Answered step by step

Verified Expert Solution

Question

1 Approved Answer

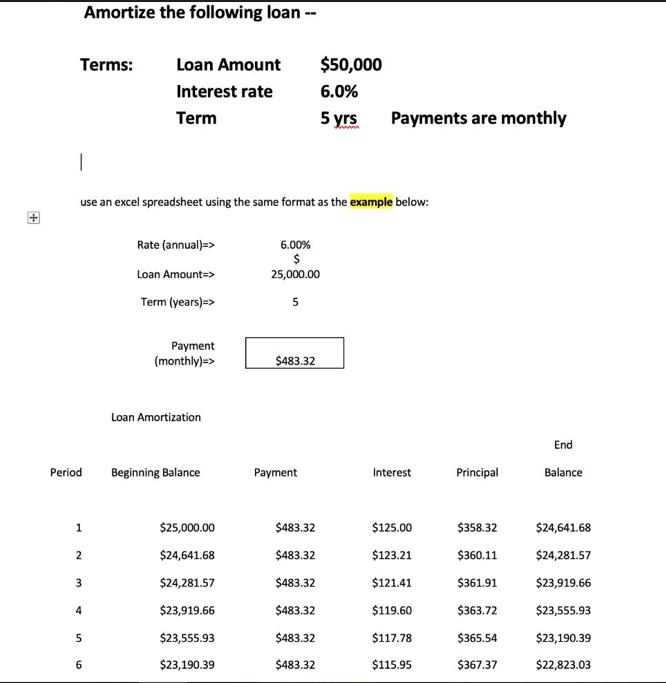

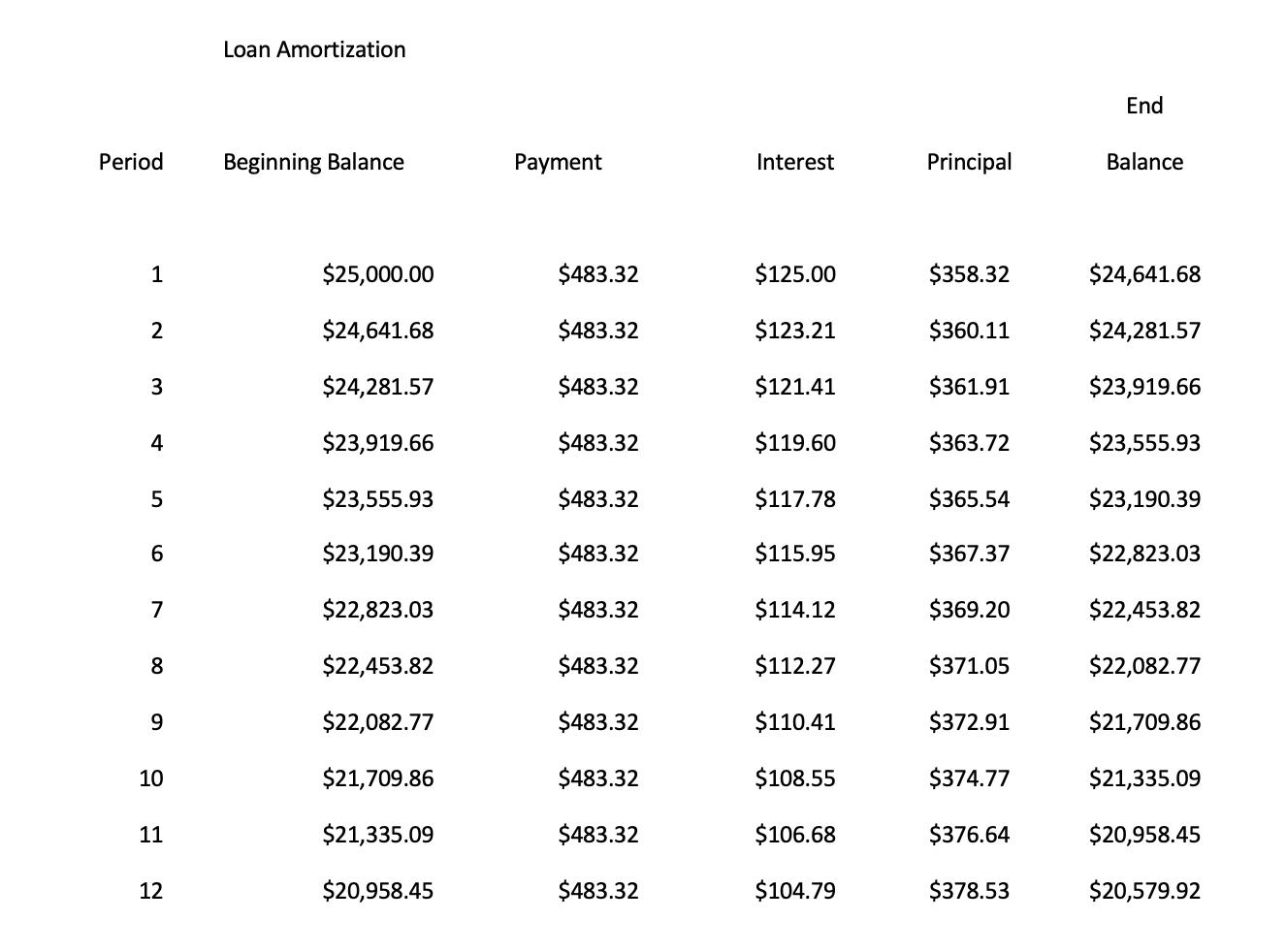

