Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. After working in accounting for fifteen years, you and two friends have decided, you would really like to start your own firm. Some

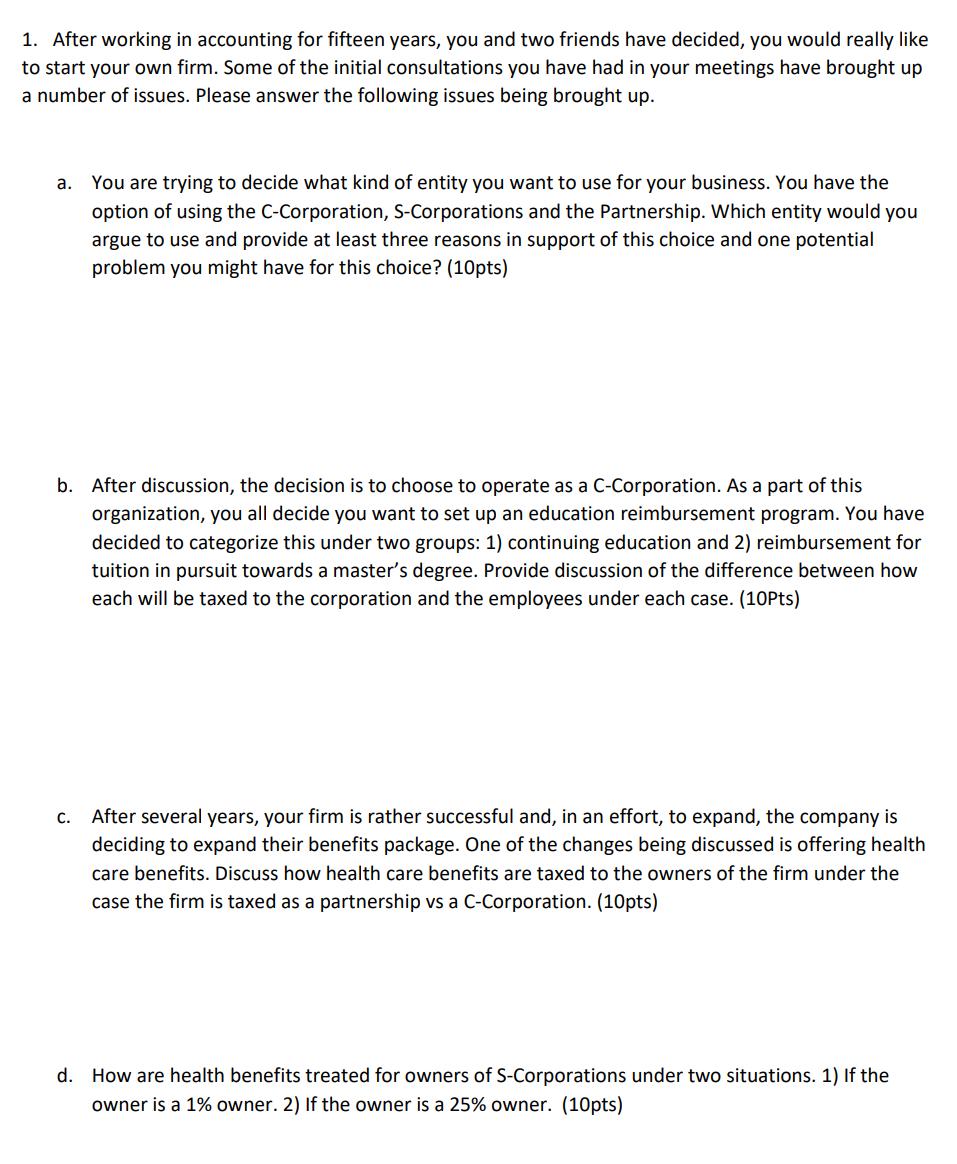

1. After working in accounting for fifteen years, you and two friends have decided, you would really like to start your own firm. Some of the initial consultations you have had in your meetings have brought up a number of issues. Please answer the following issues being brought up. a. You are trying to decide what kind of entity you want to use for your business. You have the option of using the C-Corporation, S-Corporations and the Partnership. Which entity would you argue to use and provide at least three reasons in support of this choice and one potential problem you might have for this choice? (10pts) b. After discussion, the decision is to choose to operate as a C-Corporation. As a part of this organization, you all decide you want to set up an education reimbursement program. You have decided to categorize this under two groups: 1) continuing education and 2) reimbursement for tuition in pursuit towards a master's degree. Provide discussion of the difference between how each will be taxed to the corporation and the employees under each case. (10pts) C. After several years, your firm is rather successful and, in an effort, to expand, the company is deciding to expand their benefits package. One of the changes being discussed is offering health care benefits. Discuss how health care benefits are taxed to the owners of the firm under the case the firm is taxed as a partnership vs a C-Corporation. (10pts) d. How are health benefits treated for owners of S-Corporations under two situations. 1) If the owner is a 1% owner. 2) If the owner is a 25% owner. (10pts)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a You are trying to decide what kind of entity you want to use for your business You have the option of using the CCorporation SCorporations and the Partnership Which entity would you argue to use and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started