Answered step by step

Verified Expert Solution

Question

1 Approved Answer

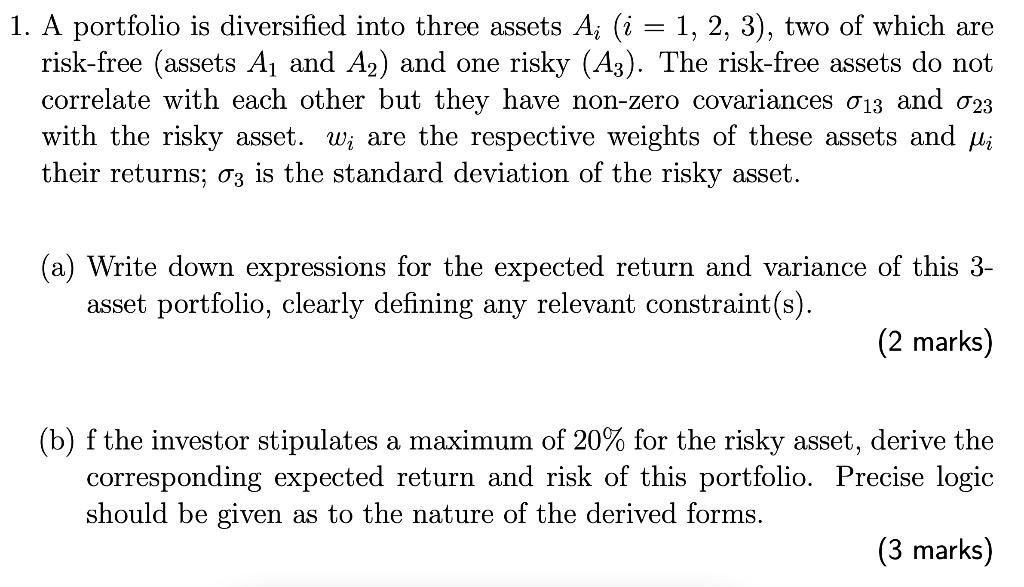

1. A portfolio is diversified into three assets Ai (i = 1, 2, 3), two of which are risk-free (assets A and A2) and

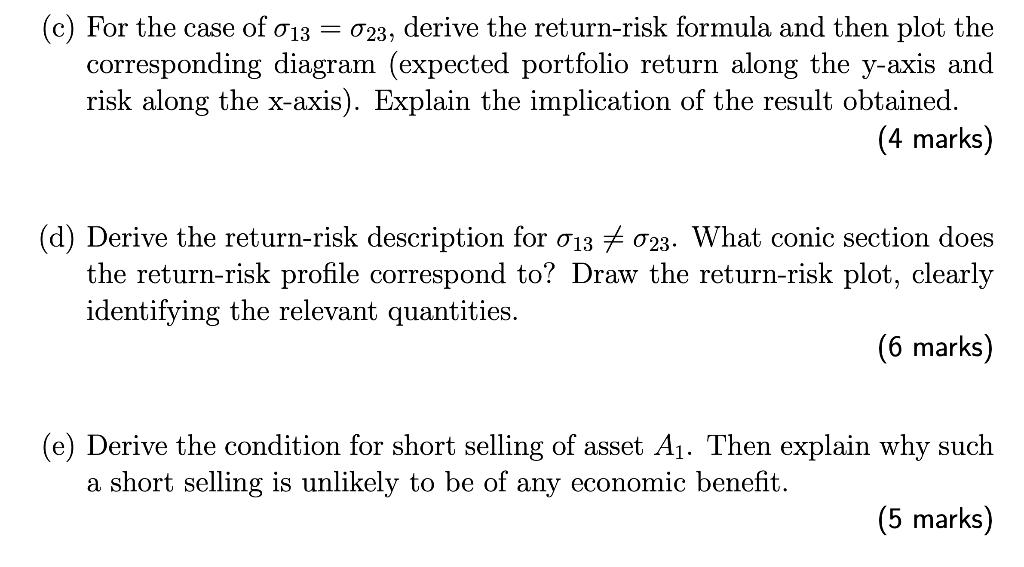

1. A portfolio is diversified into three assets Ai (i = 1, 2, 3), two of which are risk-free (assets A and A2) and one risky (A3). The risk-free assets do not correlate with each other but they have non-zero covariances 13 and 23 with the risky asset. w; are the respective weights of these assets and i their returns; 3 is the standard deviation of the risky asset. (a) Write down expressions for the expected return and variance of this 3- asset portfolio, clearly defining any relevant constraint(s). (2 marks) (b) f the investor stipulates a maximum of 20% for the risky asset, derive the corresponding expected return and risk of this portfolio. Precise logic should be given as to the nature of the derived forms. (3 marks) = (c) For the case of 13 023, derive the return-risk formula and then plot the corresponding diagram (expected portfolio return along the y-axis and risk along the x-axis). Explain the implication of the result obtained. (4 marks) (d) Derive the return-risk description for 13 023. What conic section does the return-risk profile correspond to? Draw the return-risk plot, clearly identifying the relevant quantities. (6 marks) (e) Derive the condition for short selling of asset A. Then explain why such a short selling is unlikely to be of any economic benefit. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started