Answered step by step

Verified Expert Solution

Question

1 Approved Answer

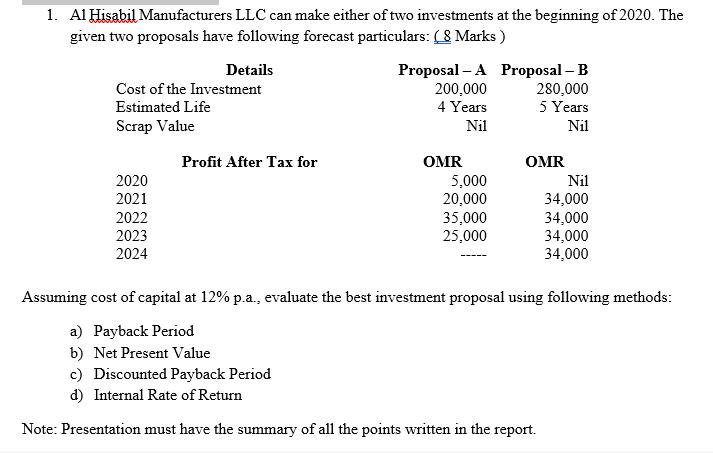

1. Al Hisabil Manufacturers LLC can make either of two investments at the beginning of 2020. The given two proposals have following forecast particulars:

1. Al Hisabil Manufacturers LLC can make either of two investments at the beginning of 2020. The given two proposals have following forecast particulars: (8 Marks ) Details Proposal A Proposal B 280,000 5 Years Cost of the Investment 200,000 Estimated Life 4 Years Scrap Value Nil Nil Profit After Tax for OMR OMR 2020 5,000 20,000 35,000 25,000 Nil 2021 34,000 34,000 34,000 34,000 2022 2023 2024 Assuming cost of capital at 12% p.a., evaluate the best investment proposal using following methods: a) Payback Period b) Net Present Value c) Discounted Payback Period d) Internal Rate of Return Note: Presentation must have the summary of all the points written in the report.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Present Value of Cash FlowCash Flow1iN idiscount rateCost of Capi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started