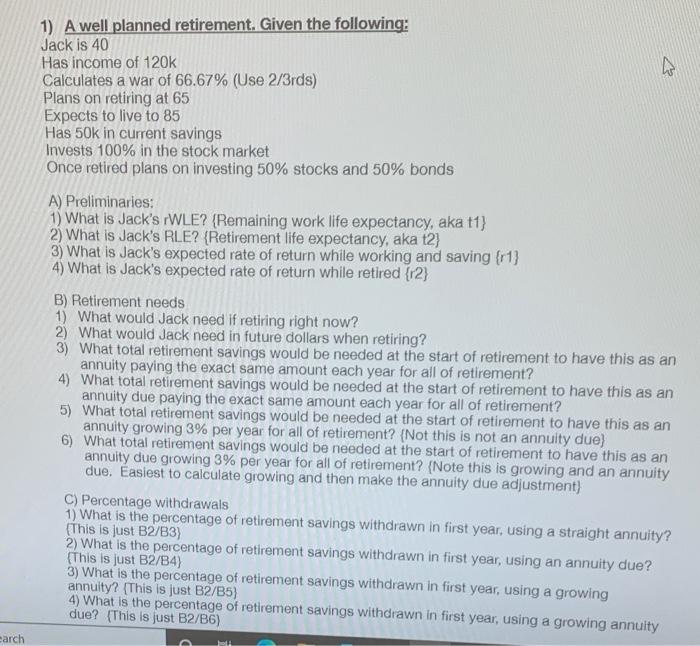

1) A well planned retirement. Given the following: Jack is 40 Has income of 120K Calculates a war of 66.67% (Use 2/3rds) Plans on retiring at 65 Expects to live to 85 Has 50k in current savings Invests 100% in the stock market Once retired plans on investing 50% stocks and 50% bonds A) Preliminaries: 1) What is Jack's rWLE? \{Remaining work life expectancy, aka t1 \} 2) What is Jack's RLE? \{Retirement life expectancy, aka t2\} 3) What is Jack's expected rate of return while working and saving {r1} 4) What is Jack's expected rate of return while retired \{r2\} B) Retirement needs 1) What would Jack need if retiring right now? 2) What would Jack need in future dollars when retiring? 3) What total retirement savings would be needed at the start of retirement to have this as an annuity paying the exact same amount each year for all of retirement? 4) What total retirement savings would be needed at the start of retirement to have this as an annuity due paying the exact same amount each year for all of retirement? 5) What total retirement savings would be needed at the start of retirement to have this as an annuity growing 3% per year for all of retirement? (Not this is not an annuity due\} 6) What total retirement savings would be needed at the start of retirement to have this as an annuity due growing 3% per year for all of retirement? (Note this is growing and an annuity due. Easiest to calculate growing and then make the annuity due adjustment) C) Percentage withdrawals 1) What is the percentage of retirement savings withdrawn in first year, using a straight annuity? (This is just B2/B3 ) 2) What is the percentage of retirement savings withdrawn in first year, using an annuity due? (This is just B2/B4) 3) What is the percentage of retirement savings withdrawn in first year, using a growing annuity? [This is just B2/B5] 4) What is the percentage of retirement savings withdrawn in first year, using a growing annuity due? (This is just B2/B6) 1) A well planned retirement. Given the following: Jack is 40 Has income of 120K Calculates a war of 66.67% (Use 2/3rds) Plans on retiring at 65 Expects to live to 85 Has 50k in current savings Invests 100% in the stock market Once retired plans on investing 50% stocks and 50% bonds A) Preliminaries: 1) What is Jack's rWLE? \{Remaining work life expectancy, aka t1 \} 2) What is Jack's RLE? \{Retirement life expectancy, aka t2\} 3) What is Jack's expected rate of return while working and saving {r1} 4) What is Jack's expected rate of return while retired \{r2\} B) Retirement needs 1) What would Jack need if retiring right now? 2) What would Jack need in future dollars when retiring? 3) What total retirement savings would be needed at the start of retirement to have this as an annuity paying the exact same amount each year for all of retirement? 4) What total retirement savings would be needed at the start of retirement to have this as an annuity due paying the exact same amount each year for all of retirement? 5) What total retirement savings would be needed at the start of retirement to have this as an annuity growing 3% per year for all of retirement? (Not this is not an annuity due\} 6) What total retirement savings would be needed at the start of retirement to have this as an annuity due growing 3% per year for all of retirement? (Note this is growing and an annuity due. Easiest to calculate growing and then make the annuity due adjustment) C) Percentage withdrawals 1) What is the percentage of retirement savings withdrawn in first year, using a straight annuity? (This is just B2/B3 ) 2) What is the percentage of retirement savings withdrawn in first year, using an annuity due? (This is just B2/B4) 3) What is the percentage of retirement savings withdrawn in first year, using a growing annuity? [This is just B2/B5] 4) What is the percentage of retirement savings withdrawn in first year, using a growing annuity due? (This is just B2/B6)