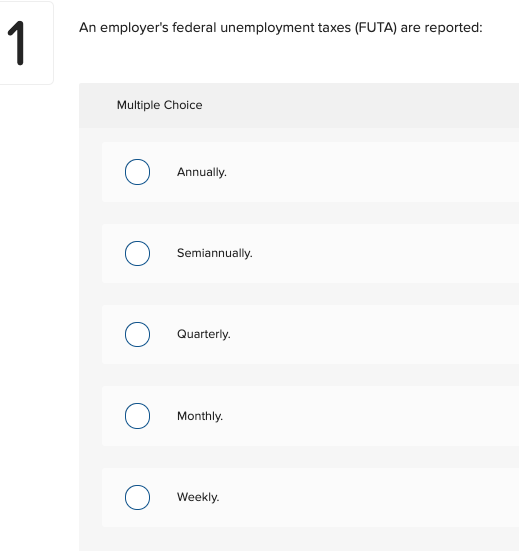

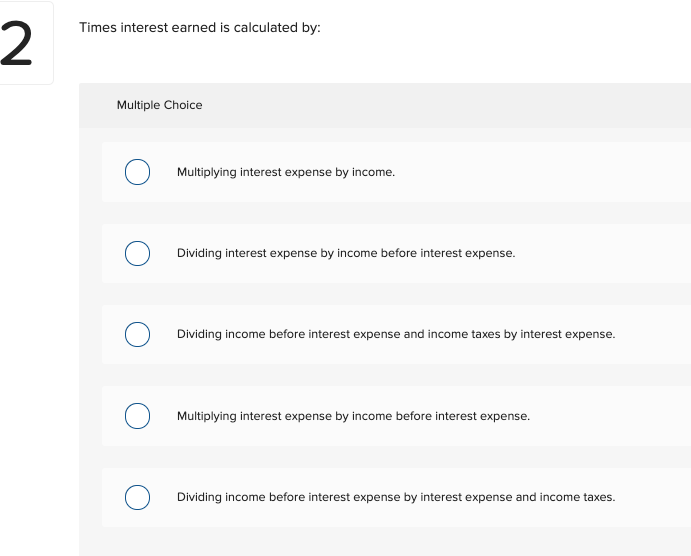

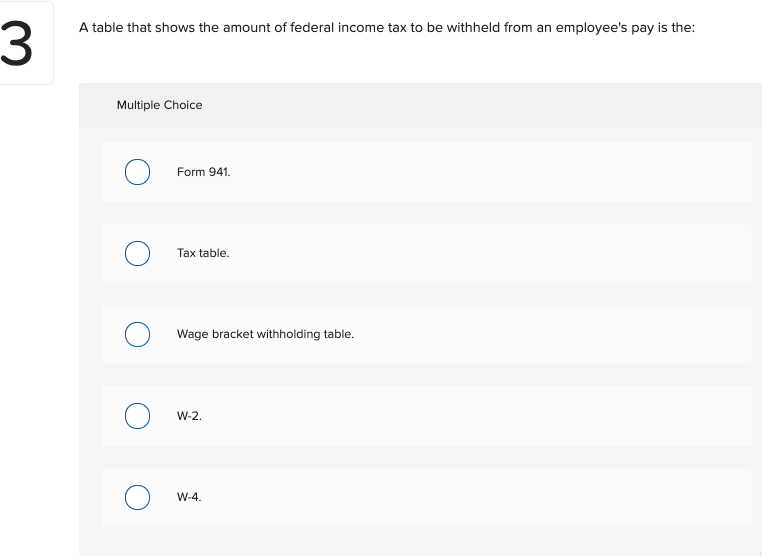

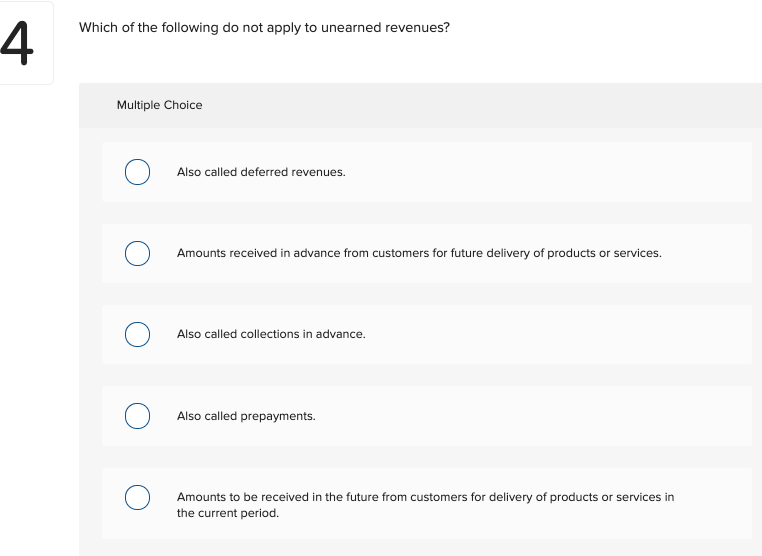

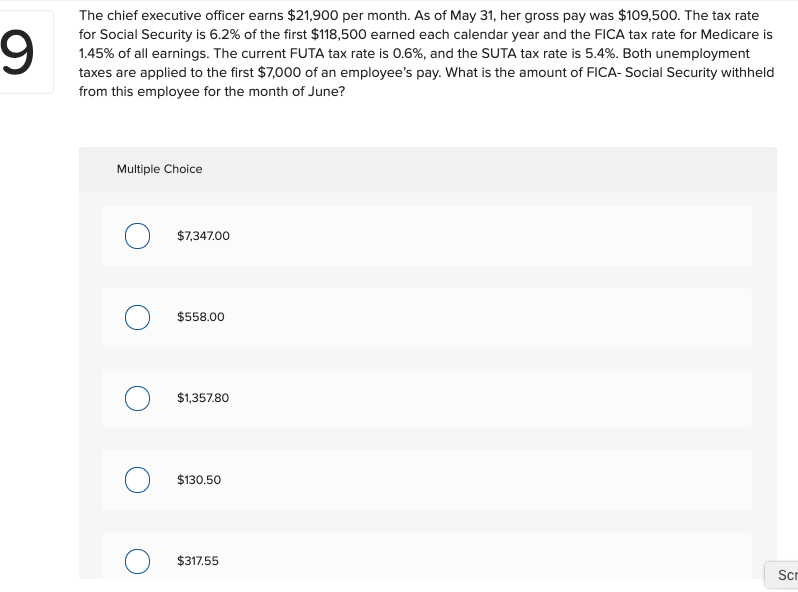

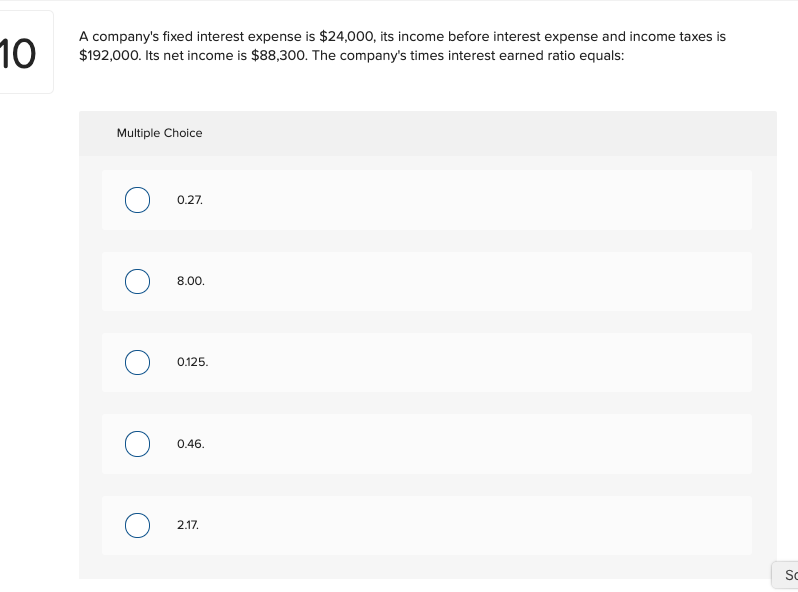

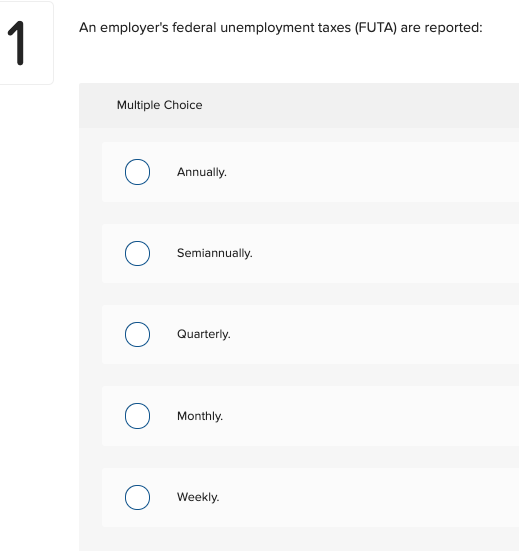

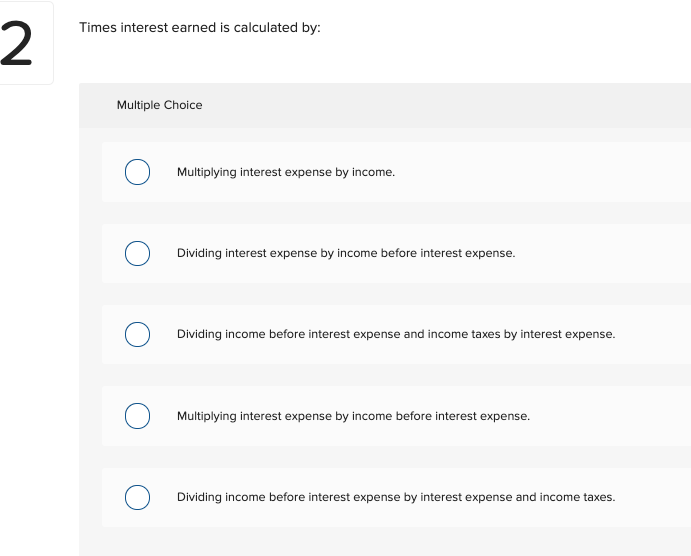

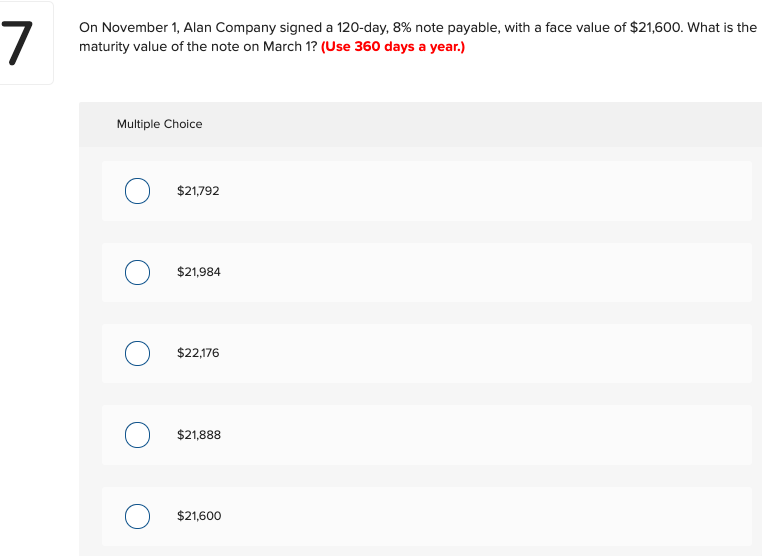

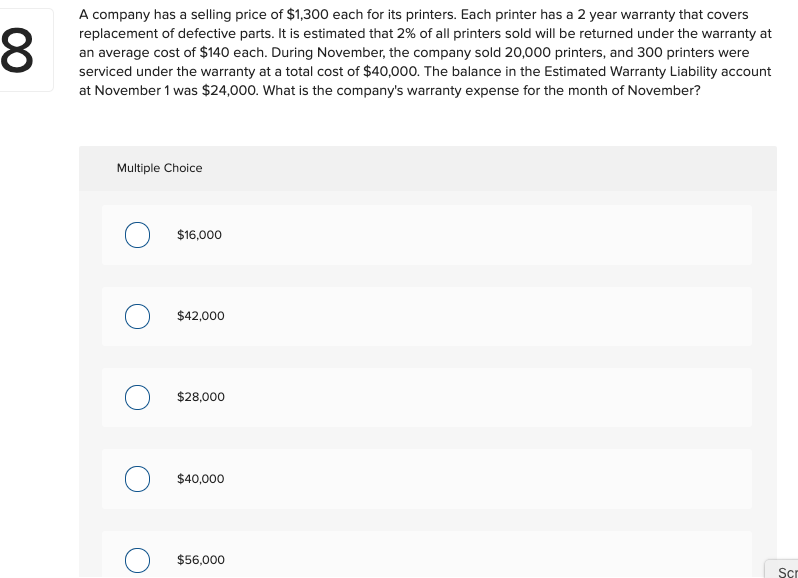

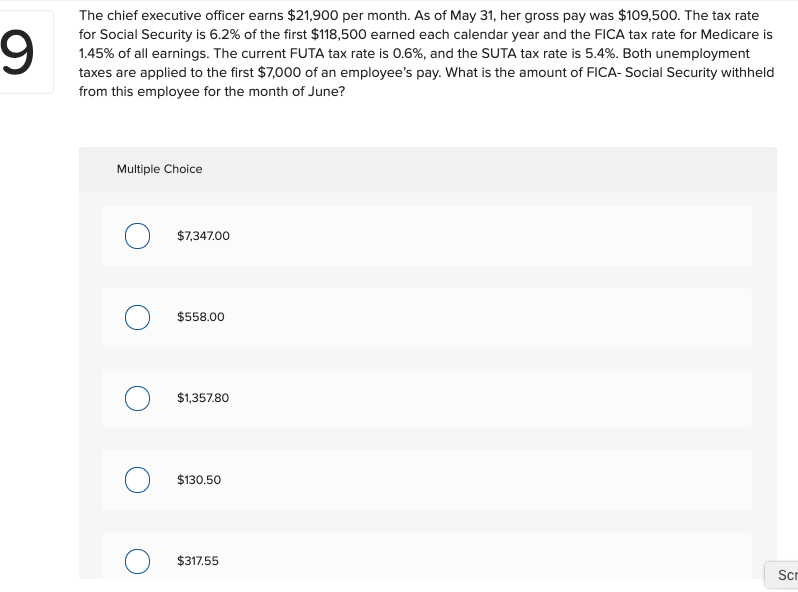

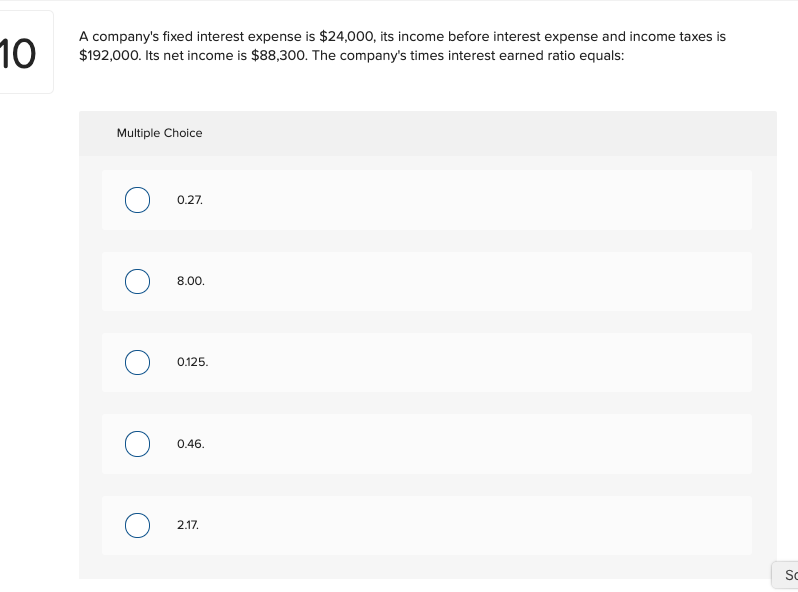

1 An employer's federal unemployment taxes (FUTA) reported: are Multiple Choice Annually Semiannually. Quarterly. Monthly. Weekly 2 Times interest earned is calculated by: Multiple Choice Multiplying interest expense by income. Dividing interest expense by income before interest expense. Dividing income before interest expense