Question

1 A US firm has sold $100 million in exports to another firm in the UK. The current spot rate is $2.00 = 1

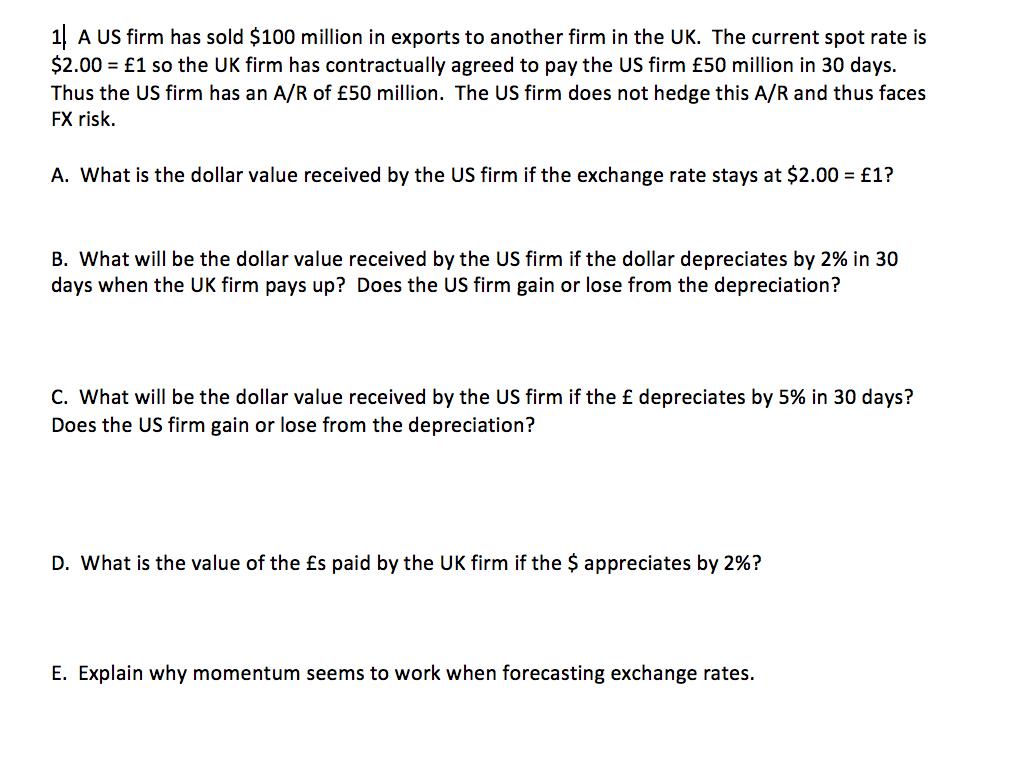

1 A US firm has sold $100 million in exports to another firm in the UK. The current spot rate is $2.00 = 1 so the UK firm has contractually agreed to pay the US firm 50 million in 30 days. Thus the US firm has an A/R of 50 million. The US firm does not hedge this A/R and thus faces FX risk. A. What is the dollar value received by the US firm if the exchange rate stays at $2.00 1? B. What will be the dollar value received by the US firm if the dollar depreciates by 2% in 30 days when the UK firm pays up? Does the US firm gain or lose from the depreciation? C. What will be the dollar value received by the US firm if the depreciates by 5% in 30 days? Does the US firm gain or lose from the depreciation? D. What is the value of the s paid by the UK firm if the $ appreciates by 2%? E. Explain why momentum seems to work when forecasting exchange rates.

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Markets and Institutions

Authors: Anthony Saunders, Marcia Cornett

6th edition

9780077641849, 77861663, 77641841, 978-0077861667

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App