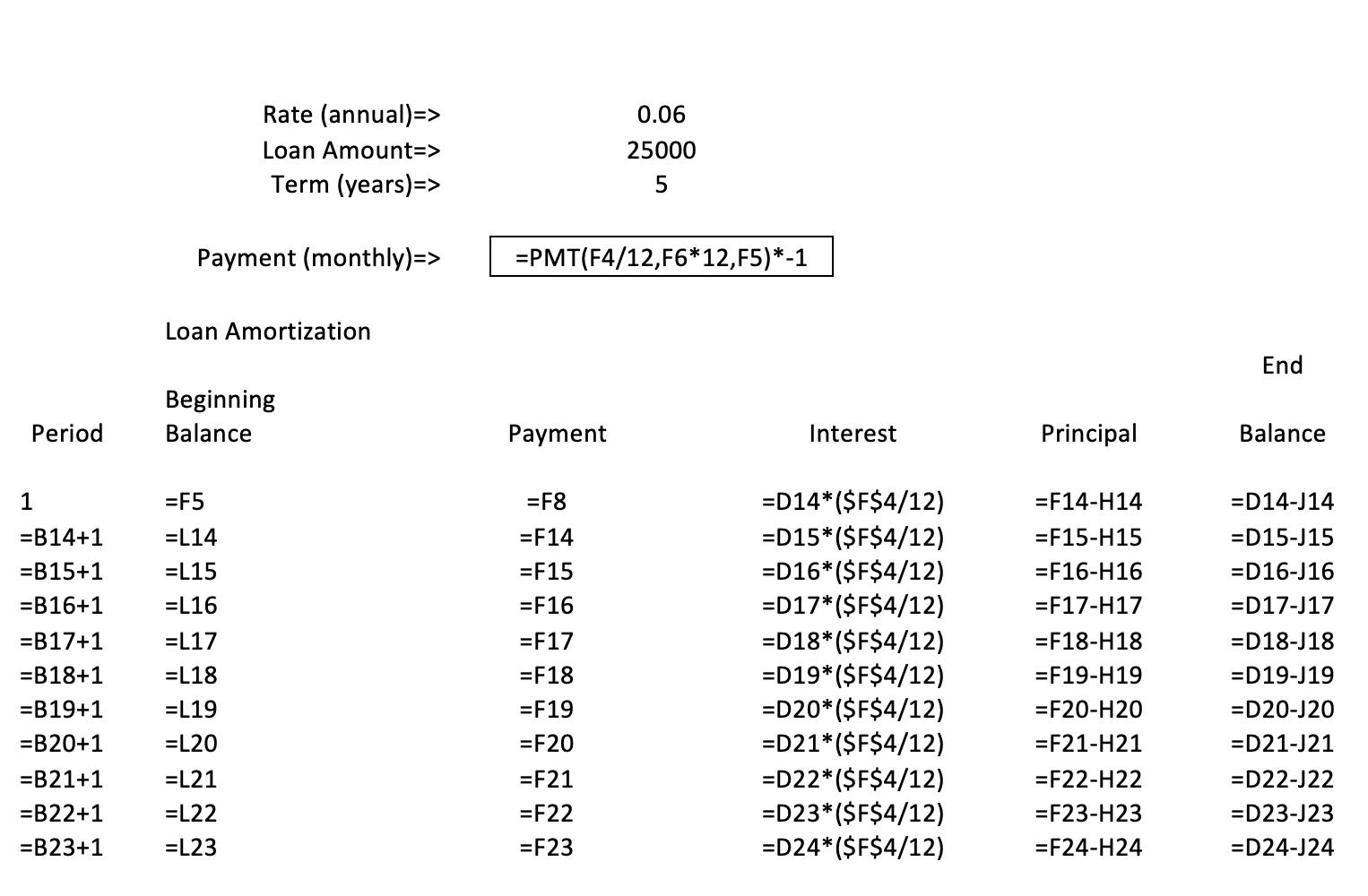

+ Terms: I Period 1 use an excel spreadsheet using the same format as the example below: 2 Amortize the following loan -- 3

