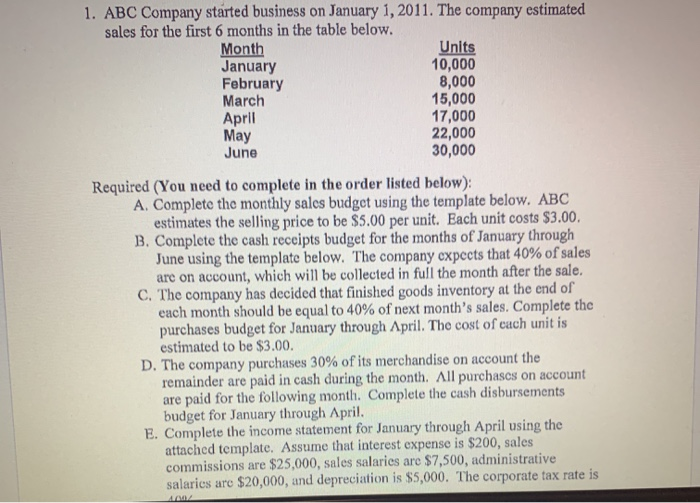

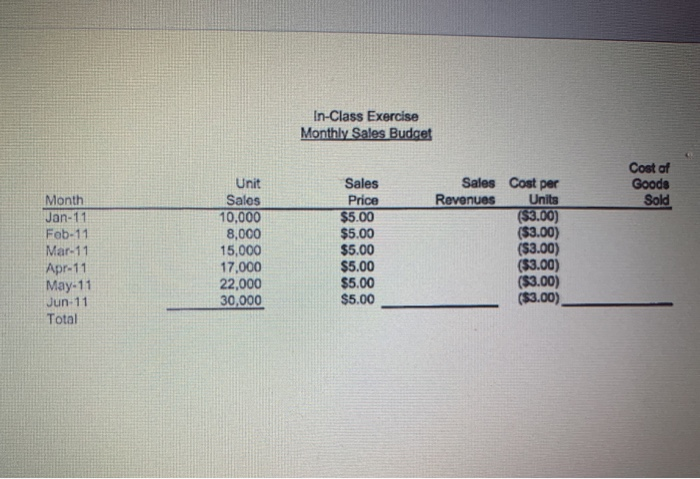

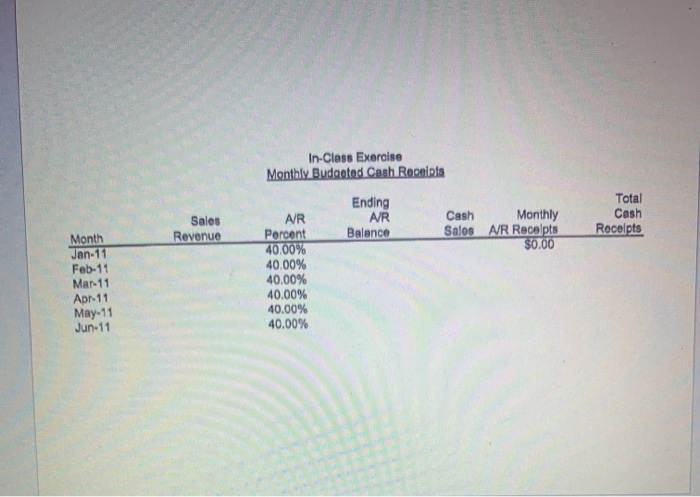

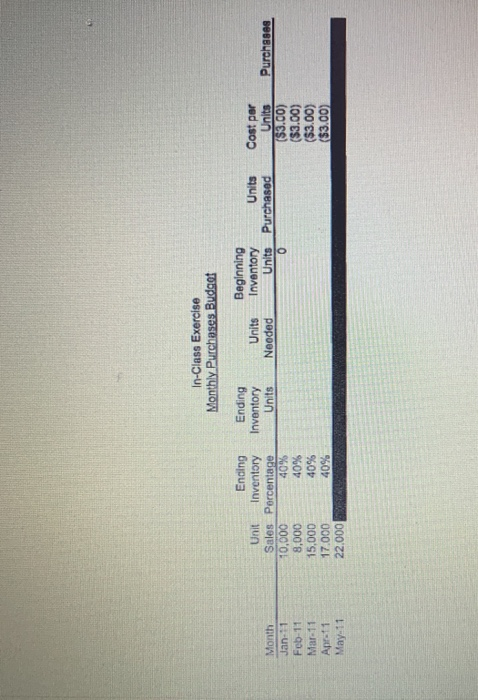

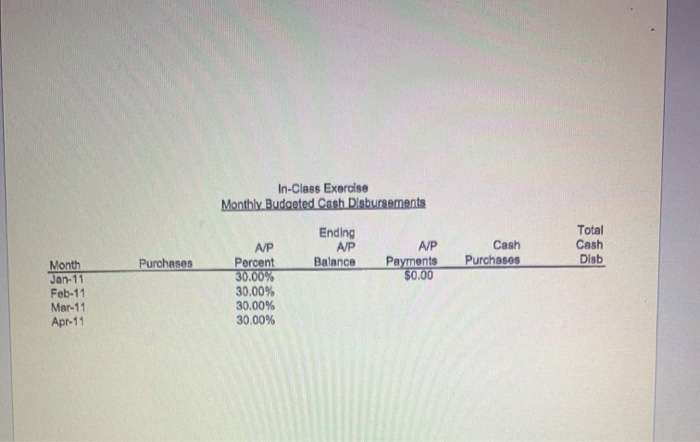

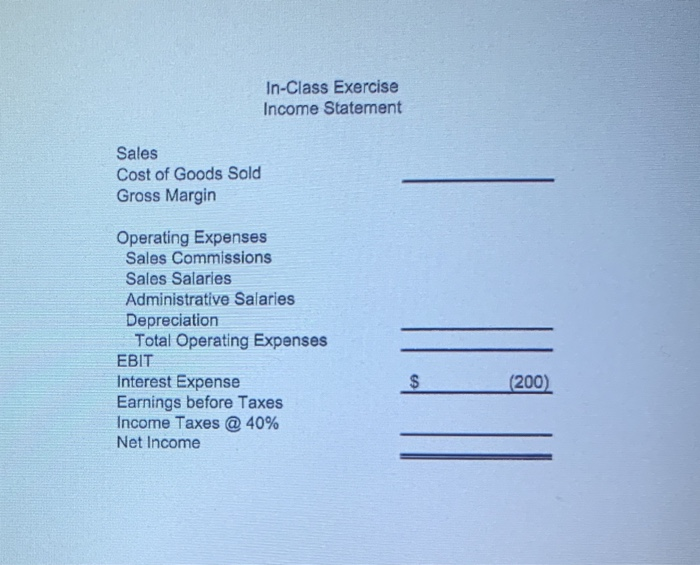

1. ABC Company started business on January 1, 2011. The company estimated sales for the first 6 months in the table below. Month Units January 10,000 February 8,000 March 15,000 April 17,000 May 22,000 June 30,000 Required (You need to complete in the order listed below): A. Complete the monthly sales budget using the template below. ABC estimates the selling price to be $5.00 per unit. Each unit costs $3.00. B. Complete the cash receipts budget for the months of January through June using the template below. The company expects that 40% of sales are on account, which will be collected in full the month after the sale. C. The company has decided that finished goods inventory at the end of each month should be equal to 40% of next month's sales. Complete the purchases budget for January through April. The cost of each unit is estimated to be $3.00. D. The company purchases 30% of its merchandise on account the remainder are paid in cash during the month. All purchascs on account are paid for the following month. Complete the cash disbursements budget for January through April. E. Complete the income statement for January through April using the attached template. Assume that interest expense is $200, sales