Answered step by step

Verified Expert Solution

Question

1 Approved Answer

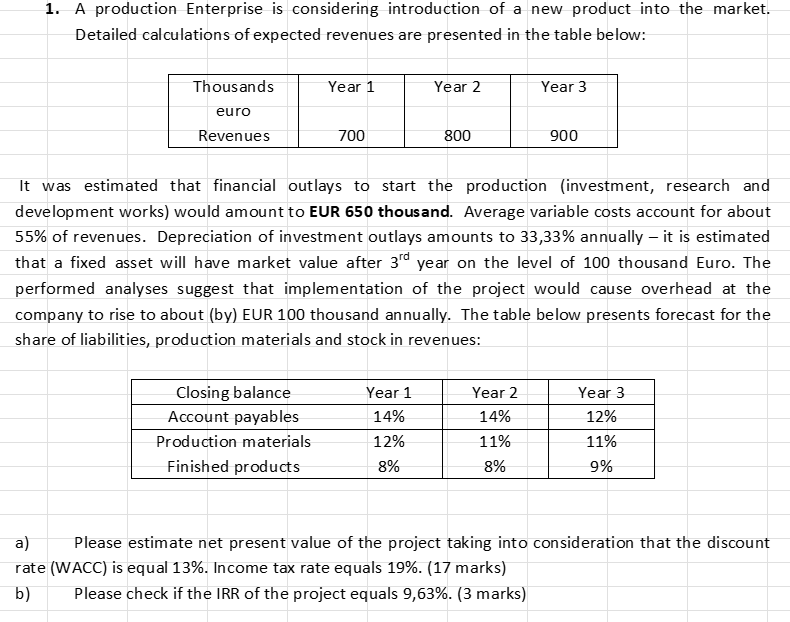

1. A production Enterprise is considering introduction of a new product into the market. Detailed calculations of expected revenues are presented in the table

1. A production Enterprise is considering introduction of a new product into the market. Detailed calculations of expected revenues are presented in the table below: Thousands euro Revenues Year 1 Closing balance Account payables Production materials Finished products 700 Year 2 Year 1 14% 12% 8% 800 It was estimated that financial outlays to start the production (investment, research and development works) would amount to EUR 650 thousand. Average variable costs account for about 55% of revenues. Depreciation of investment outlays amounts to 33,33% annually - it is estimated that a fixed asset will have market value after 3rd year on the level of 100 thousand Euro. The performed analyses suggest that implementation of the project would cause overhead at the company to rise to about (by) EUR 100 thousand annually. The table below presents forecast for the share of liabilities, production materials and stock in revenues: Year 3 Year 2 14% 11% 8% 900 Year 3 12% 11% 9% a) Please estimate net present value of the project taking into consideration that the discount rate (WACC) is equal 13%. Income tax rate equals 19%. (17 marks) b) Please check if the IRR of the project equals 9,63%. (3 marks)

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the project we need to follow these steps 1 Calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started