Question

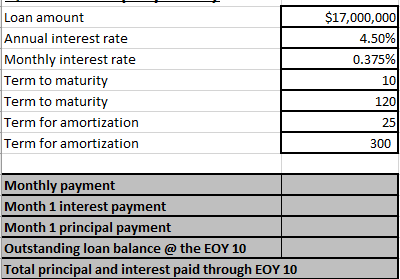

1. a. What is the monthly payment for the loan? Use the PMT function in Excel to solve the problem. Round your answer to the

1. a. What is the monthly payment for the loan? Use the "PMT" function in Excel to solve the problem. Round your answer to the nearest dollar and enter your payment as a NEGATIVE number since it is a cash outflow.

b. Based on the monthly payment calculated in part A, how much will you pay in interest to the lender in month 1? Round your answer to the nearest dollar and enter your answer as a NEGATIVE number since it is a cash outflow.

c. Based on the monthly payment calculated in part A and the interest paid to the lender in part B, how much will you reduce the principal owed to the lender in month 1? Round your answer to the nearest dollar and enter your answer as a NEGATIVE number since it is a cash outflow.

d. Using the monthly payment calculated in part A, how much will you still owe the lender at the end of year 10? In other words, what is the outstanding loan balance at the end of year 10? Round your answer to the nearest dollar and enter your answer as a NEGATIVE number since it is a cash outflow.

e. After making 10 years worth of payments, how much will you have paid the lender in interest and principal? HINT: you should not include the outstanding loan balance (what you still owe the lender) at the end of year 10 in your answer. Round your answer to the nearest dollar and enter your answer as a NEGATIVE number since it is a cash outflow.

The term to maturity is 10 years or 120 months, the loan is amortized over 25 years or 300 months (periods).

\begin{tabular}{|l|r|} \hline Loan amount & $17,000,000 \\ \hline Annual interest rate & 4.50% \\ \hline Monthly interest rate & 0.375% \\ \hline Term to maturity & 10 \\ \hline Term to maturity & 120 \\ \hline Term for amortization & 25 \\ \hline Term for amortization & 300 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Monthly payment & \\ \hline Month 1 interest payment & \\ \hline Month 1 principal payment & \\ \hline Outstanding loan balance @ the EOY 10 & \\ \hline Total principal and interest paid through EOY 10 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Loan amount & $17,000,000 \\ \hline Annual interest rate & 4.50% \\ \hline Monthly interest rate & 0.375% \\ \hline Term to maturity & 10 \\ \hline Term to maturity & 120 \\ \hline Term for amortization & 25 \\ \hline Term for amortization & 300 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Monthly payment & \\ \hline Month 1 interest payment & \\ \hline Month 1 principal payment & \\ \hline Outstanding loan balance @ the EOY 10 & \\ \hline Total principal and interest paid through EOY 10 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started