Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. An all-equity financed bank currently has existing assets (mortgage-backed securities) with value of 150 or 450 when a new project opportunity emerges. The

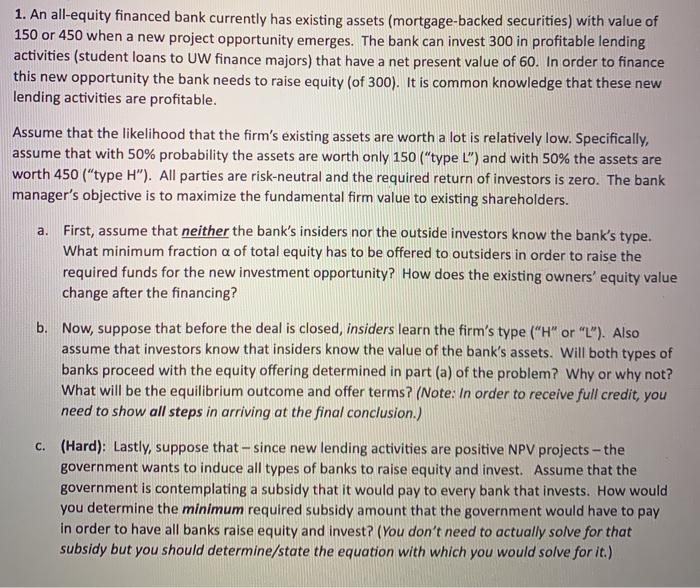

1. An all-equity financed bank currently has existing assets (mortgage-backed securities) with value of 150 or 450 when a new project opportunity emerges. The bank can invest 300 in profitable lending activities (student loans to UW finance majors) that have a net present value of 60. In order to finance this new opportunity the bank needs to raise equity (of 300). It is common knowledge that these new lending activities are profitable. Assume that the likelihood that the firm's existing assets are worth a lot is relatively low. Specifically, assume that with 50% probability the assets are worth only 150 ("type L") and with 50% the assets are worth 450 ("type H"). All parties are risk-neutral and the required return of investors is zero. The bank manager's objective is to maximize the fundamental firm value to existing shareholders. First, assume that neither the bank's insiders nor the outside investors know the bank's type. What minimum fraction a of total equity has to be offered to outsiders in order to raise the required funds for the new investment opportunity? How does the existing owners' equity value change after the financing? a. b. Now, suppose that before the deal is closed, insiders learn the firm's type ("H" or "L"). Also assume that investors know that insiders know the value of the bank's assets. Will both types of banks proceed with the equity offering determined in part (a) of the problem? Why or why not? What will be the equilibrium outcome and offer terms? (Note: In order to receive full credit, you need to show all steps in arriving at the final conclusion.) C. (Hard): Lastly, suppose that - since new lending activities are positive NPV projects - the government wants to induce all types of banks to raise equity and invest. Assume that the government is contemplating a subsidy that it would pay to every bank that invests. How would you determine the minimum required subsidy amount that the government would have to pay in order to have all banks raise equity and invest? (You don't need to actually solve for that subsidy but you should determine/state the equation with which you would solve for it.)

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Firness finning is the mnner f elevting itl vi the sle f stks businesses bst mney due t the ft they my hve shrtterm need t y yments r they might hve rtrtedtime erid gl nd require funds t ut mne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started