commissions are $25,000, sales salaries are $7,500, administrative salaries are $20,000, and depreciation is $5,000. The corporate tax rate is In-Class Exercise Monthly Sales Budget Cost of Goods Sold Month Jan-11 Feb-11 Mar 11 Apr-11 May-11 Jun 11 Total Unit Sales 10,000 8,000 15,000 17,000 22,000 30,000 Sales Price $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 Sales Cost per Revenues Units ($3.00) ($3.00) ($3.00) (53.00) ($3.00) ($3.00) In-Class Exercise Monthly Budgeted Cash Recints Sales Revenue Ending AR Balance Cash Salos Monthly AVR Receipts $0.00 Total Cash Rocepts Month Jan-11 Feb-11 Mar 11 Apr 11 May-11 Jun-11 AR Porcent 40.00% 40.00% 40.00% 40.00% 40.00% 40.00% In-Class Exercise Monthly Purchases Budget Ending Inventory Units Units Needed Beginning Inventory Units Units Purchased Purchases Month Jan-1 Feb-11 Mar 11 Apr 1 May 11 Ending Unit Inventory Sales Percentage 10,000 40% 8,000 40% 15,000 40% 17.000 40% 22.000 Cost per U nits ($3.00) ($3.00) ($3.00) ($3.00) In-Class Exercise Monthly Budgeted Cash Disbursements Ending AP Balance Purchases Total Cash Disb AJP Payments $0.00 Cash Purchases AP Percent 30.00% 30.00% 30.00% 30.00% Month Jan-11 Feb-11 Mar-11 Apr-11 In-Class Exercise Income Statement Sales Cost of Goods Sold Gross Margin Operating Expenses Sales Commissions Sales Salaries Administrative Salaries Depreciation Total Operating Expenses EBIT Interest Expense Earnings before Taxes Income Taxes @ 40% Net Income (200)