Answered step by step

Verified Expert Solution

Question

1 Approved Answer

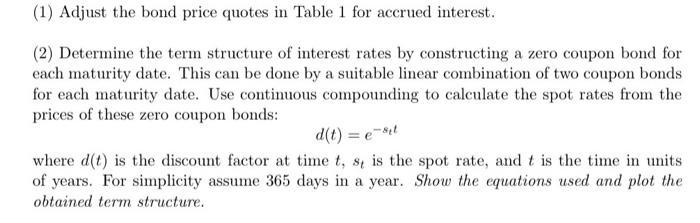

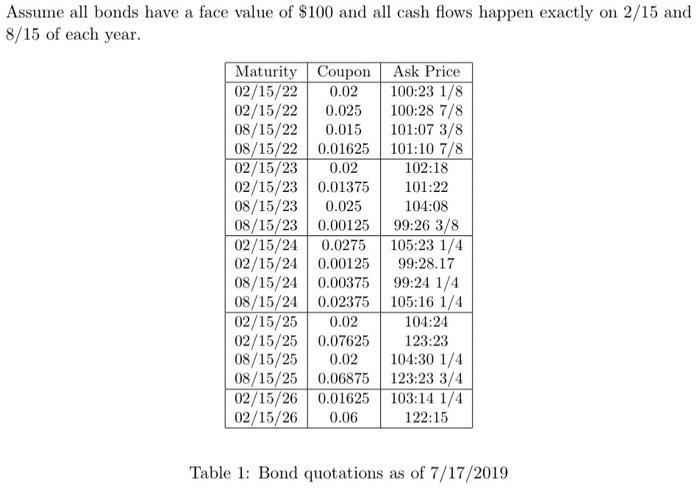

(1) Adjust the bond price quotes in Table 1 for accrued interest. (2) Determine the term structure of interest rates by constructing a zero

(1) Adjust the bond price quotes in Table 1 for accrued interest. (2) Determine the term structure of interest rates by constructing a zero coupon bond for each maturity date. This can be done by a suitable linear combination of two coupon bonds for each maturity date. Use continuous compounding to calculate the spot rates from the prices of these zero coupon bonds: d(t) = e-sit where d(t) is the discount factor at time t, s, is the spot rate, and t is the time in units of years. For simplicity assume 365 days in a year. Show the equations used and plot the obtained term structure. Assume all bonds have a face value of $100 and all cash flows happen exactly on 2/15 and 8/15 of each year. Maturity Coupon 02/15/22 0.02 02/15/22 0.025 08/15/22 0.015 08/15/22 0.01625 02/15/23 0.02 02/15/23 0.01375 08/15/23 0.025 08/15/23 0.00125 02/15/24 0.0275 02/15/24 0.00125 08/15/24 0.00375 08/15/24 0.02375 02/15/25 0.02 02/15/25 0.07625 08/15/25 0.02 08/15/25 0.06875 02/15/26 0.01625 02/15/26 0.06 Ask Price 100:23 1/8 100:28 7/8 101:07 3/8 101:10 7/8 102:18 101:22 104:08 99:26 3/8 105:23 1/4 99:28.17 99:24 1/4 105:16 1/4 104:24 123:23 104:30 1/4 123:23 3/4 103:14 1/4 122:15 Table 1: Bond quotations as of 7/17/2019

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the accrued interest we use the following formula Accrued interest Face value Coupon ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started