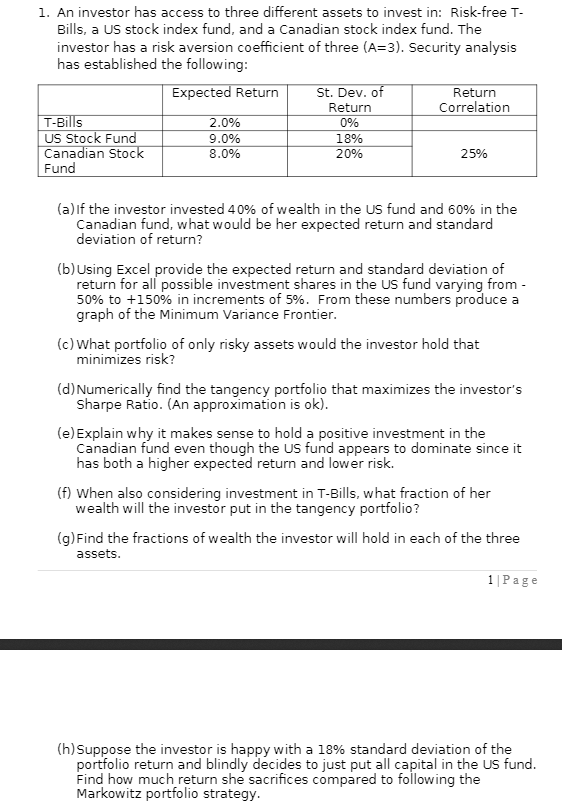

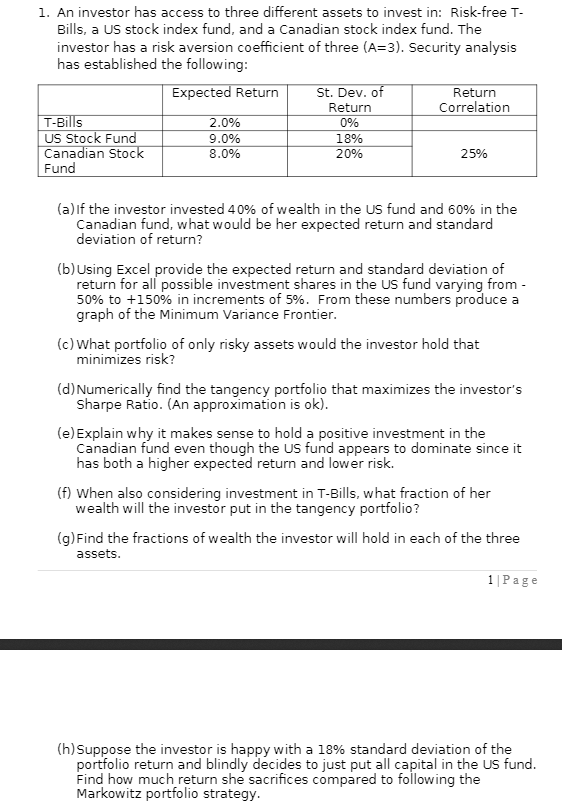

1. An investor has access to three different assets to invest in: Risk-free T- Bills, a US stock index fund, and a Canadian stock index fund. The investor has a risk aversion coefficient of three (A=3). Security analysis has established the following: Expected Return St. Dev. of Return Return Correlation T-Bills US Stock Fund Canadian Stock 8.0% 20% 25% Fund 2.0% 9.0% 0% 18% (a) If the investor invested 40% of wealth in the US fund and 60% in the Canadian fund, what would be her expected return and standard deviation of return? (b) Using Excel provide the expected return and standard deviation of return for all possible investment shares in the US fund varying from - 50% to +150% in increments of 5%. From these numbers produce a graph of the Minimum Variance Frontier. (c) What portfolio of only risky assets would the investor hold that minimizes risk? (d) Numerically find the tangency portfolio that maximizes the investor's Sharpe Ratio. (An approximation is ok). (e) Explain why it makes sense to hold a positive investment in the Canadian fund even though the US fund appears to dominate since it has both a higher expected return and lower risk. (f) when also considering investment in T-Bills, what fraction of her wealth will the investor put in the tangency portfolio? (g) Find the fractions of wealth the investor will hold in each of the three assets. 1 Page (h) Suppose the investor is happy with a 18% standard deviation of the portfolio return and blindly decides to just put all capital in the US fund. Find how much return she sacrifices compared to following the Markowitz portfolio strategy. 1. An investor has access to three different assets to invest in: Risk-free T- Bills, a US stock index fund, and a Canadian stock index fund. The investor has a risk aversion coefficient of three (A=3). Security analysis has established the following: Expected Return St. Dev. of Return Return Correlation T-Bills US Stock Fund Canadian Stock 8.0% 20% 25% Fund 2.0% 9.0% 0% 18% (a) If the investor invested 40% of wealth in the US fund and 60% in the Canadian fund, what would be her expected return and standard deviation of return? (b) Using Excel provide the expected return and standard deviation of return for all possible investment shares in the US fund varying from - 50% to +150% in increments of 5%. From these numbers produce a graph of the Minimum Variance Frontier. (c) What portfolio of only risky assets would the investor hold that minimizes risk? (d) Numerically find the tangency portfolio that maximizes the investor's Sharpe Ratio. (An approximation is ok). (e) Explain why it makes sense to hold a positive investment in the Canadian fund even though the US fund appears to dominate since it has both a higher expected return and lower risk. (f) when also considering investment in T-Bills, what fraction of her wealth will the investor put in the tangency portfolio? (g) Find the fractions of wealth the investor will hold in each of the three assets. 1 Page (h) Suppose the investor is happy with a 18% standard deviation of the portfolio return and blindly decides to just put all capital in the US fund. Find how much return she sacrifices compared to following the Markowitz portfolio strategy