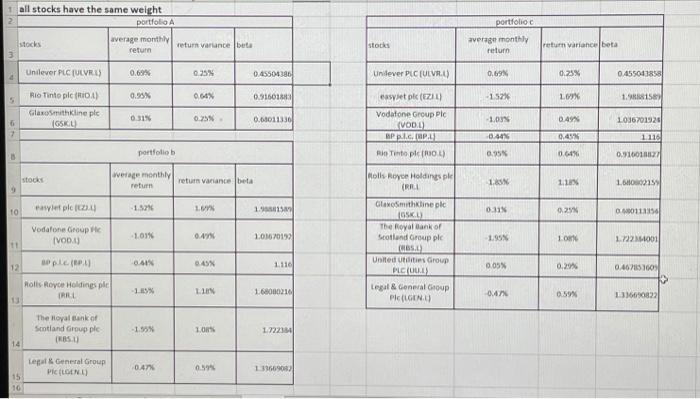

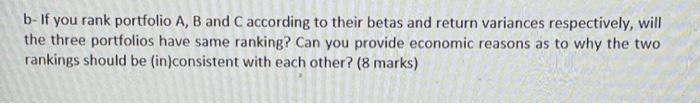

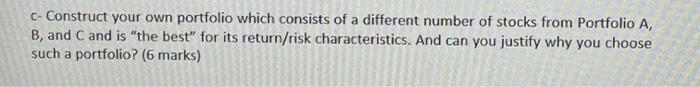

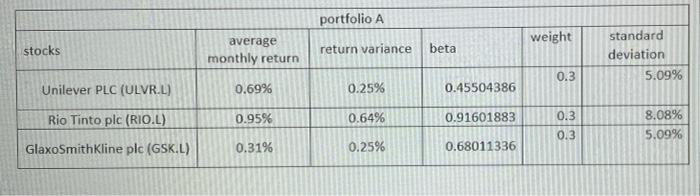

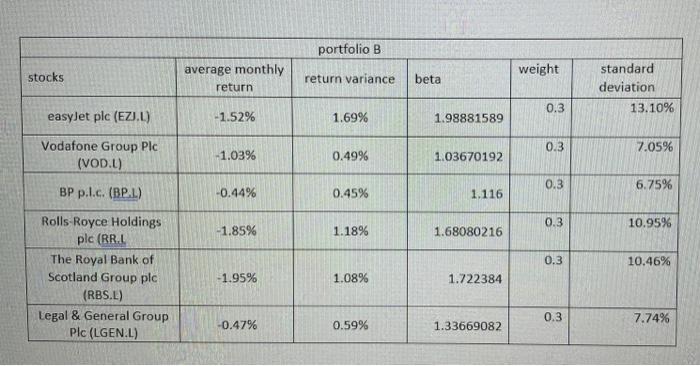

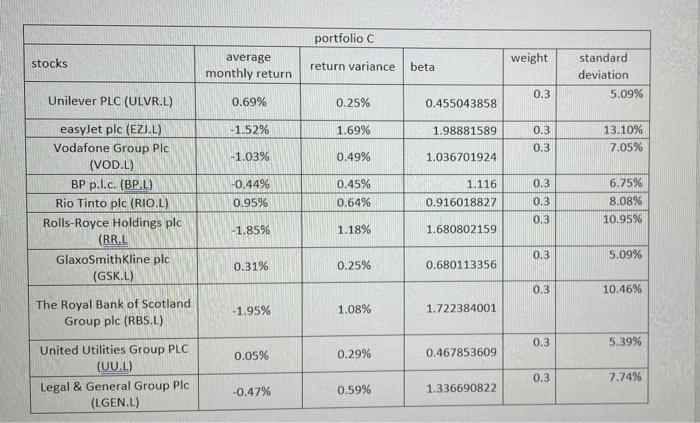

1 all stocks have the same weight 2 portfolio average monthly return portfolio averager monthly return return variance buta stocks return variance beta Unilever PLC (ULVEL 0.69% 0.25% 0.45501386 Un dever PLC (ULVRU) 0.69 0.25% 0.455013858 0.95% 0.66% 0.91601333 -15 169X 1.15 Rio Tinto plc (RO) GlaxoSmithKline ple 0.25% 0.00011330 0.49% -1.03% 1036701926 esset plc (ZILI Vodafone Group PIC VODU Ple, WAP | Rio Tinto plo) 6 2 -0.44 0.45% 1110 portfolio 0.95% 0.6 0.91001017 stocks were monthly return return variance beta 1SN 1 1.600015 10 awet plc 15% 1. Rolls Royce Holdings ple IRRI GlaxoSmithKlinec IGSKL The Royal Bank of Scotland Group 1915 0.31 0.25% 00011150 Vodafone Groupe IV0011 1,01% 0.4 1.01670193 1.95 10 1.722001 pl 00N 0.45 12 1110 0.05% 0.2 Rolls Royce Holdings ple IRL United Utilities Group PLC ULLI Legal & General Group PIEGEND 0.467151003 > 3660822 LIN 1.6800210 0.59% The Royal Bank of Scotland Group plc -1.95% LORS 172234 14 Lepa & General Group CLONA 0.47 0594 11366908 15 10 b- If you rank portfolio A, B and C according to their betas and return variances respectively, will the three portfolios have same ranking? Can you provide economic reasons as to why the two rankings should be (in)consistent with each other? (8 marks) C- Construct your own portfolio which consists of a different number of stocks from Portfolio A, B, and C and is "the best" for its return/risk characteristics. And can you justify why you choose such a portfolio? (6 marks) portfolio A weight stocks average monthly return return variance beta standard deviation 5.09% 0.3 Unilever PLC (ULVR.L) 0.69% 0.25% 0.45504386 Rio Tinto plc (RIO.L) 0.95% 0.64% 0.91601883 0.3 0.3 8.08% 5.09% GlaxoSmithKline plc (GSK.L) 0.31% 0.25% 0.68011336 portfolio B weight stocks average