Answered step by step

Verified Expert Solution

Question

1 Approved Answer

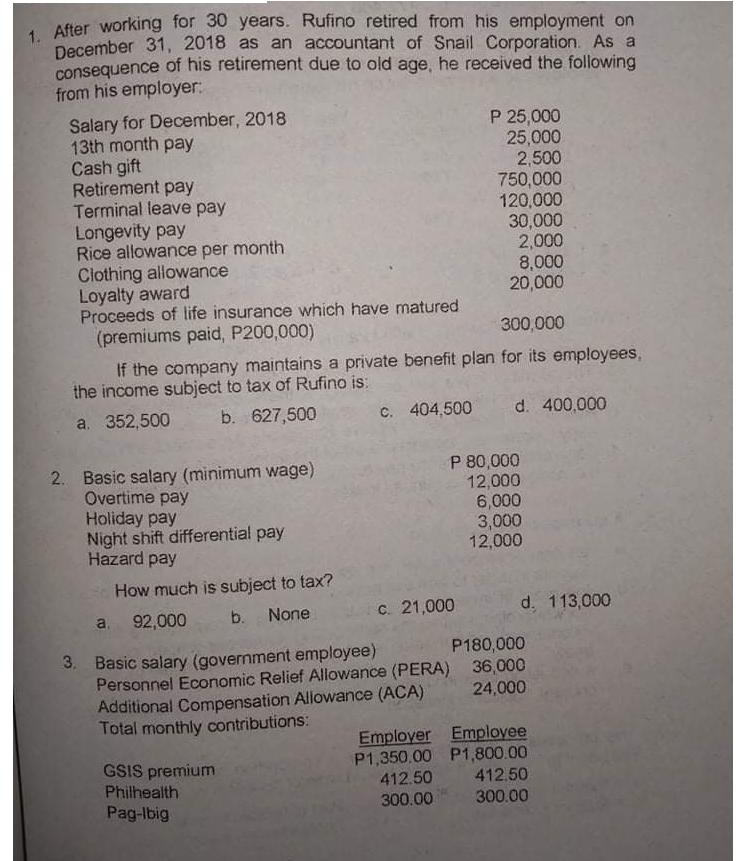

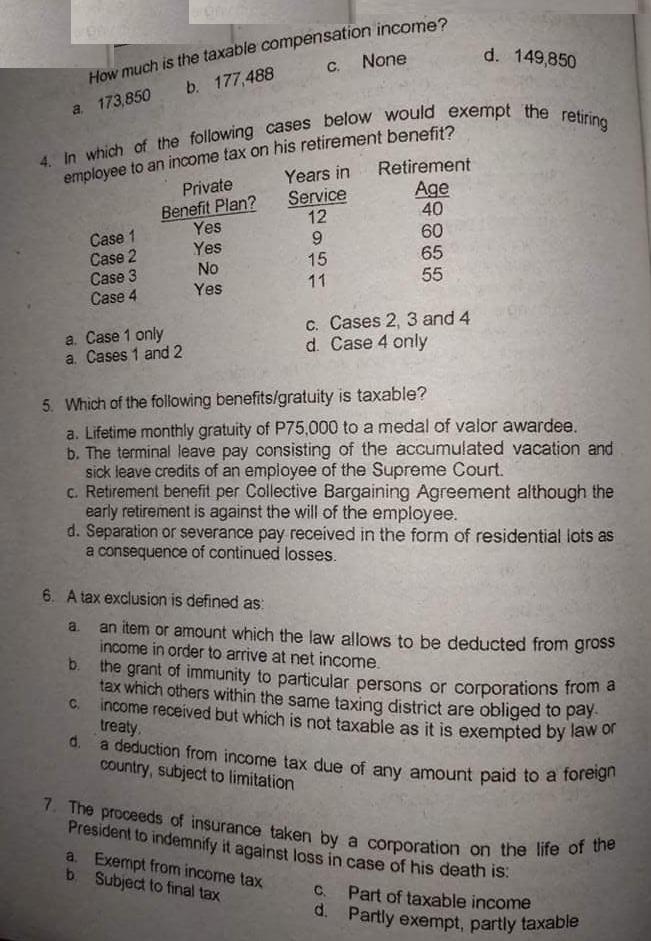

1. After working for 30 years. Rufino retired from his employment on December 31, 2018 as an accountant of Snail Corporation. As a consequence

1. After working for 30 years. Rufino retired from his employment on December 31, 2018 as an accountant of Snail Corporation. As a consequence of his retirement due to old age, he received the following from his employer: Salary for December, 2018 13th month pay Cash gift Retirement pay Terminal leave pay Longevity pay Rice allowance per month Clothing allowance Loyalty award Proceeds of life insurance which have matured (premiums paid, P200,000) 2. Basic salary (minimum wage) Overtime pay Holiday pay Night shift differential pay Hazard pay How much is subject to tax? a. 92,000 b. None 300,000 If the company maintains a private benefit plan for its employees, the income subject to tax of Rufino is: a. 352,500 b. 627,500 c. 404,500 3. Basic salary (government employee) Personnel Economic Relief Allowance (PERA) Additional Compensation Allowance (ACA) Total monthly contributions: GSIS premium Philhealth Pag-Ibig c. 21,000 Employer P1,350.00 P 25,000 25,000 2,500 412.50 300.00 750,000 120,000 30,000 2,000 8,000 20,000 d. 400,000 P 80,000 12,000 6,000 3,000 12,000 d. 113,000 P180,000 36,000 24,000 Employee P1,800.00 412.50 300.00 OAVIS How much is the taxable compensation income? a 173,850 b. 177,488 Onc Case 1 Case 2 Case 3 Case 4 a. Case 1 only a. Cases 1 and 2 a. 4. In which of the following cases below would exempt the retiring employee to an income tax on his retirement benefit? Private Years in Service 12 9 15 11 Benefit Plan? Yes Yes No Yes C. 6. A tax exclusion is defined as: C. None Retirement Age 40 5. Which of the following benefits/gratuity is taxable? a. Lifetime monthly gratuity of P75,000 to a medal of valor awardee. b. The terminal leave pay consisting of the accumulated vacation and sick leave credits of an employee of the Supreme Court. c. Retirement benefit per Collective Bargaining Agreement although the early retirement is against the will of the employee. d. Separation or severance pay received in the form of residential lots as a consequence of continued losses. 60 65 55 a. Exempt from income tax b. Subject to final tax d. 149,850 c. Cases 2, 3 and 4 d. Case 4 only an item or amount which the law allows to be deducted from gross income in order to arrive at net income. b. the grant of immunity to particular persons or corporations from a tax which others within the same taxing district are obliged to pay. income received but which is not taxable as it is exempted by law or treaty, d. a deduction from income tax due of any amount paid to a foreign country, subject to limitation 7. The proceeds of insurance taken by a corporation on the life of the President to indemnify it against loss in case of his death is: c. Part of taxable income d. Partly exempt, partly taxable

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Proceeds of life insurance which have matured premiums paid P200000If the company maintains a private benefit plan for its employees the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started