Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. ABC uses a predetermined overhead rate of $20 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $160,000 of

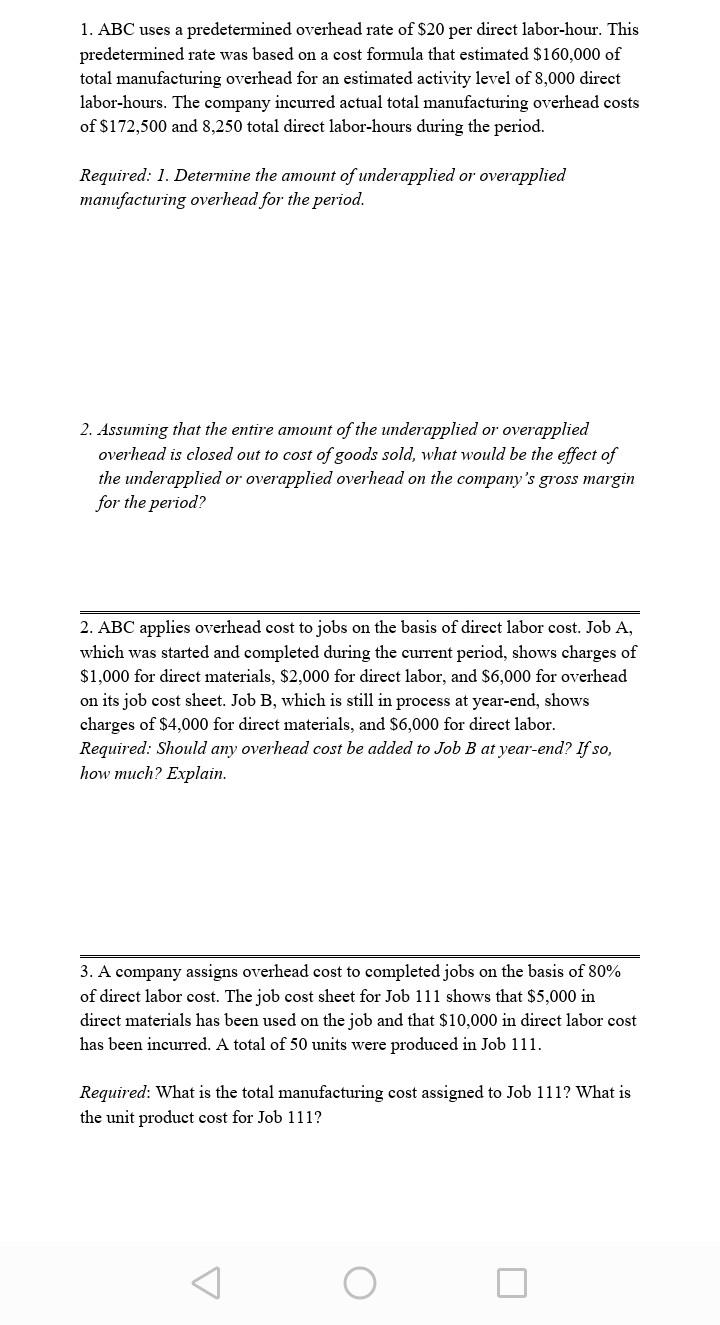

1. ABC uses a predetermined overhead rate of $20 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $160,000 of total manufacturing overhead for an estimated activity level of 8,000 direct labor-hours. The company incurred actual total manufacturing overhead costs of $172,500 and 8,250 total direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assuming that the entire amount of the underapplied or overapplied overhead is closed out to cost of goods sold, what would be the effect of the underapplied or overapplied overhead on the company's gross margin for the period? 2. ABC applies overhead cost to jobs on the basis of direct labor cost. Job A, which was started and completed during the current period, shows charges of $1,000 for direct materials, $2,000 for direct labor, and $6,000 for overhead on its job cost sheet. Job B, which is still in process at year-end, shows charges of $4,000 for direct materials, and $6,000 for direct labor. Required: Should any overhead cost be added to Job B at year-end? If so, how much? Explain. 3. A company assigns overhead cost to completed jobs on the basis of 80% of direct labor cost. The job cost sheet for Job 111 shows that $5,000 in direct materials has been used on the job and that $10,000 in direct labor cost has been incuired. A total of 50 units were produced in Job 111. Required: What is the total manufacturing cost assigned to Job 111? What is the unit product cost for Job 111? v O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started