Answered step by step

Verified Expert Solution

Question

1 Approved Answer

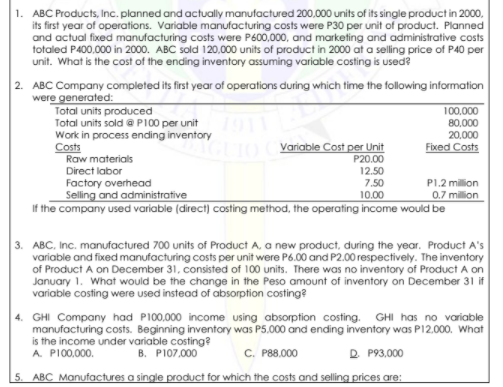

1. ABC Products, Inc. planned and actually manufactured 200,000 units of its single product in 2000, its first year of operations. Variable manufacturing costs

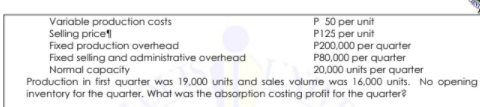

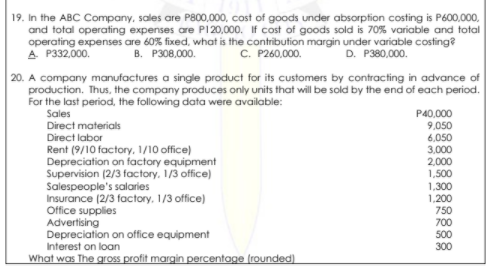

1. ABC Products, Inc. planned and actually manufactured 200,000 units of its single product in 2000, its first year of operations. Variable manufacturing costs were P30 per unit of product. Planned and actual fixed manufacturing costs were P600,000, and marketing and administrative costs totaled P400,000 in 2000. ABC sold 120,000 units of product in 2000 at a selling price of P40 per unit. What is the cost of the ending inventory assuming variable costing is used? 2. ABC Company completed its first year of operations during which time the following information were generated: Total units produced Total units sold @ P100 per unit 100,000 80,000 Work in process ending inventory 20,000 Costs Raw materials Direct labor Variable Cost per Unit Fixed Costs P20.00 12.50 Factory overhead Selling and administrative 7.50 10.00 P1.2 million 0.7 million If the company used variable (direct) costing method, the operating income would be 3. ABC, Inc. manufactured 700 units of Product A, a new product, during the year. Product A's variable and fixed manufacturing costs per unit were P6.00 and P2.00 respectively. The inventory of Product A on December 31, consisted of 100 units. There was no inventory of Product A on January 1. What would be the change in the Peso amount of inventory on December 31 if variable costing were used instead of absorption costing? 4. GHI Company had P100,000 income using absorption costing. GHI has no variable manufacturing costs. Beginning inventory was P5,000 and ending inventory was P12,000. What is the income under variable costing? A. P100,000. B. P107,000 C. P88,000 D. P93,000 5. ABC Manufactures a single product for which the costs and selling prices are: Variable production costs Selling price Fixed production overhead Fixed selling and administrative overhead P 50 per unit P125 per unit P200,000 per quarter P80,000 per quarter Normal capacity 20,000 units per quarter Production in first quarter was 19,000 units and sales volume was 16,000 units. No opening inventory for the quarter. What was the absorption costing profit for the quarter? 19. In the ABC Company, sales are P800,000, cost of goods under absorption costing is P600,000, and total operating expenses are P120,000. If cost of goods sold is 70% variable and total operating expenses are 60% fixed, what is the contribution margin under variable costing? A. P332,000. B. P308,000. C. P260,000. D. P380,000. 20. A company manufactures a single product for its customers by contracting in advance of production. Thus, the company produces only units that will be sold by the end of each period. For the last period, the following data were available: Sales Direct materials Direct labor Rent (9/10 factory, 1/10 office) Depreciation on factory equipment Supervision (2/3 factory, 1/3 office) Salespeople's salaries Insurance (2/3 factory, 1/3 office) Office supplies Advertising Depreciation on office equipment Interest on loan What was The gross profit margin percentage (rounded) P40,000 9,050 6,050 3,000 2,000 1,500 1,300 1,200 750 700 500 300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started