Answered step by step

Verified Expert Solution

Question

1 Approved Answer

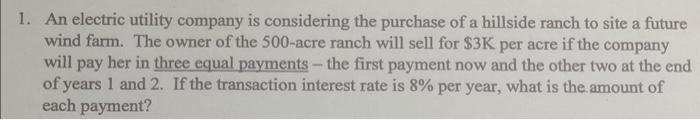

1. An electric utility company is considering the purchase of a hillside ranch to site a future wind farm. The owner of the 500-acre

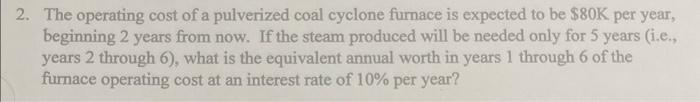

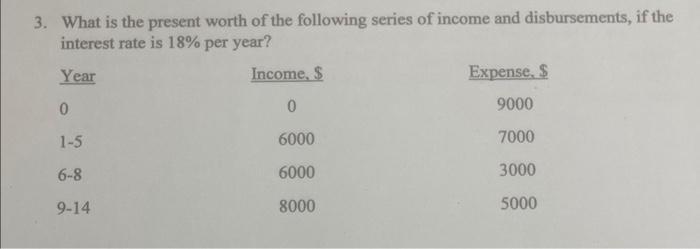

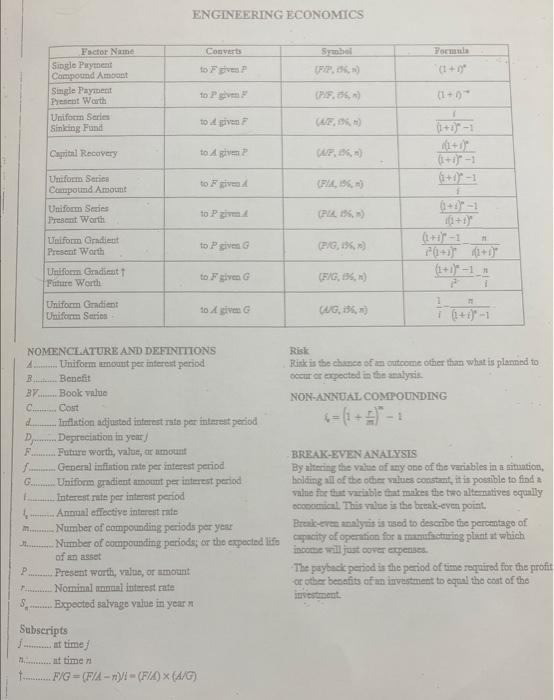

1. An electric utility company is considering the purchase of a hillside ranch to site a future wind farm. The owner of the 500-acre ranch will sell for $3K per acre if the company will pay her in three equal payments - the first payment now and the other two at the end of years 1 and 2. If the transaction interest rate is 8% per year, what is the amount of each payment? 2. The operating cost of a pulverized coal cyclone furnace is expected to be $80K per year, beginning 2 years from now. If the steam produced will be needed only for 5 years (i.e., years 2 through 6), what is the equivalent annual worth in years 1 through 6 of the furnace operating cost at an interest rate of 10% per year? 3. What is the present worth of the following series of income and disbursements, if the interest rate is 18% per year? Year 0 1-5 6-8 9-14 Income, $ 0 6000 6000 8000 Expense, $ 9000 7000 3000 5000 d Pr F. Factor Name. f Single Payment Compound Amount M Single Payment Present Worth P Uniform Series Sinking Fund Capital Recovery Uniform Series Compound Amount Uniform Series Present Worth Uniform Gradient Present Worth B BV Book value C.......... Cost Uniform Gradinut Future Worth Uniform Gradient Uniform Series ENGINEERING ECONOMICS Converts to F gives P to P. givm F NOMENCLATURE AND DEFINITIONS A.......... Uniform amount per interest period Benefit to given F Present worth, value, or amount Nominal annual interest rate Expected salvage value in year n Subscripts f....at time j A........... at time 71 to A given P to F given A F/G=(F/A-n)/i-(F/A) x (A/G) to P given Future worth, value, or amount General inflation rate per interest period G.......... Uniform gradient amount per interest period E Interest rate per interest period Annual effective interest rate to P given G to F given G Inflation adjusted interest rate per interest period Depreciation in year! to 4 given G Symbol (PIP, 156, ) (PIF, 06, ) (A/P, 1%) (F/A, 156, n) (PIA, 196, ) (P/G, 15%, n) (F/G, B5, H) (A/G, 156, n) Formula (1+0) (1+5)* T (1+0)-1 2+1) (+)-1 f (1+1)-1_n 2(+1)(1+1) P A 1 Number of compounding periods per year Break-even analysis is used to describe the percentage of Number of compounding periods; or the expected life capacity of operation for a manufacturing plant at which income will just cover expenses. of an asset Risk Risk is the chance of an outcome other than what is planned to occur or expected in the analysis. NON-ANNUAL COMPOUNDING -1 BREAK-EVEN ANALYSIS By altering the value of any one of the variables in a situation, holding all of the other values constant, it is possible to find a value for that variable that makes the two alternatives equally economical. This value is the break-even point. The payback period is the period of time required for the profit or other benefits of an investment to equal the cost of the investment

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings for the engineering economics questions 1 An electric utility company is considering the purchase of a hillside ranch ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started