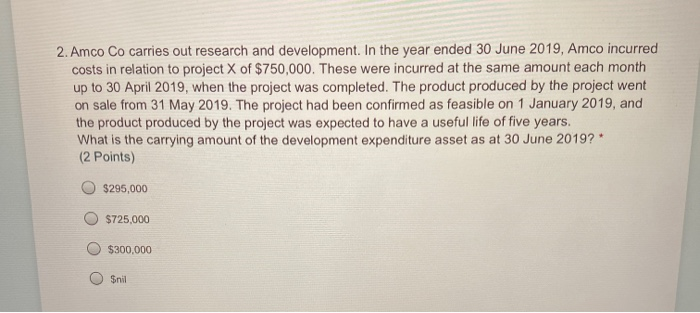

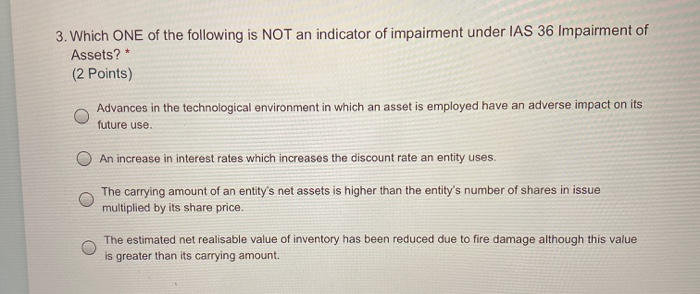

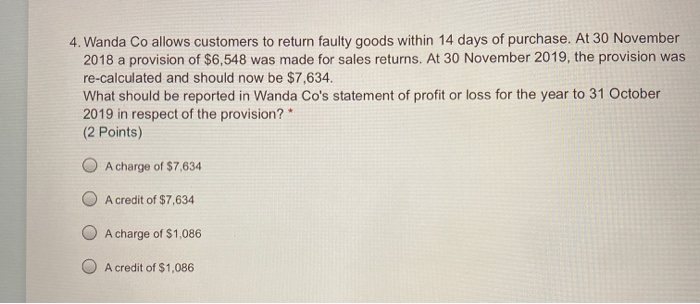

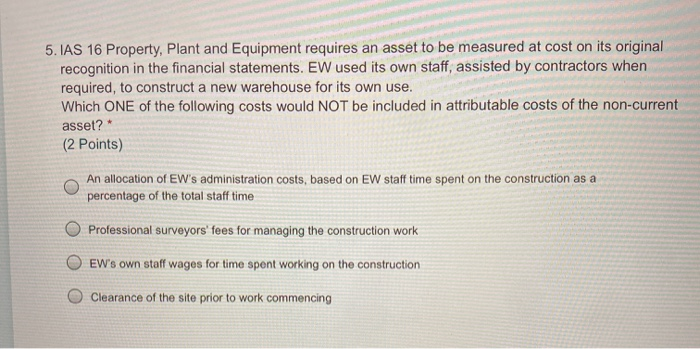

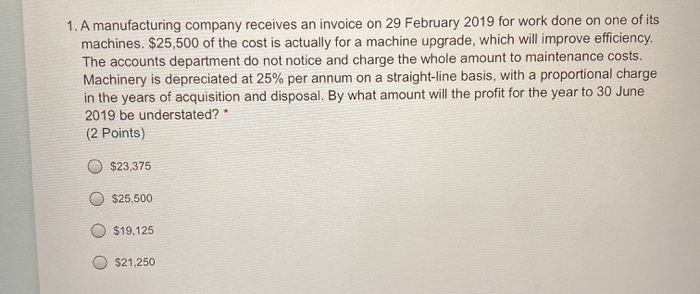

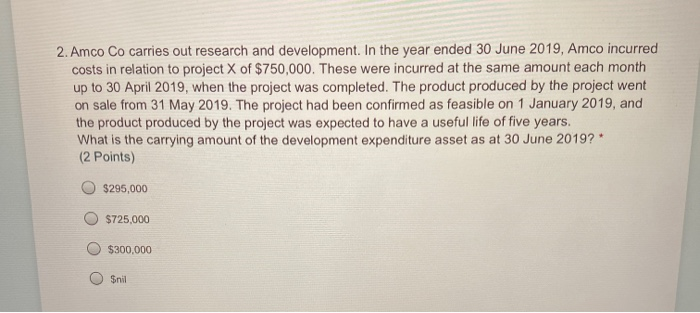

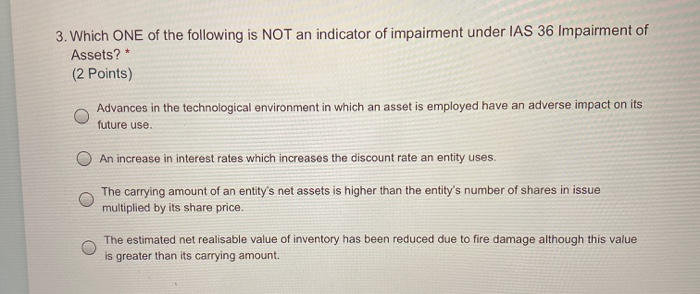

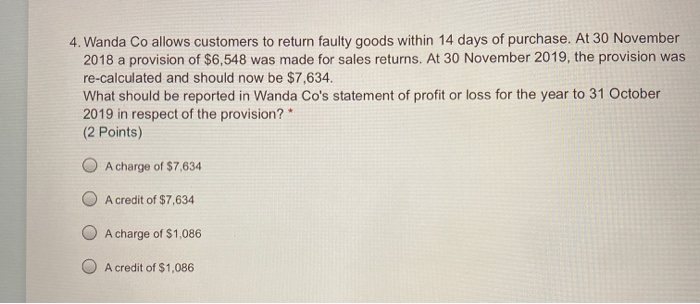

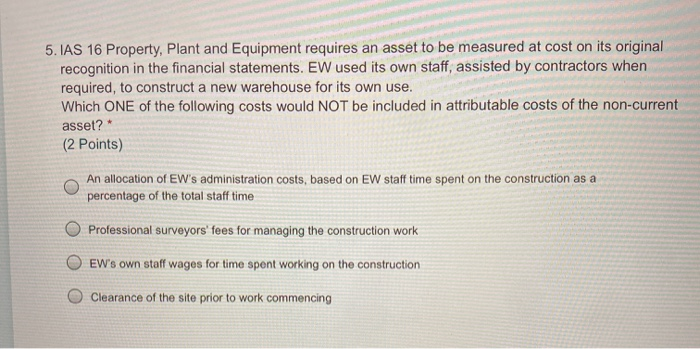

1. A manufacturing company receives an invoice on 29 February 2019 for work done on one of its machines. $25,500 of the cost is actually for a machine upgrade, which will improve efficiency. The accounts department do not notice and charge the whole amount to maintenance costs. Machinery is depreciated at 25% per annum on a straight-line basis, with a proportional charge in the years of acquisition and disposal. By what amount will the profit for the year to 30 June 2019 be understated? (2 points) $23,375 $25,500 $19,125 $21,250 2. Amco Co carries out research and development. In the year ended 30 June 2019, Amco incurred costs in relation to project X of $750,000. These were incurred at the same amount each month up to 30 April 2019, when the project was completed. The product produced by the project went on sale from 31 May 2019. The project had been confirmed as feasible on 1 January 2019, and the product produced by the project was expected to have a useful life of five years. What is the carrying amount of the development expenditure asset as at 30 June 2019? * (2 points) $295,000 $725,000 $300,000 Snil 3. Which ONE of the following is NOT an indicator of impairment under IAS 36 Impairment of Assets? (2 Points) Advances in the technological environment in which an asset is employed have an adverse impact on its future use. An increase in interest rates which increases the discount rate an entity uses. The carrying amount of an entity's net assets is higher than the entity's number of shares in issue multiplied by its share price. The estimated net realisable value of inventory has been reduced due to fire damage although this value is greater than its carrying amount 4. Wanda Co allows customers to return faulty goods within 14 days of purchase. At 30 November 2018 a provision of $6,548 was made for sales returns. At 30 November 2019, the provision was re-calculated and should now be $7,634. What should be reported in Wanda Co's statement of profit or loss for the year to 31 October 2019 in respect of the provision? * (2 Points) A charge of $7,634 A credit of $7,634 A charge of $1,086 A credit of $1,086 5. IAS 16 Property, Plant and Equipment requires an asset to be measured at cost on its original recognition in the financial statements. EW used its own staff, assisted by contractors when required, to construct a new warehouse for its own use. Which ONE of the following costs would NOT be included in attributable costs of the non-current asset? (2 points) * An allocation of EW's administration costs, based on EW staff time spent on the construction as a percentage of the total staff time Professional surveyors fees for managing the construction work EW's own staff wages for time spent working on the construction Clearance of the site prior to work commencing