monthly return return variance beta standard deviation 13.10% 0.3 easyJet plc (EZJ..) -1.52% 1.69% 1.98881589 0.3 7.05% Vodafone Group Plc (VOD.L) -1.03% 0.49% 1.03670192 0.3 6.75% BP p... (BP.L) -0.44% 0.45% 1.116 0.3 10.95% -1.85% 1.18% 1.68080216 0.3 10.46% Rolls-Royce Holdings plc (RR.L The Royal Bank of Scotland Group plc (RBS.L) Legal & General Group Plc (LGEN.L) -1.95% 1.08% 1.722384 0.3 7.74% -0.47% 0.59% 1.33669082 portfolio C stocks weight average monthly return return variance beta standard deviation 5.09% 0.3 Unilever PLC (ULVR.L) 0.69% 0.25% 0.455043858 -1.52% 1.69% 1.98881589 0.3 0.3 13.10% 7.05% -1.03% 0.49% 1.036701924 easyJet plc (EZJ.L) Vodafone Group Plc (VOD.L) BP p.I.c. (BP.L) Rio Tinto plc (RIO.L) Rolls-Royce Holdings plc (RR.L GlaxoSmithKline plc (GSK.L) -0.44% 0.95% 0.45% 0.64% 1.116 0.916018827 0.3 0.3 0.3 6.7596 8.08% 10.95% -1.8596 1.18% 1.680802159 0.3 5.09% 0.31% 0.25% 0.680113356 0.3 10.46% -1.95% 1.08% The Royal Bank of Scotland Group plc (RBS.L) 1.722384001 0.3 5.39%6 0.05% 0.29% 0.467853609 United Utilities Group PLC (UU.L) Legal & General Group Plc (LGEN.L) 0.3 7.74% -0.47% 0.59% 1.336690822 1 all stocks have the same weight 2 portfolio average monthly return portfolio averager monthly return return variance buta stocks return variance beta Unilever PLC (ULVEL 0.69% 0.25% 0.45501386 Un dever PLC (ULVRU) 0.69 0.25% 0.455013858 0.95% 0.66% 0.91601333 -15 169X 1.15 Rio Tinto plc (RO) GlaxoSmithKline ple 0.25% 0.00011330 0.49% -1.03% 1036701926 esset plc (ZILI Vodafone Group PIC VODU Ple, WAP | Rio Tinto plo) 6 2 -0.44 0.45% 1110 portfolio 0.95% 0.6 0.91001017 stocks were monthly return return variance beta 1SN 1 1.600015 10 awet plc 15% 1. Rolls Royce Holdings ple IRRI GlaxoSmithKlinec IGSKL The Royal Bank of Scotland Group 1915 0.31 0.25% 00011150 Vodafone Groupe IV0011 1,01% 0.4 1.01670193 1.95 10 1.722001 pl 00N 0.45 12 1110 0.05% 0.2 Rolls Royce Holdings ple IRL United Utilities Group PLC ULLI Legal & General Group PIEGEND 0.467151003 > 3660822 LIN 1.6800210 