Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A share of common stock just paid a dividend of $1.00. If the growth rate for this stock is 5.4%, and investors' required rate

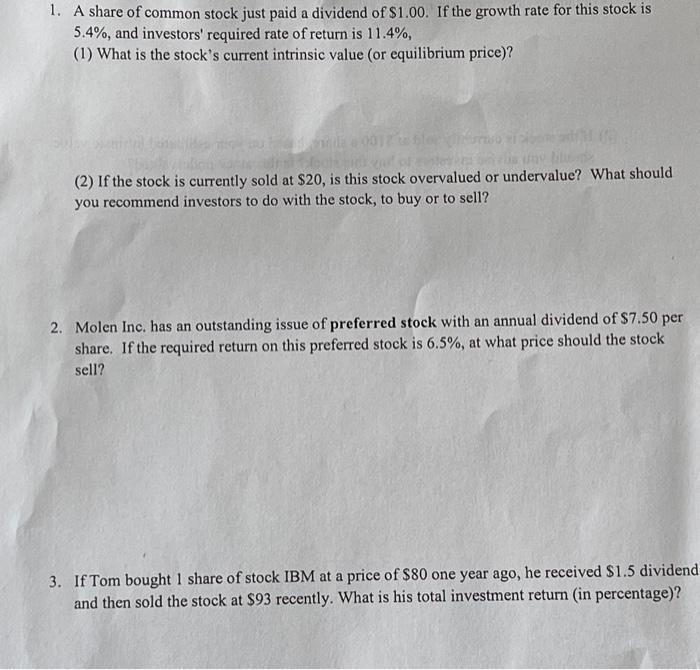

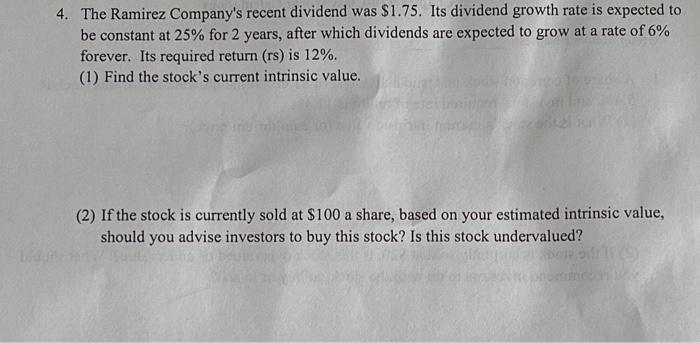

1. A share of common stock just paid a dividend of $1.00. If the growth rate for this stock is 5.4%, and investors' required rate of return is 11.4%, (1) What is the stock's current intrinsic value (or equilibrium price)? Splay 20 10, de 400, one adal 561/08 tray (2) If the stock is currently sold at $20, is this stock overvalued or undervalue? What should you recommend investors to do with the stock, to buy or to sell? 2. Molen Inc. has an outstanding issue of preferred stock with an annual dividend of $7.50 per share. If the required return on this preferred stock is 6.5%, at what price should the stock sell? 3. If Tom bought 1 share of stock IBM at a price of $80 one year ago, he received $1.5 dividend and then sold the stock at $93 recently. What is his total investment return (in percentage)?

look at images, please answer all in detail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started