and income taxes by interest expense. Multiplying interest expense by income before interest expense. Dividing income before interest expense by interest expense and income taxes 3 A table that shows the amount of federal income tax to be withheld from an employee's pay is the: Multiple Choice Form 941. Tax table. Wage bracket withholding table. W-2 w-4. 4 Which of the following do not apply to unearned revenues? Multiple Choice Also called deferred revenues. Amounts received in advance from customers for future delivery of products or services. Also called collections in advance. Also called prepayments Amounts to be received in the future from customers for delivery of products or services in the current period 5 In order to be reported, liabilities must Multiple Choice Be certain Sometimes be estimated. Be for a specific amount Always have a definite date for payment. Involve an outflow of cash. 6 A company's income before interest expense and income taxes is $200,000 and its interest expense is $70,000. Its times interest earned ratio is: Multiple Choice 1,00 0.35 1.51 2.51 2.86 7 On November 1, Alan Company signed a 120-day, 8% note payable, with a face value of $21,600. What is the maturity value of the note on March 1? (Use 360 days a year.) Multiple Choice $21,792 $21,984 $22,176 $21,888 $21,600 A company has a selling price of $1,300 each for its printers. Each printer has a 2 year warranty that covers replacement of defective parts. It is estimated that 2% of all printers sold will be returned under the warranty at an average cost of $140 each. During November, the company sold 20,000 printers, and 300 printers were serviced under the warranty at a total cost of $40,000. The balance in the Estimated Warranty Liability account at November 1 was $24,000. What is the company's warranty expense for the month of November? Multiple Choice $16,000 $42,000 $28,000 $40,000 $56,000 The chief executive officer earns $21,900 per month. As of May 31, her gross pay was $109,500. The tax rate for Social Security is 6.2% of the first $118,500 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of FICA- Social Security withheld from this employee for the month of June? Multiple Choice $7,34700 $558.00 $1,357.80 $130.50 $317.55 Sc A company's fixed interest expense is $24,000, its income before interest expense and income taxes is $192,000. Its net income is $88,300. The company's times interest earned ratio equals: 10 Multiple Choice 0.27 8.00 0.125 0.46 2.17 Sc