Question

1. A U.S. fund manager who bought 100 million in Australian dollar (A$) bonds when the A$ was at US$/ A$0. 72 is worried that

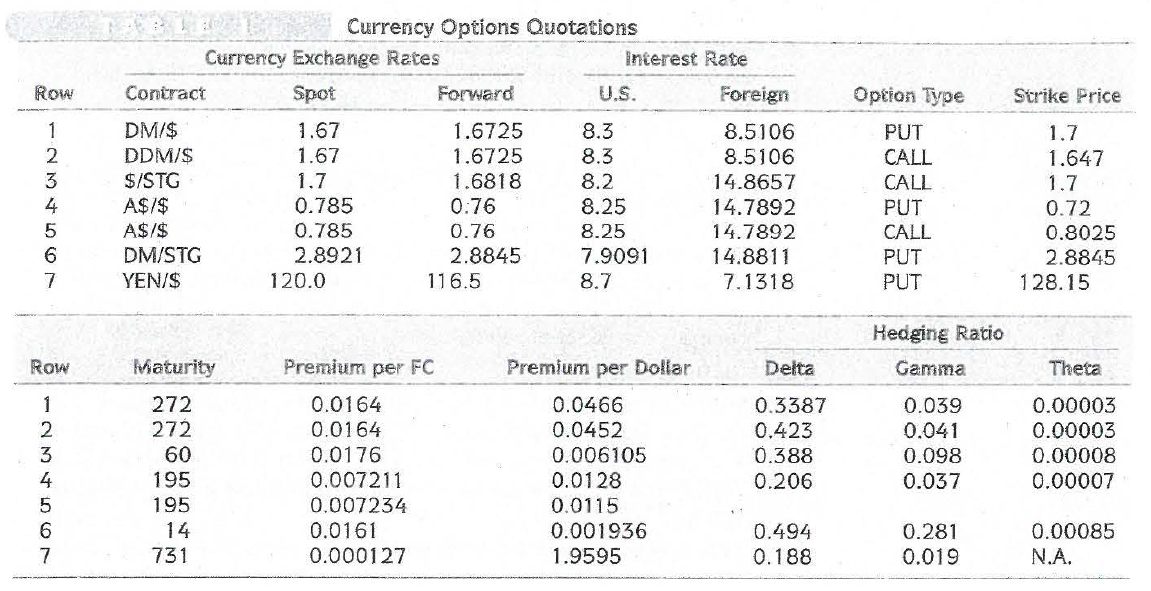

1. A U.S. fund manager who bought 100 million in Australian dollar (A$) bonds when the A$ was at US$/ A$0. 72 is worried that the A$ might depreciate because of disappointing Australian economic performance. He decides to set A$/$0.72 as the maximum downside loss that he wants to risk from the current level of A$/$0.7850 (spot). The fund manager doesn't mind foregoing profit opportunities from a further upward move in the A$ and is uncertain how long he will hold the bonds. He sets the year end as his time horizon. By utilizing Table I (Rows 4 and 5) data, which hedging strategy should the fund manager adopt?

2. A German company is bidding on a contract in the U.K. The bid is estimated at 40 million and they anticipate a profit margin of 30 percent on the project. Hence, they will need to repatriate 12 million in profit, but they worry that the new U.K. economic trends could hurt the pound sterling exchange rate. Determine how the German company could hedge their potential exposure. Utilize Table I (Row 6) for data.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started