Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. An insurer sells a very large number of policies to people with the following loss distribution: $100,000 with probability 0.005 $ 60,000 with

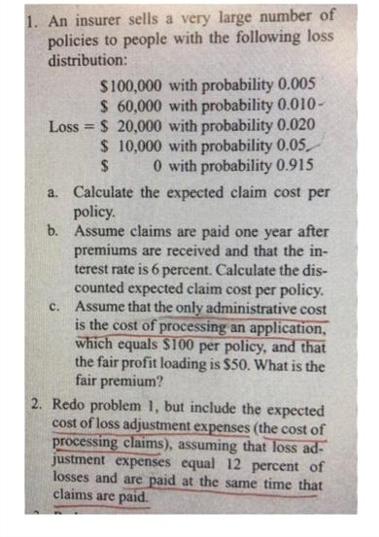

1. An insurer sells a very large number of policies to people with the following loss distribution: $100,000 with probability 0.005 $ 60,000 with probability 0.010- Loss $20,000 with probability 0.020 $ 10,000 with probability 0.05 $ 0 with probability 0.915 = a. Calculate the expected claim cost per policy. b. Assume claims are paid one year after premiums are received and that the in- terest rate is 6 percent. Calculate the dis- counted expected claim cost per policy. c. Assume that the only administrative cost is the cost of processing an application, which equals $100 per policy, and that the fair profit loading is $50. What is the fair premium? 2. Redo problem 1, but include the expected cost of loss adjustment expenses (the cost of processing claims), assuming that loss ad- justment expenses equal 12 percent of losses and are paid at the same time that claims are paid.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Calculation without Loss Adjustment Expenses a Calculate the expected claim cost per policy Expected ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started