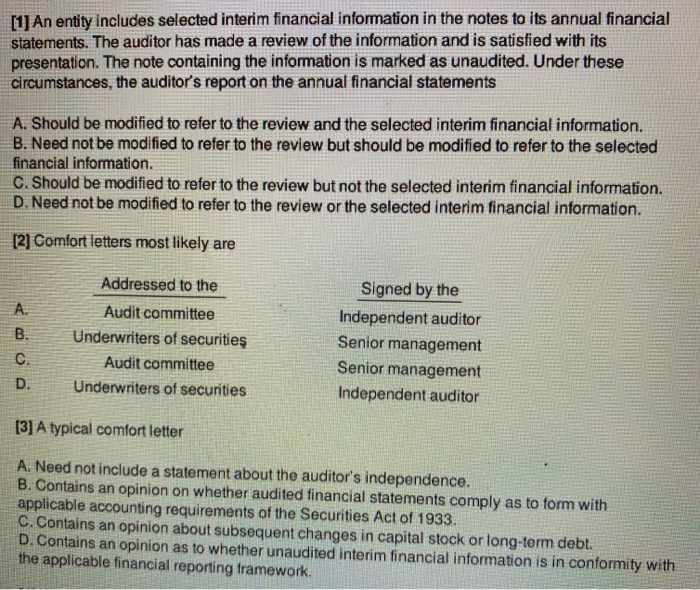

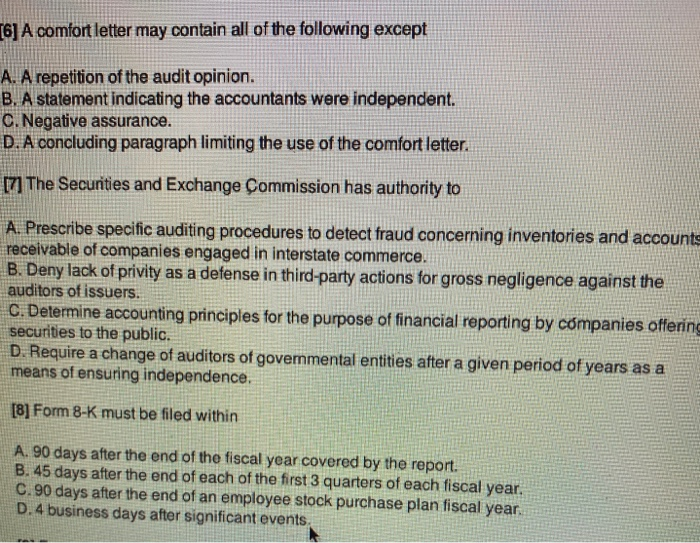

[1] An entity includes selected interim financial information in the notes to its annual financial statements. The auditor has made a review of the information and is satisfied with its presentation. The note containing the information is marked as unaudited. Under these circumstances, the auditor's report on the annual financial statements A. Should be modified to refer to the review and the selected interim financial information. B. Need not be modified to refer to the review but should be modified to refer to the selected financial information. C. Should be modified to refer to the review but not the selected interim financial information. D. Need not be modified to refer to the review or the selected interim financial information. [2] Comfort letters most likely are A. B. C. D. Addressed to the Audit committee Underwriters of securities Audit committee Underwriters of securities Signed by the Independent auditor Senior management Senior management Independent auditor [3] A typical comfort letter A. Need not include a statement about the auditor's independence. B. Contains an opinion on whether audited financial statements comply as to form with applicable accounting requirements of the Securities Act of 1933. C. Contains an opinion about subsequent changes in capital stock or long-term debt. D. Contains an opinion as to whether unaudited interim financial information is in conformity with the applicable financial reporting framework. [6] A comfort letter may contain all of the following except A. A repetition of the audit opinion. B. A statement indicating the accountants were independent. C. Negative assurance. D. A concluding paragraph limiting the use of the comfort letter. [7] The Securities and Exchange Commission has authority to A. Prescribe specific auditing procedures to detect fraud concerning inventories and accounts receivable of companies engaged in Interstate commerce. B. Deny lack of privity as a defense in third-party actions for gross negligence against the auditors of issuers. C. Determine accounting principles for the purpose of financial reporting by companies offering securities to the public. D. Require a change of auditors of governmental entities after a given period of years as a means of ensuring independence. [8] Form 8-K must be filed within A. 90 days after the end of the fiscal year covered by the report. B. 45 days after the end of each of the first 3 quarters of each fiscal year. C.90 days after the end of an employee stock purchase plan fiscal year. D.4 business days after significant events