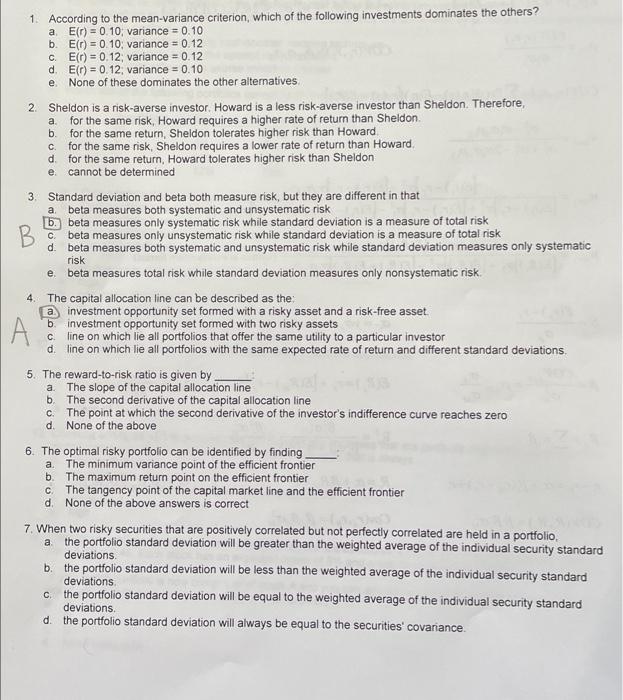

1. According to the mean-variance criterion, which of the following investments dominates the others? a. E(r)=0.10; variance =0.10 b. E(r)=0.10; variance =0.12 c. E(r)=0.12; variance =0.12 d. E(r)=0.12; variance =0.10 e. None of these dominates the other altematives. 2. Sheldon is a risk-averse investor. Howard is a less risk-averse investor than Sheldon. Therefore, a. for the same risk, Howard requires a higher rate of return than Sheldon. b. for the same return, Sheldon tolerates higher risk than Howard. c. for the same risk, Sheldon requires a lower rate of return than Howard. d. for the same return, Howard tolerates higher risk than Sheldon e. cannot be determined 3. Standard deviation and beta both measure risk, but they are different in that a. beta measures both systematic and unsystematic risk b. beta measures only systematic risk while standard deviation is a measure of total risk c. beta measures only unsystematic risk while standard deviation is a measure of total risk d. beta measures both systematic and unsystematic risk while standard deviation measures only systematic risk e. beta measures total risk while standard deviation measures only nonsystematic risk. 4. The capital allocation line can be described as the: a. investment opportunity set formed with a risky asset and a risk-free asset. b. investment opportunity set formed with two risky assets c. Iine on which lie all portfolios that offer the same utility to a particular investor d. line on which lie all portfolios with the same expected rate of return and different standard deviations. 5. The reward-to-risk ratio is given by a. The slope of the capital allocation line b. The second derivative of the capital allocation line c. The point at which the second derivative of the investor's indifference curve reaches zero d. None of the above 6. The optimal risky portfolio can be identified by finding a. The minimum variance point of the efficient frontier b. The maximum return point on the efficient frontier c. The tangency point of the capital market line and the efficient frontier d. None of the above answers is correct 7. When two risky securities that are positively correlated but not perfectly correlated are held in a portfolio, a. the portfolio standard deviation will be greater than the weighted average of the individual security standard deviations. b. the portfolio standard deviation will be less than the weighted average of the individual security standard deviations. c. the portfolio standard deviation will be equal to the weighted average of the individual security standard deviations. d. the portfolio standard deviation will always be equal to the securities' covariance