Answered step by step

Verified Expert Solution

Question

1 Approved Answer

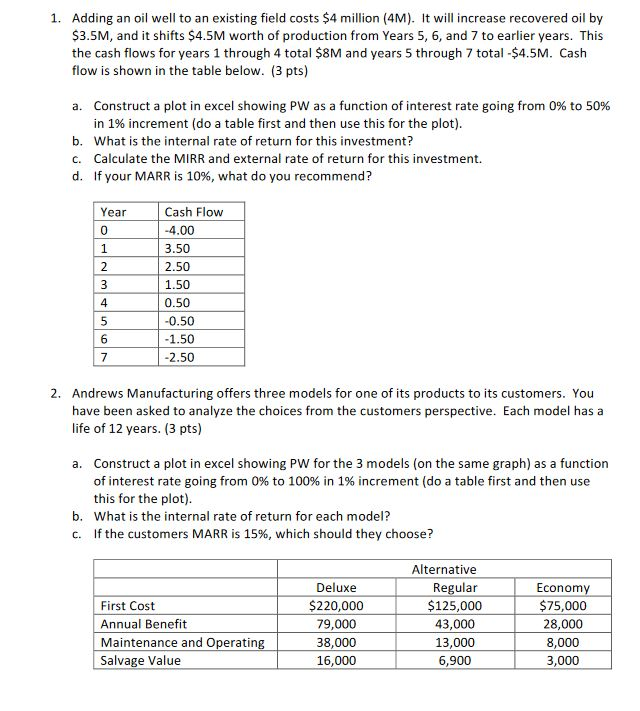

1. Adding an oil well to an existing field costs $4 million (4). It wil increase recovered oil by $3.5M, and it shifts $4.5M worth

1. Adding an oil well to an existing field costs $4 million (4). It wil increase recovered oil by $3.5M, and it shifts $4.5M worth of production from Years 5, 6, and 7 to earlier years. This the cash flows for years 1 through 4 total $8M and years 5 through 7 total $4.5M. Cash flow is shown in the table below. (3 pts) a. Construct a plot in excel showing Pw as a function of interest rate going from 0% to 50% in 1% increment (do a table first and then use this for the plot) b. What is the internal rate of return for this investment? c. Calculate the MIRR and external rate of return for this investment. d. If your MARR is 10%, what do you recommend? Cash Flow 4.00 3.50 2.50 1.50 0.50 0.50 1.50 2.50 Year 0 4 6 2. Andrews Manufacturing offers three models for one of its products to its customers. You have been asked to analyze the choices from the customers perspective. Each model has a life of 12 years. (3 pts) Construct a plot in excel showing PW for the 3 models (on the same graph) as a function of interest rate going from 0% to 100% in 1% increment (do a table first and then use this for the plot) a. b. What is the internal rate of return for each model? C. If the customers MARR is 15%, which should they choose? Alternative First Cost Annual Benefit Maintenance and Operatin Salvage Value Deluxe $220,000 79,000 38,000 16,000 Regular $125,000 43,000 13,000 6,900 Econom $75,000 28,000 8,000 3,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started