0.59% The Royal Bank of Scotland Group plc -1.95% LORS 172234 14 Lepa & General Group CLONA 0.47 0594 11366908 15 10 b- If you rank portfolio A, B and C according to their betas and return variances respectively, will the three portfolios have same ranking? Can you provide economic reasons as to why the two rankings should be (in)consistent with each other? (8 marks) C- Construct your own portfolio which consists of a different number of stocks from Portfolio A, B, and C and is "the best" for its return/risk characteristics. And can you justify why you choose such a portfolio? (6 marks) portfolio A weight stocks average monthly return return variance beta standard deviation 5.09% 0.3 Unilever PLC (ULVR.L) 0.69% 0.25% 0.45504386 Rio Tinto plc (RIO.L) 0.95% 0.64% 0.91601883 0.3 0.3 8.08% 5.09% GlaxoSmithKline plc (GSK.L) 0.31% 0.25% 0.68011336 portfolio B weight stocks average monthly return return variance beta standard deviation 13.10% 0.3 easyJet plc (EZJ..) -1.52% 1.69% 1.98881589 0.3 7.05% Vodafone Group Plc (VOD.L) -1.03% 0.49% 1.03670192 0.3 6.75% BP p... (BP.L) -0.44% 0.45% 1.116 0.3 10.95% -1.85% 1.18% 1.68080216 0.3 10.46% Rolls-Royce Holdings plc (RR.L The Royal Bank of Scotland Group plc (RBS.L) Legal & General Group Plc (LGEN.L) -1.95% 1.08% 1.722384 0.3 7.74% -0.47% 0.59% 1.33669082 portfolio C stocks weight average monthly return return variance beta standard deviation 5.09% 0.3 Unilever PLC (ULVR.L) 0.69% 0.25% 0.455043858 -1.52% 1.69% 1.98881589 0.3 0.3 13.10% 7.05% -1.03% 0.49% 1.036701924 easyJet plc (EZJ.L) Vodafone Group Plc (VOD.L) BP p.I.c. (BP.L) Rio Tinto plc (RIO.L) Rolls-Royce Holdings plc (RR.L GlaxoSmithKline plc (GSK.L) -0.44% 0.95% 0.45% 0.64% 1.116 0.916018827 0.3 0.3 0.3 6.7596 8.08% 10.95% -1.8596 1.18% 1.680802159 0.3 5.09% 0.31% 0.25% 0.680113356 0.3 10.46% -1.95% 1.08% The Royal Bank of Scotland Group plc (RBS.L) 1.722384001 0.3 5.39%6 0.05% 0.29% 0.467853609 United Utilities Group PLC (UU.L) Legal & General Group Plc (LGEN.L) 0.3 7.74% -0.47% 0.59% 1.336690822