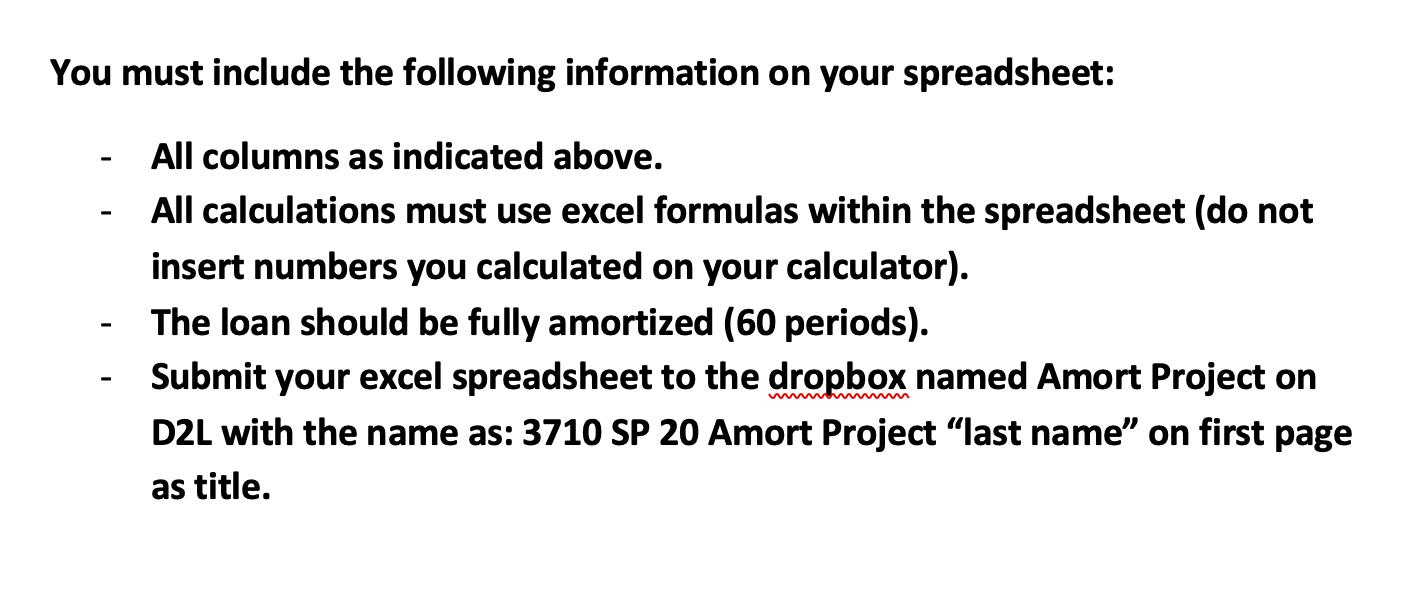

+ Terms: I Period 1 use an excel spreadsheet using the same format as the example below: 2 Amortize the following loan -- 3 4 5 6 Loan Amount Interest rate Term Rate (annual) => Loan Amount=> Term (years)=> Payment (monthly)=> Loan Amortization Beginning Balance $25,000.00 $24,641.68 $24,281.57 $23,919.66 $23,555.93 $23,190.39 6.00% $ 25,000.00 5 $483.32 Payment $483.32 $50,000 6.0% 5 yrs Payments are monthly $483.32 $483.32 $483.32 $483.32 $483.32 Interest $125.00 $123.21 $121.41 $119.60 $117.78 $115.95 Principal $358.32 $360.11 $361.91 $363.72 $365.54 $367.37 End Balance $24,641.68 $24,281.57 $23,919.66 $23,555.93 $23,190.39 $22,823.03 Period 1 2 3 4 5 6 7 8 9 10 11 12 Loan Amortization Beginning Balance $25,000.00 $24,641.68 $24,281.57 $23,919.66 $23,555.93 $23,190.39 $22,823.03 $22,453.82 $22,082.77 $21,709.86 $21,335.09 $20,958.45 Payment $483.32 $483.32 $483.32 $483.32 $483.32 $483.32 $483.32 $483.32 $483.32 $483.32 $483.32 $483.32 Interest $125.00 $123.21 $121.41 $119.60 $117.78 $115.95 $114.12 $112.27 $110.41 $108.55 $106.68 $104.79 Principal $358.32 $360.11 $361.91 $363.72 $365.54 $367.37 $369.20 $371.05 $372.91 $374.77 $376.64 $378.53 End Balance $24,641.68 $24,281.57 $23,919.66 $23,555.93 $23,190.39 $22,823.03 $22,453.82 $22,082.77 $21,709.86 $21,335.09 $20,958.45 $20,579.92 Period 1 =B14+1 =B15+1 =B16+1 =B17+1 =B18+1 =B19+1 =B20+1 =B21+1 =B22+1 =B23+1 Rate (annual)=> Loan Amount => Term (years) => Payment (monthly)=> Loan Amortization Beginning Balance =F5 =L14 =L15 =L16 =L17 =L18 =L19 =L20 =L21 =L22 =L23 =PMT(F4/12,F6*12, F5)*-1 Payment 0.06 25000 5 =F8 =F14 =F15 =F16 =F17 =F18 =F19 =F20 =F21 =F22 =F23 Interest =D14* ($F$4/12) =D15*($F$4/12) =D16*($F$4/12) =D17*($F$4/12) =D18*($F$4/12) =D19* ($F$4/12) =D20* ($F$4/12) =D21*($F$4/12) =D22* ($F$4/12) =D23* ($F$4/12) =D24*($F$4/12) Principal =F14-H14 =F15-H15 =F16-H16 =F17-H17 =F18-H18 =F19-H19 =F20-H20 =F21-H21 =F22-H22 =F23-H23 =F24-H24 End Balance =D14-J14 =D15-J15 =D16-J16 =D17-J17 =D18-J18 =D19-J19 =D20-J20 =D21-J21 =D22-J22 =D23-J23 =D24-J24 You must include the following information on your spreadsheet: All columns as indicated above. All calculations must use excel formulas within the spreadsheet (do not insert numbers you calculated on your calculator). The loan should be fully amortized (60 periods). Submit your excel spreadsheet to the dropbox named Amort Project on D2L with the name as: 3710 SP 20 Amort Project "last name" on first page as title. -

Step by Step Solution

★★★★★

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Here is the amortization schedule with stepbystep workings Rate annual 600 Loan Amount 500000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started