Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Accepted $17,500 on April 1, Year 1, as a retainer for services to be performed evenly over the next 12 months. 2. Performed

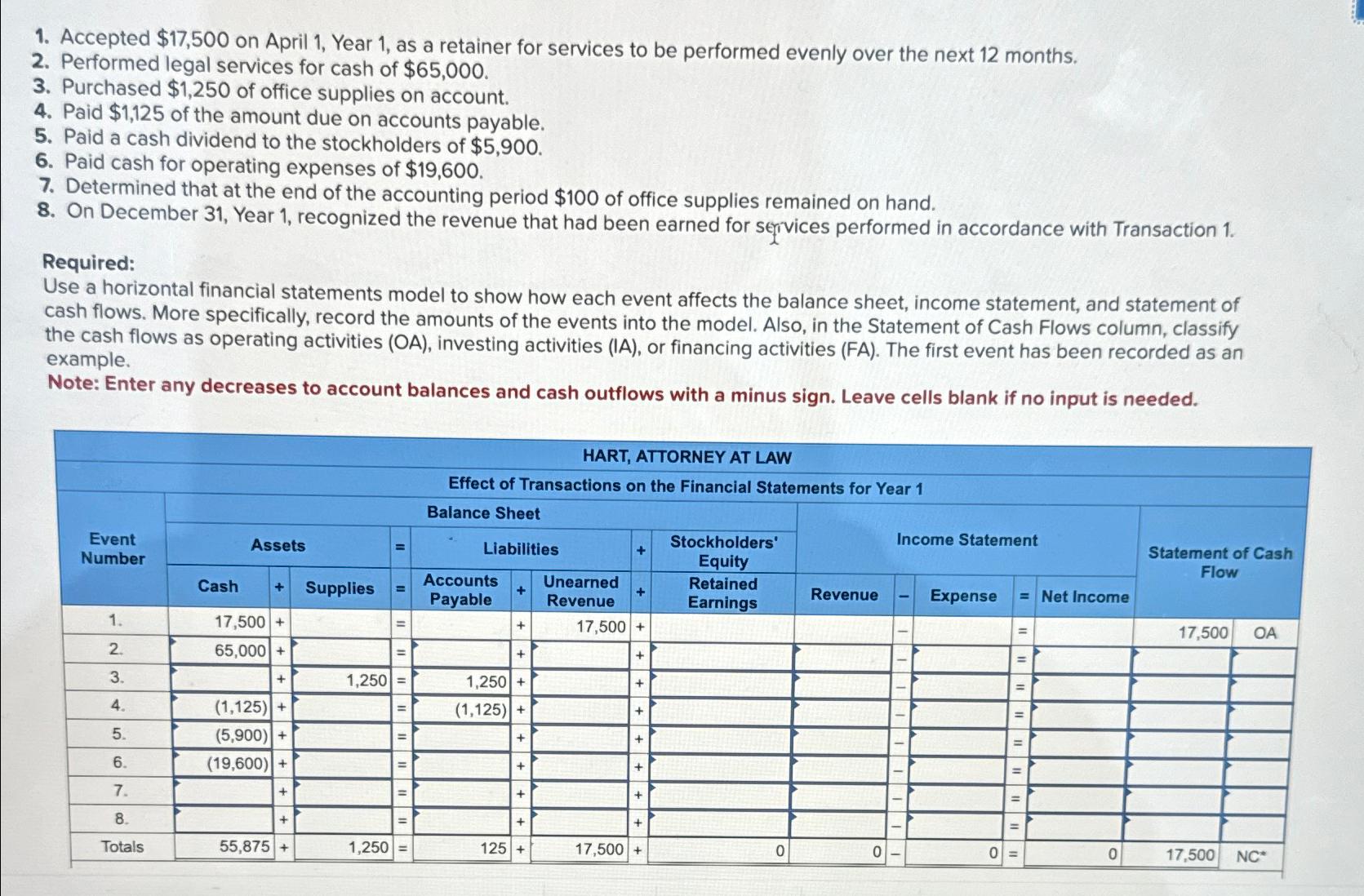

1. Accepted $17,500 on April 1, Year 1, as a retainer for services to be performed evenly over the next 12 months. 2. Performed legal services for cash of $65,000. 3. Purchased $1,250 of office supplies on account. 4. Paid $1,125 of the amount due on accounts payable. 5. Paid a cash dividend to the stockholders of $5,900. 6. Paid cash for operating expenses of $19,600. 7. Determined that at the end of the accounting period $100 of office supplies remained on hand. 8. On December 31, Year 1, recognized the revenue that had been earned for services performed in accordance with Transaction 1. Required: Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). The first event has been recorded as an example. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. HART, ATTORNEY AT LAW Effect of Transactions on the Financial Statements for Year 1 Balance Sheet Event Number Assets = Liabilities + Stockholders' Equity Income Statement Statement of Cash Flow Cash + Supplies Accounts Payable + Unearned Revenue + Retained Earnings Revenue Expense = Net Income 1. 17,500+ + 17,500 + 17,500 OA 2. 65,000+ + + 3. + 1,250 = 1,250 + + 4. (1,125) + = (1,125) + + 5. (5,900) + = + + = 6. (19,600) + = + + 7. + = + + = 8. + = + Totals 55,875+ 1,250 = 125+ 17,500+ + 0 0 0 0 17,500 NC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started