Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. According to finance theory, the ultimate goal of firm managers should be to do what? a) Maximize accounting profit b) Maximize share price c)

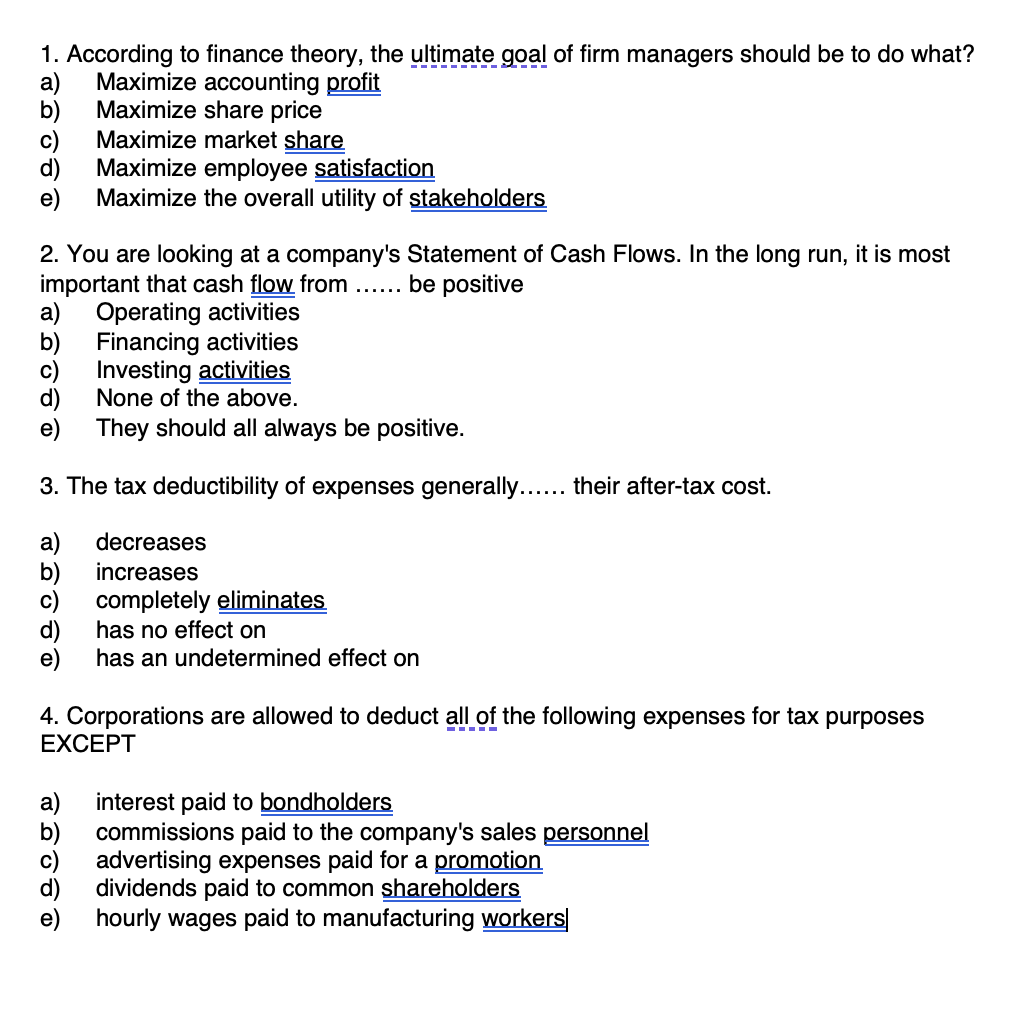

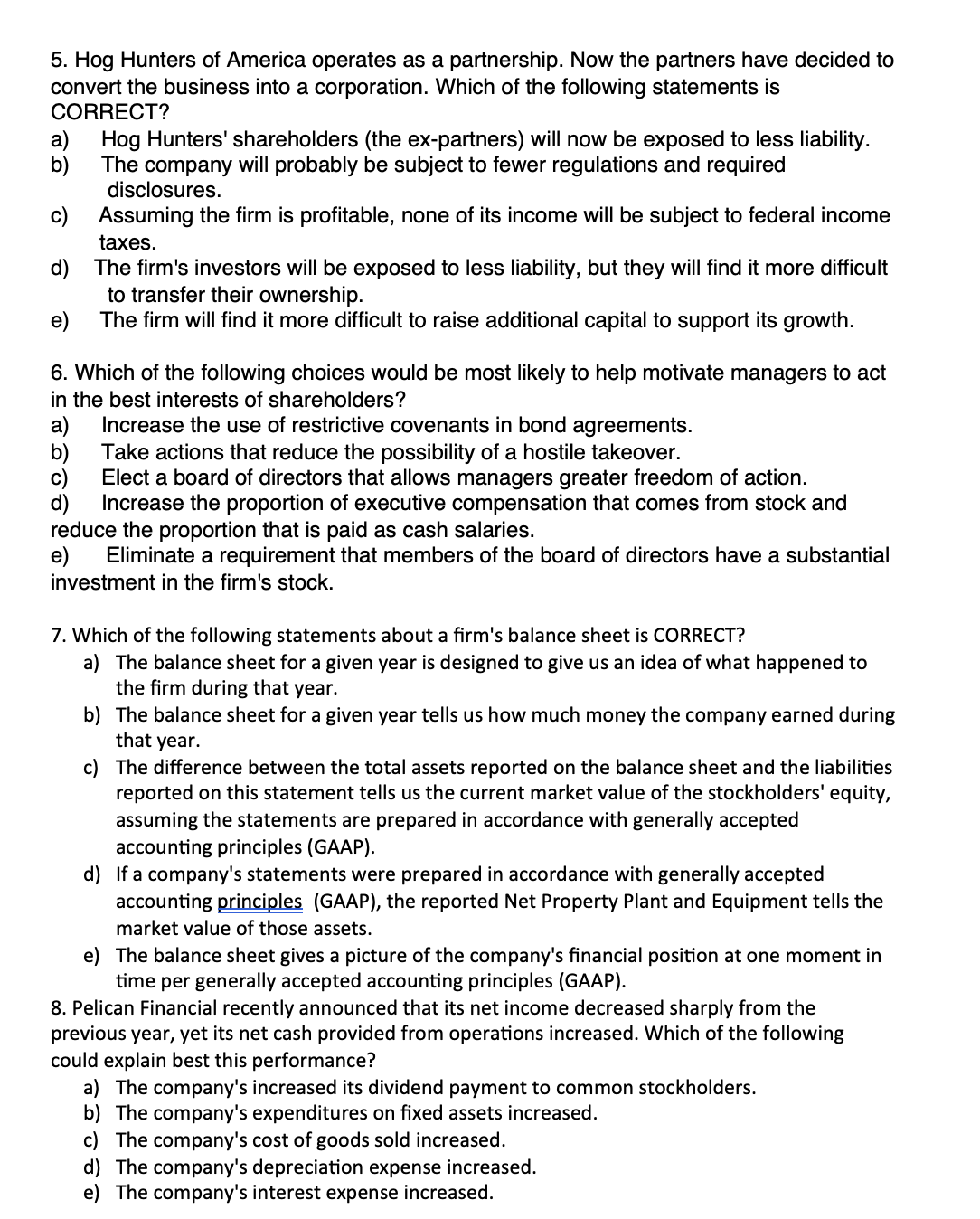

1. According to finance theory, the ultimate goal of firm managers should be to do what? a) Maximize accounting profit b) Maximize share price c) Maximize market share d) Maximize employee satisfaction e) Maximize the overall utility of stakeholders 2. You are looking at a company's Statement of Cash Flows. In the long run, it is most important that cash flow from be positive a) Operating activities b) Financing activities c) Investing activities d) None of the above. e) They should all always be positive. 3. The tax deductibility of expenses generally their after-tax cost. a) decreases b) increases c) completely eliminates d) has no effect on e) has an undetermined effect on 4. Corporations are allowed to deduct all of the following expenses for tax purposes EXCEPT a) interest paid to bondholders b) commissions paid to the company's sales personnel c) advertising expenses paid for a promotion d) dividends paid to common shareholders e) hourly wages paid to manufacturing workers 5. Hog Hunters of America operates as a partnership. Now the partners have decided to convert the business into a corporation. Which of the following statements is CORRECT? a) Hog Hunters' shareholders (the ex-partners) will now be exposed to less liability. b) The company will probably be subject to fewer regulations and required disclosures. c) Assuming the firm is profitable, none of its income will be subject to federal income taxes. d) The firm's investors will be exposed to less liability, but they will find it more difficult to transfer their ownership. e) The firm will find it more difficult to raise additional capital to support its growth. 