Question

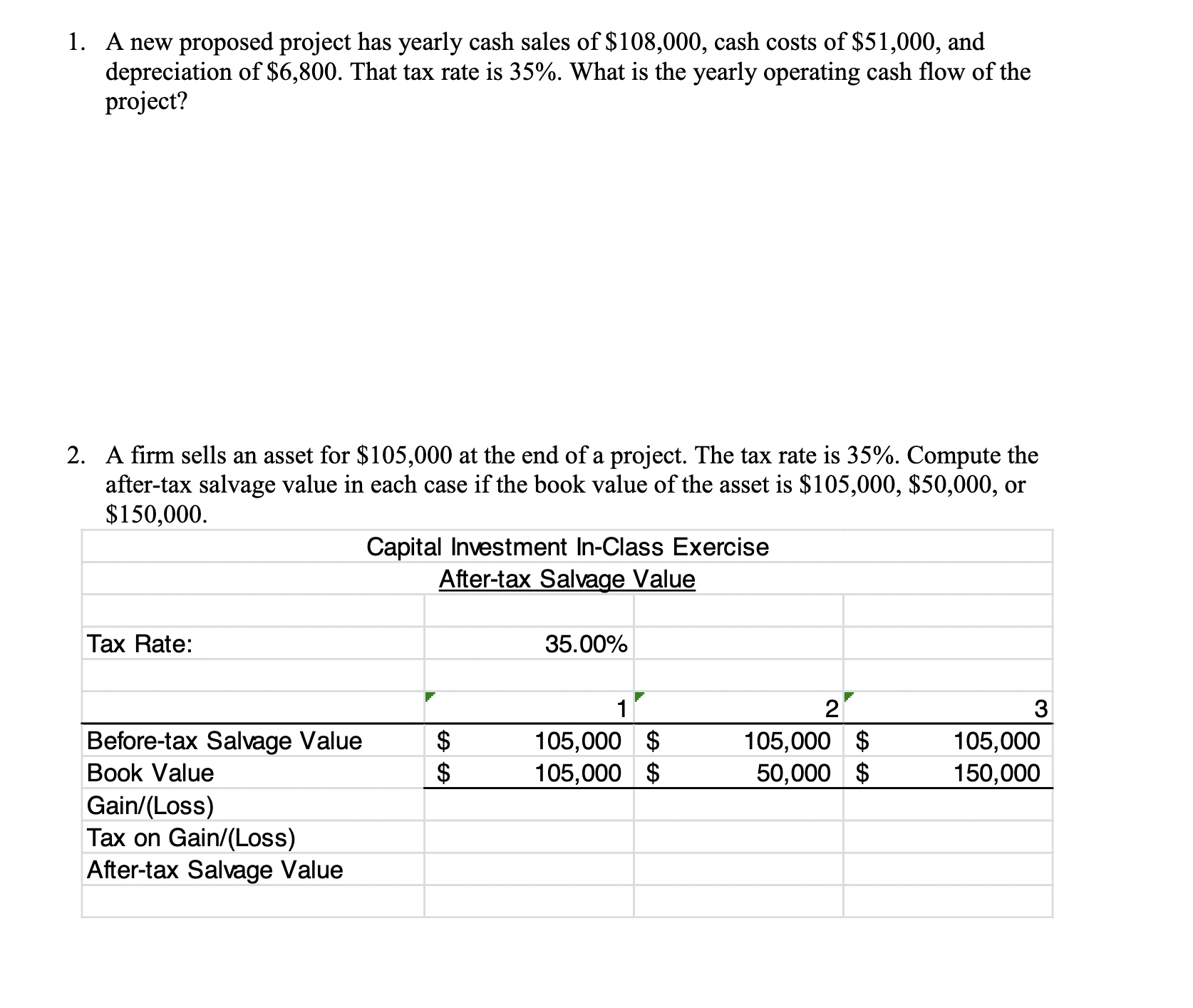

1. A new proposed project has yearly cash sales of $108,000, cash costs of $51,000, and depreciation of $6,800. That tax rate is 35%.

1. A new proposed project has yearly cash sales of $108,000, cash costs of $51,000, and depreciation of $6,800. That tax rate is 35%. What is the yearly operating cash flow of the project? 2. A firm sells an asset for $105,000 at the end of a project. The tax rate is 35%. Compute the after-tax salvage value in each case if the book value of the asset is $105,000, $50,000, or $150,000. Tax Rate: Before-tax Salvage Value Book Value Gain/(Loss) Tax on Gain/(Loss) After-tax Salvage Value Capital Investment In-Class Exercise After-tax Salvage Value 35.00% 1 105,000 $ 105,000 $ 2 105,000 $ 50,000 $ 3 105,000 150,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Yearly Operating Cash Flow Operating Income 108000 Cash Sales 51000 Cash Costs 57000 Taxable Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

11th edition

77861752, 978-0077861759

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App