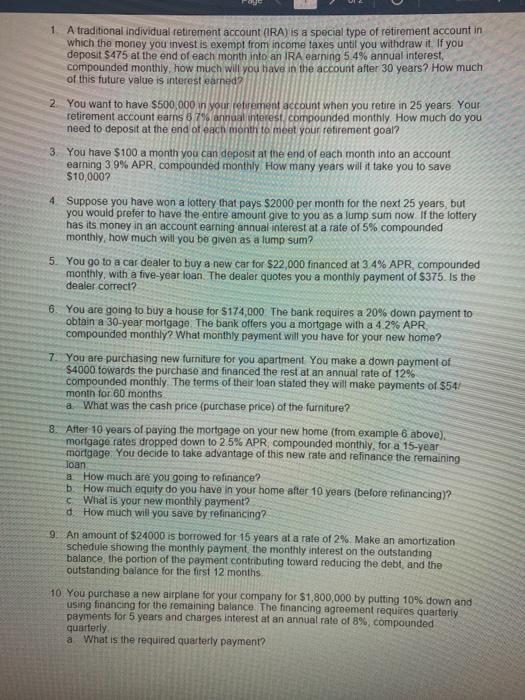

1 A traditional individual retirement account (IRA) is a special type of retirement account in which the money you invest is exempt from income taxes until you withdraw it. If you deposit $475 at the end of each month into an IRA earning 5.4% annual interest, compounded monthly, how much will you have in the account after 30 years? How much of this future value is interest earned 2. You want to have $500,000 in your retirement account when you retire in 25 years Your retirement account earns 87% annual interest, compounded monthly How much do you need to deposit at the end of each month to meet your retirement goal? 3. You have $100 a month you can deposit at the end of each month into an account earning 39% APR, compounded monthly How many years will it take you to save $10,000? 4 Suppose you have won a lottery that pays S2000 per month for the next 25 years, but you would prefer to have the entire amount give to you as a lump sum now. If the lottery has its money in an account earning annual interest at a rate of 5% compounded monthly, how much will you be given as a lump sum? 5. You go to a car dealer to buy a new car for $22,000 financed at 3 4% APR, compounded monthly, with a five-year loan. The dealer quotes you a monthly payment of $375. Is the dealer correct? 6 You are going to buy a house for $174,000 The bank requires a 20% down payment to obtain a 30-year mortgage. The bank offers you a mortgage with a 4.2% APR compounded monthly? What monthly payment will you have for your new home? 7. You are purchasing new furniture for you apartment you make a down payment of $4000 towards the purchase and financed the rest at an annual rate of 12% compounded monthly. The terms of their loan stated they will make payments of $54 month for 60 months a. What was the cash price (purchase price) of the furniture? 8. After 10 years of paying the mortgage on your new home (from example 6 above), mortgage rates dropped down to 2.5% APR compounded monthly for a 15-year mortgage. You decide to take advantage of this new rate and refinance the remaining Joan a How much are you going to refinance? b. How much equity do you have in your home after 10 years (before refinancing)? What is your new monthly payment? d How much will you save by refinancing? 9. An amount of $24000 is borrowed for 15 years at a rate of 2% Make an amortization schedule showing the monthly payment the monthly interest on the outstanding balance, the portion of the payment contributing toward reducing the debt and the outstanding balance for the first 12 months 10 You purchase a new airplane for your company for $1,800,000 by putting 10% down and using financing for the remaining balance. The financing agreement requires quarterly payments for 5 years and charges interest at an annual rate of 8%, compounded quarterly a What is the required quarterly payment