6. Which of the following choices would be most likely to help motivate managers to act in the best interests of shareholders? a) Increase the use of restrictive covenants in bond agreements. b) Take actions that reduce the possibility of a hostile takeover. c) Elect a board of directors that allows managers greater freedom of action. d) Increase the proportion of executive compensation that comes from stock and reduce the proportion that is paid as cash salaries. e) Eliminate a requirement that members of the board of directors have a substantial investment in the firm's stock. 7. Which of the following statements about a firm's balance sheet is CORRECT? a) The balance sheet for a given year is designed to give us an idea of what happened to the firm during that year. b) The balance sheet for a given year tells us how much money the company earned during that year. c) The difference between the total assets reported on the balance sheet and the liabilities reported on this statement tells us the current market value of the stockholders' equity, assuming the statements are prepared in accordance with generally accepted accounting principles (GAAP). d) If a company's statements were prepared in accordance with generally accepted accounting principles (GAAP), the reported Net Property Plant and Equipment tells the market value of those assets. e) The balance sheet gives a picture of the company's financial position at one moment in time per generally accepted accounting principles (GAAP). 8. Pelican Financial recently announced that its net income decreased sharply from the previous year, yet its net cash provided from operations increased. Which of the following could explain best this performance? a) The company's increased its dividend payment to common stockholders. b) The company's expenditures on fixed assets increased. c) The company's cost of goods sold increased. d) The company's depreciation expense increased. e) The company's interest expense increased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started