Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Adams Company had retained earnings of $56,500 at the beginning of 2013. During the year the company had total revenues of $610,000; total expenses

1. Adams Company had retained earnings of $56,500 at the beginning of 2013. During the year the company had total revenues of $610,000; total expenses (including taxes) of $503,000; bought property & equipment for $330,000, and paid cash dividends of $16,000. Whats Adams Companys retained earnings at the end of 2013?

1, 2019. 1, 2019 2. Sales from Bronx Tool & Die during 20X1 were $599,000. 20% of them on credit and 80% from cash. During the year, accounts receivable increased from $151,000 to $178,000, an increase of $27,000. Whats the amount of cash did Bronx receive from customers during 20X1?

3. Brankov Company purchased common stock in Ramona Company for $400,000. In the current year, Ramona Company reported net income of $50,000 and paid a dividend of $32,000. At the end of the year, the market value of the investment in Ramona Company was $410,000. A) Assume Brankov Company owns 10% of the shares of Ramona Company. Brankov Company considers the investment to be available-for-sale securities. Show the effects of the transactions above on the accounts of Brankov Company using the balance sheet equation. B) Assume Brankov Company owns 25% of the shares of Ramona Company. Show the effects of the transactions above on the accounts of Brankov Company using the balance sheet equation.

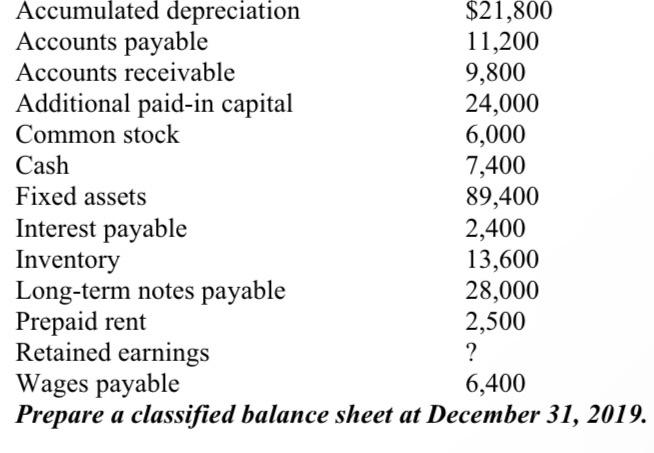

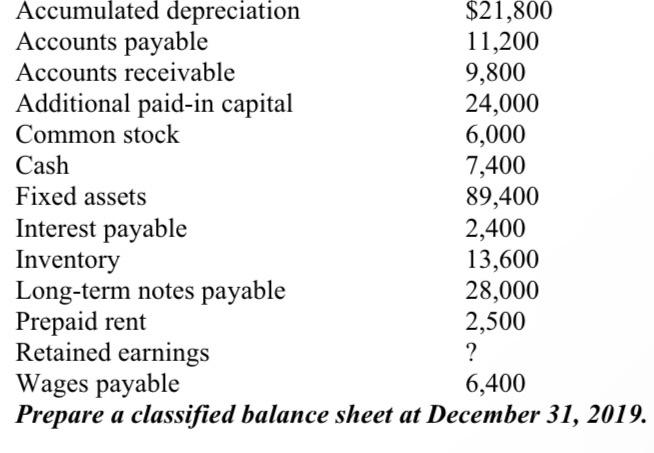

4. The following balances are available for Thompson Company on December 31, 2015:

see image

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started