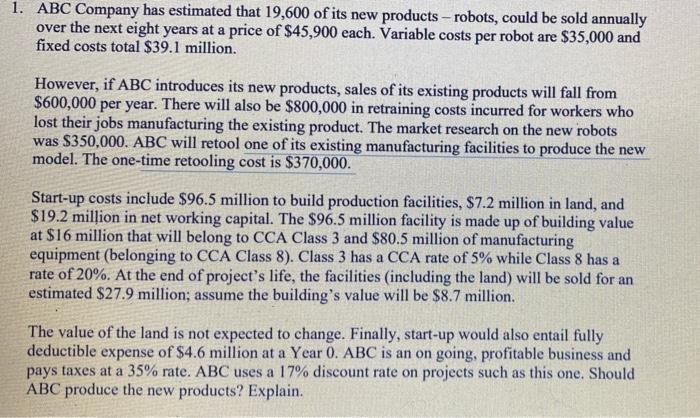

1. ABC Company has estimated that 19,600 of its new products - robots, could be sold annually over the next eight years at a price of $45,900 each. Variable costs per robot are $35,000 and fixed costs total $39.1 million. However, if ABC introduces its new products, sales of its existing products will fall from $600,000 per year. There will also be $800,000 in retraining costs incurred for workers who lost their jobs manufacturing the existing product. The market research on the new robots was $350,000. ABC will retool one of its existing manufacturing facilities to produce the new model. The one-time retooling cost is $370,000. Start-up costs include $96.5 million to build production facilities, $7.2 million in land, and $19.2 million in net working capital. The $96.5 million facility is made up of building value at $16 million that will belong to CCA Class 3 and $80.5 million of manufacturing equipment (belonging to CCA Class 8). Class 3 has a CCA rate of 5% while Class 8 has a rate of 20%. At the end of project's life, the facilities (including the land) will be sold for an estimated $27.9 million; assume the building's value will be $8.7 million. The value of the land is not expected to change. Finally, start-up would also entail fully deductible expense of $4.6 million at a Year 0. ABC is an on going, profitable business and pays taxes at a 35% rate. ABC uses a 17% discount rate on projects such as this one. Should ABC produce the new products? Explain. 1. ABC Company has estimated that 19,600 of its new products - robots, could be sold annually over the next eight years at a price of $45,900 each. Variable costs per robot are $35,000 and fixed costs total $39.1 million. However, if ABC introduces its new products, sales of its existing products will fall from $600,000 per year. There will also be $800,000 in retraining costs incurred for workers who lost their jobs manufacturing the existing product. The market research on the new robots was $350,000. ABC will retool one of its existing manufacturing facilities to produce the new model. The one-time retooling cost is $370,000. Start-up costs include $96.5 million to build production facilities, $7.2 million in land, and $19.2 million in net working capital. The $96.5 million facility is made up of building value at $16 million that will belong to CCA Class 3 and $80.5 million of manufacturing equipment (belonging to CCA Class 8). Class 3 has a CCA rate of 5% while Class 8 has a rate of 20%. At the end of project's life, the facilities (including the land) will be sold for an estimated $27.9 million; assume the building's value will be $8.7 million. The value of the land is not expected to change. Finally, start-up would also entail fully deductible expense of $4.6 million at a Year 0. ABC is an on going, profitable business and pays taxes at a 35% rate. ABC uses a 17% discount rate on projects such as this one. Should ABC produce the new products? Explain