Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A short-term obligation can be excluded from current liabilities if the company intends to refinance it on a long-term basis and demonstrates the

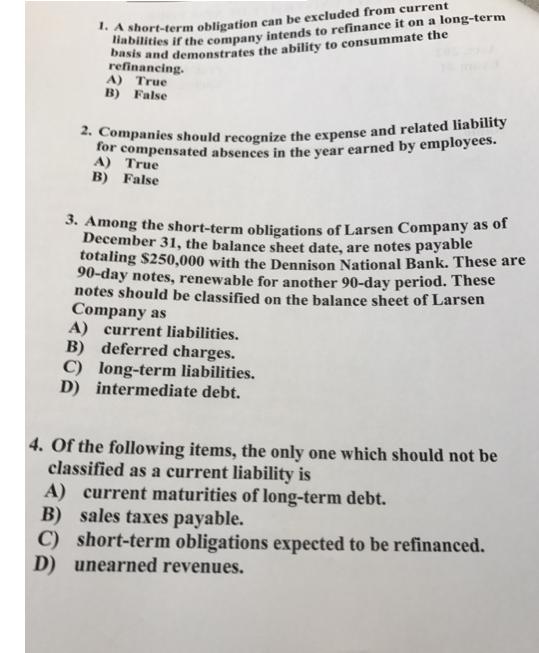

1. A short-term obligation can be excluded from current liabilities if the company intends to refinance it on a long-term basis and demonstrates the ability to consummate the refinancing. A) True B) False 2. Companies should recognize the expense and related liability for compensated absences in the year earned by employees. A) True B) False 3. Among the short-term obligations of Larsen Company as of December 31, the balance sheet date, are notes payable totaling $250,000 with the Dennison National Bank. These are 90-day notes, renewable for another 90-day period. These notes should be classified on the balance sheet of Larsen Company as A) current liabilities. B) deferred charges. C) long-term liabilities. D) intermediate debt. 4. Of the following items, the only one which should not be classified as a current liability is A) current maturities of long-term debt. B) sales taxes payable. C) short-term obligations expected to be refinanced. D) unearned revenues.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 A True This statement is true A company may exclude a shortterm obligation from current liabilitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started